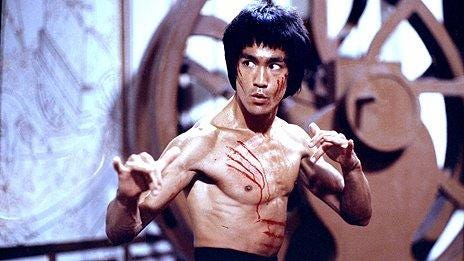

be water my friend

“Empty your mind, be formless, shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot it becomes the teapot. Now, water can flow, it can crash. Be water my friend”

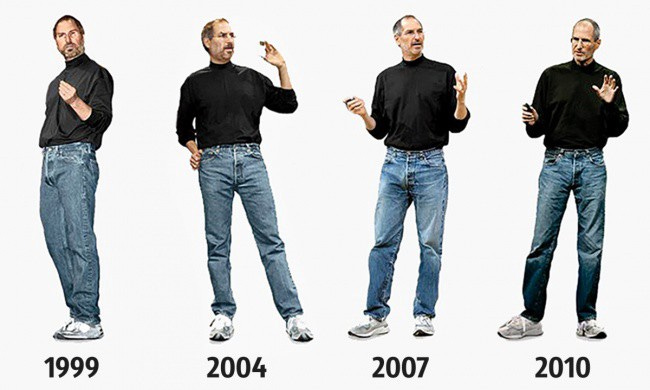

Variety is the spice of life. Or so they say. But to be honest, I’m not so sure “they” are right about that. Plenty of people prefer structure, order, consistency. One of the great innovators of our time may have had a bone to pick with the variety stans.

Personally, this particular anon errs on the side of structure. A consistent routine is how I tend to maximize my day and my thinking for that matter. To be clear, that routine includes blocking off some time to research weird stuff, fall down rabbit holes, dm people I find interesting or just generally let my mind wander. I think this is important.

A thread from one of my favorite self-reflective thinkers last week got me to scratch this itch a bit more.

https://twitter.com/gametheorizing/thread/1548606541741412353

Most people don’t appreciate how large a role path dependency plays in our everyday lives. Maybe that’s a good thing. Even as I type this I wonder if I’m talking out of both sides of my mouth; I have said in the past that wasting energy on things you can’t control is -EV. Thankfully you dear reader, are sharp enough to appreciate the nuance of realizing the current reality is just the outcome of one path. Just because you can’t change past decisions or actions, doesn’t mean you can’t trace how they’ve led to your current reality.

A problem I see surfacing though is the narrowing of outcomes on an individual level. Said a different way, it feels to me like the standard deviation of outcomes for any single person is shrinking when it should be expanding. I don’t know, maybe I’m just projecting. But it seems easier than ever to get trapped in the daily cycle of:

This type of passive existence isn’t exactly fertile ground for divergent outcomes. How do you break the wheel and do something meaningful? Pardon the existential question but…

If we take no personal risk in our lives, then what are the true consequences of failure?

_________________________

One of the benefits to earmarking part of my time for “free play” is that it’s frequently where I expose myself to things I wouldn’t ordinarily comes across in my day-to-day life. It’s an active pursuit of fringey ideas or giga-brain utopian/dystopian visions. Sometimes it’s less grandiose, yet still interesting: things like how weather forecasting works or the nature vs. nurture debate in athletics. Most importantly, it’s where I tend to consume perspectives different than my own. The true motivation behind the time I set aside to learn weird stuff is to be there when meaningful novel ideas develop. Actively seeking them out is a conscience decision and an effective way for me to evolve my thinking.

I bring this up to highlight another point from Jordi’s thread:

The rules of the game change often. There’s a reason so few investors sustain excellence over many decades. If I asked you to make a list of them, you’d all probably have the same names on there. None of your lists would be very long either. That’s no coincidence.

The crux of this phenomenon is there are far more “pit-spitters” out there. Many more cases of investors /entrepreneurs whose success was a result of being in the right place at the right time, riding a temporary wave or being propped up by expansionary monetary policy. To be clear, I don’t actually begrudge most of these cases either, so long as the success is in good faith & not predatory (of which we’ve seen far too many instances). But when entrepreneurs make the important decision of who to include on their cap table, when employees decide what organization to lend their skillset to and when investors decide which founders to trust their LPs capital with, a critical question to ask is: “if & when conditions, markets, parameters, sentiment changes…how likely is it this person/organization will adapt to the new reality?”

Sometimes those changes happen quickly. The train leaves the station and those who excelled during the previous period are left at the platform. Many times the approach they took or the framework they used during their successful run is what holds them back from seeing the next shift. They suggest the train that left is not actually the right one to be on, or that the next train is the one they are waiting for. What makes this even more difficult is that in today’s world cycles are compressing. Trains seem to be coming & going at an accelerating pace.

____________________________

I wrote previously about a structural shift in the US that occurred in late 1970’s/early 1980’s. President Nixon effectively nuking the Bretton Woods system in the early 1970’s was another inflection point that we still feel the effects of today. I believe the actions post-GFC – along with its cultural impact – are yet one more enduring shift in market structure. Just look at the history of the Fed Funds Rate since 1970.

Consistently lower highs. Post-GFC we lived on the lower bound for over a decade. During this time, for some reason the Fed felt it necessary to overcommunicate to the market what was going on in all their meetings. The Dot Plot was introduced. These were economic, policy or communication decisions, but the cultural effects of this period can’t be overstated. Huge swaths of millennials graduated into a horrific recessionary period. Job offers were pulled. Layoffs were commonplace. The seedlings of resentment toward boomers were planted. At the same time, zoomers were at a critical age where they likely felt the effects of that recession from their parents. Retirement savings were crippled. Rainy day reserves were tapped. It’s not shocking that bitcoin was birthed when it was.

The larger point here is to reiterate the only sure thing is the rules of the game will continue to change. I’ve only glossed over some of the broader monetary policy & financial-specific shifts we’ve seen. Add in the far more rapid technology advancements along with the cultural reverberations felt from those (good & bad). At the end of the day though, the driving force behind change is human behavior. We push the envelope because we want to see progress.

One of the best things about the human condition is that people can observe the same information and come to radically different conclusions. That’s what makes markets! Those conclusions are shaped by our own experiences, the people we share ideas with, what we’d like to see in the future & a host of other variables. It’s also precisely why that list of investors I mentioned earlier is so short. It takes discipline, vision, and a willingness to evolve your thinking to consistently succeed like that. It also means being comfortable making decisions with incomplete information. Learning to be comfortable being uncomfortable. This example is specific to investing but surely you can see the parallels to entrepreneurs who take on risk to build businesses or technology that others tell them isn’t feasible. Or that it’s too novel. Or that it will never see mainstream adoption. The people issuing these critiques are often those stuck on the passive existence hamster wheel. They’ve risked nothing. And so I come back to the initial question I posed…

If we take no personal risk in our lives, then what are the true consequences of failure?

For me, the simple answer is that the consequences are by definition meaningless. It is minor inconvenience, a slightly less comfortable lifestyle, a slow march toward an inevitable end. We have risked nothing, so what is failure really?

For those of you hanging at the edges, building cool stuff, taking risk, or just reading something particularly compelling, my dm’s are always open (@0xsmac)