crypto is eating the (fintech) world

“To eat is a necessity, but to eat intelligently is an art” - François de la Rochefoucauld

Despite the continued weakness in crypto markets, I’ve been pleasantly surprised with the level of activity “behind the scenes”. I suppose this should be expected if we assume each successive wave of adoption ultimately leads to a net gain in buildooors, even after the inevitable washout. Personally, I’m interested in the activity around capital accessibility, cost, discoverability & depth. This is admittedly less straightforward than “Music NFTs” or GameFi, but one of the flaws in your favorite VC’s thinking lies in defining what exactly “adoption” means. It’s common knowledge that each successive generation games more than the last and I agree a new wave of users will be onboarded through an awesome crypto game. But I’m just wise enough to know that I’m too dumb to choose which game/studio will be the one to do it. I’m also of the belief that “adoption” is often misconstrued.

Indulge me for a second and larp as a vc1…

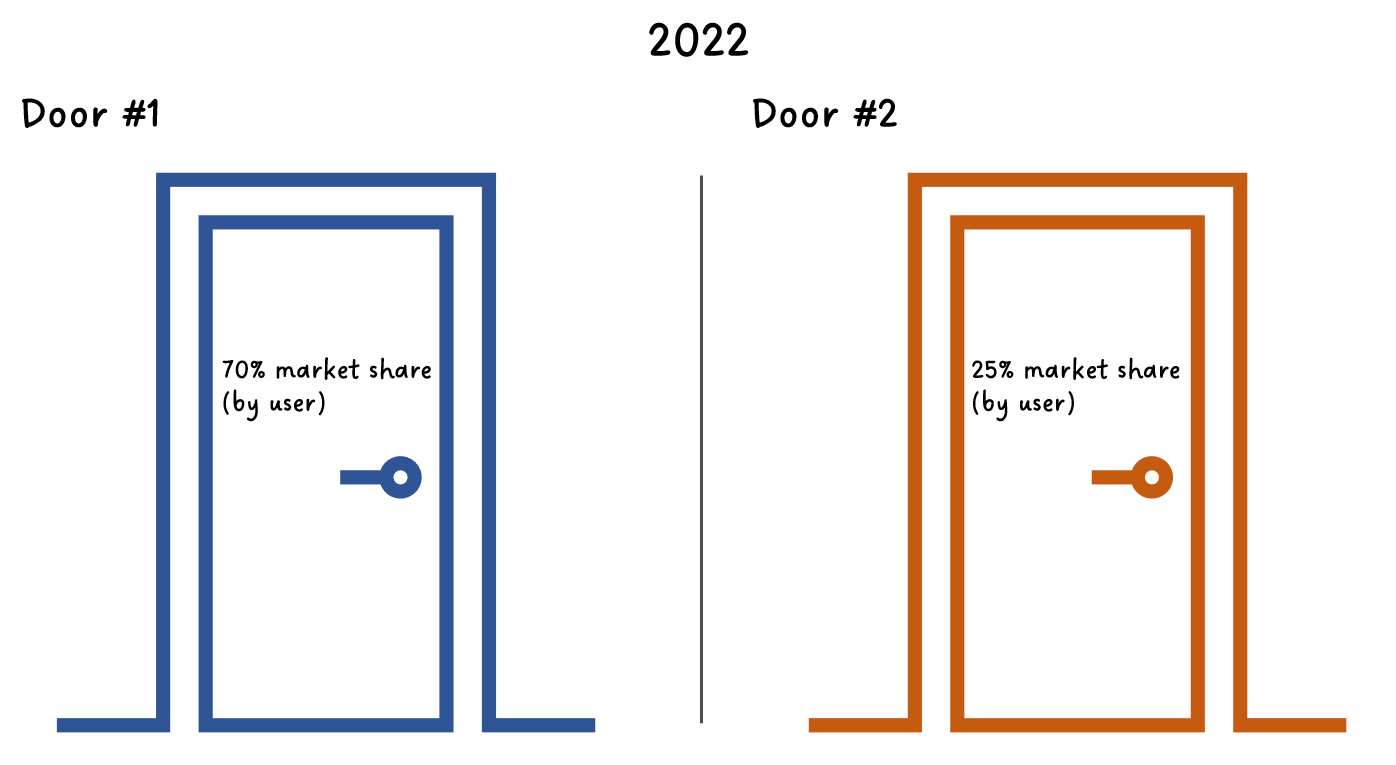

Suppose I offered you the 2 doors below and asked you to choose which you’d prefer, with no other information available?

Door 1 or Door 2????

Ok what if I give you a second data point from 4 years ago, does this change your choice?

You may think, “hmm well I don’t love the trend but 70% share of users is dominant still, I’ll stick with Door 2”

Some of you clever ones will say, “duh Door 2! LoOk aT tHe TrEnD”

Indeed, the trend is often your friend - but I’d caution against relying too heavily on trends & maybe take a second to look at the bigger picture: 70% vs. 25% is a significant gap.

So what’s behind the 2 doors?

Operating systems. Specifically the global share of operating systems. Obviously a US-only split would look quite different2 and this only represents the user market share, which is very different from the share of profits each of these generates.

The point of this thought exercise is to show that “adoption” can have multiple meanings. It could very well mean where do the next 100 million users come from. It could also mean where do the next 1,000 institutions come from. Still more it could mean where does the next 10 trillion dollars come from. This last interpretation of adoption is where I think more conversations should gravitate toward. That’s not to diminish other areas of focus like crypto gaming or the creator economy (credit to me for being an OG music NFT collector during the first week of sound.xyz drops kek). I’m just of the view that capital adoption is widely overlooked and will be more important to crypto’s long-term success than the next Axie.

Within this context, where is crypto best equipped to generate orders of magnitude improvement (or novel approaches) to cost, accessibility, discoverability, and flexibility of capital. To find this answer, we should look to those who recently sought to disrupt the coordination & distribution of capital: fintech.

What we know as “fintech” today is best described as two separate phases, with varying degrees of success.

In Phase I, we saw no new products, just digital versions of the existing suite. Every bank and credit card company launched their own application making it more convenient and easier to manage accounts, make payments, view transaction history, transfer money, etc. There were no new products launched during this particular phase of fintech, rather existing products were brought closer to the customer via desktop or mobile. At the risk of dating myself, I distinctly remember thinking “hmm this is kind of cool” the first time I deposited a check just by taking a picture of it. Self-service began normalizing and our ingrained behavior — going to the bank — started to shift as well. *Most* services were now open 24/7 (albeit with the same t+2 settlement lag for some transactions).

Phase II can be described as a bit more chaotic with incrementally better products in some cases, while in others the product was built first and customers were sought out second. Applying the “lipstick on a pig” analogy here would be too harsh, but this period is one defined by the “everything is fintech” mantra. A dizzying number of banking apps came to market and direct-to-consumer financial products (commission-free trading, lending, insurance, credit, BNPL) were everywhere. The capital environment— 0% rates for a decade — incentivized raising money ad nauseam and throwing shit at the wall until something stuck.

Spoiler alert: most things didn’t stick as very few of these companies found true product-market fit. Even the exceptions (Square, Venmo, Robinhood, Lemonade, Affirm) aren’t widely agreed to be “successes” in some cases – though to be fair this is a matter of perspective. I’m sure the earliest employees and check-writers are quite pleased with the outcomes. There is also something to be said for younger generations being indoctrinated into the financial system earlier3. But I would be remiss not to note how brutal public markets have been toward these (& other related fintech) names.

Sure, there were apps that automated savings and investing but these were incremental improvements to existing options. Same goes for peer-to-peer payments which still rely on traditional rails. The lesson from phase II is that we spent a lot of time talking about fintech but the hype around it mostly outweighed the substance4. Feel free to DM me if you’d like to hear my unconstrained thoughts on the BNPL model.

Much of the froth from this era has been (or will be) washed away as the environment today looks very different from the one teams grew comfy in. This is a great moment for crypto founders. There’s huge opportunity to solve low-hanging fruit problems (SME lending) and to build deep-rooted relationships. Over time those who do this well will realize best-in-class lifetime customer value. This is an especially critical period of time as customer belts will tighten given economic conditions. This is already happening in the crypto space. Teams will feel doubt as sales prove more difficult than previous years, and less convicted founders will struggle with a more muddied picture of future funding.

But for those who delight in navigating the unknown toward a north star vision, this will be a fantastic time. There is vast design space for teams to build companies that accelerate capital adoption on crypto rails. One of those specific areas lies within SME lending – a market that accounts for 40-45% of economic activity in the United States. Fintech (phase II) tried its hand at tapping this market and was mostly unsuccessful. In a past life, I evaluated many of the early fintech lending platforms: SoFi, OnDeck (acquired by Enova), LendingClub, Kabbage, FundingCircle, etc. Each believed they could combine “alternative” data sources5 with ML to build risk-based pricing models, allowing them to underwrite small businesses at scale. At best it was a marginal improvement to simple FICO scoring models and in reality gave teams a false sense of product differentiation. However, reaching this market has obvious upside given (i) its size and (ii) that it’s historically been underserved by traditional banking – mostly because it’s been too difficult and cumbersome to underwrite profitably.

The reality is banks are in the business of deploying capital as efficiently as possible. Underwriting hundreds of thousands of $50K loans to heterogeneous businesses doesn’t fit this mandate. The lines of commercial vs. consumer lending blur here too, making internal regulatory committees skittish and overly conservative. There’s also nothing to cross-sell to these small businesses in the same way investment banks offer a suite of services to larger corporations (treasury management, bond offerings, M&A, structured products, etc).

This lending void persists today despite a wave of fintech platforms flooding the space during fintech phase II. Their underwriting models *were* better predictors of loan performance and they accessed cheap capital thanks to big bank securitization. But many (all?) of these companies failed to appreciate the inherent vulnerabilities in their business model…

1) Customer acquisition was incredibly expensive. Direct mail was a core method for trying to reach potential customers, a sign these platforms were spraying & praying without really knowing who their customer was. This same customer acquisition slide appeared in every deck:

This was shown as a sign of diligent underwriting – “see how stringent we are!” – which was the right message to convey to prospective lenders but revealed a flaw for equity investors. The inefficiency with which these companies acquired customers was staggering.

2) Lifetime customer value was low. Given the shallow product offering6, the CAC problem was exacerbated because these platforms couldn’t spread the high cost over multiple products, or even repeat turns of the same product. The best customers were repeat borrowers but there weren’t nearly enough to cover acquisition spend and they felt no allegiance to any individual lender.

3) Adverse selection was rampant. The least attractive borrowers (i.e. those with the weakest underlying business economics) were the ones most likely to find their product. An example to clarify for anyone unfamiliar:

Company A is a thriving small business that turns nice recurring cash flow, but the operator is not especially financially literate. The business runs fine as-is but could run more efficiently with a recurring credit line product that pays the lender a small yield while the owner improves profitability via operating leverage.

Company B meanwhile is on its last legs. It’s bleeding cash and forced into offering discounts, rebates, sales just to stay afloat. The operator knows this isn’t sustainable, can feel the walls caving in and realizes it’s a matter of time before the business goes under.

Lenders would prefer customers like Company A, but in reality, saw far more inbound interest from Company B profiles. This is the adverse selection problem.

4) No moat was ever built. These companies never ingrained themselves with customers or consistently iterated to deliver products that made customers sticky. Shopping around for the lowest rate became the norm. If the product is simply a commodity (in this case an interest rate) it’s hard to win repeatedly. It’s also near impossible to accrue value to your platform.

These are all problems that were inherently baked into the business model of these companies. Some of their struggles could be explained by an overreliance on unsustainable cheap capital. Others can be explained by a laissez-faire attitude toward developing long-term, deep customer relationships. Growth was the name of the game in this space just as it was in many others over the past decade7. The sugar high has worn off.

But just how poor have the economics been? A recent study8 revealed less than 5% of neobanks in the world are breaking even. This suggests two things:

It’s extraordinarily difficult to scale this type of vertically integrated business using the current approach – casting as wide a net as possible & pushing a limited product on customers is not the answer:

“The key here is to seek first to understand and then to be understood. The problem with telling a potential customer what you think they need before you understand what they think they need is…

…You’re basing your position on a known set of requirements from a broad base of companies instead of unknown specific opportunities.

…It positions you as more of a commodity or just a vendor – as opposed to a partner that can help transform the way they conduct their business.”

- Mark Cranney, If SaaS Products Sell Themselves Why Do We Need Sales?

An incredible opportunity still exists for teams who can find the right customers, build & ship high-retention products & offer appropriate depth from a product suite perspective – crypto will have a meaningful role to play here

Let’s approach the current fintech landscape from the opposite point of view now. Customers have embraced on-demand finance and are increasingly frustrated with traditional financial services. They’re also not keen to download 20 different apps to manage their personal finances. As the crypto ecosystem continues maturing, the need for crypto-native financial services will only grow. In the traditional world we take for granted that our employers have embedded relationships with 401(k) providers, payroll management partners, wealth management services, healthcare relationships and other employee-benefit perks. This ecosystem has yet to develop in crypto, with each respective TAM presenting its own compelling opportunity.

Take wealth management for example – embedding a cryptonative robo-advisor or automated asset allocator into an existing payroll provider (Bitwage) is a compelling value-prop for those customers. It meets them at an existing channel (reducing friction) and offers a seamless, automated service without asking much from them. We talk a lot about composability legos9 and here’s a great example of where they can deliver & accrue value. Embedding at this level gives you access to customers already familiar with the space who will have a higher pull-through rate. Teams building here will need to be sharp on communicating exactly what they’re delivering (“we offer users passive crypto exposure through a market-weighted ETF product composed of the top 30 cryptocurrencies, rebalanced quarterly”). Alongside is just one example of a team building around this focus. User-controlled discretion and simplicity will be important too as these teams bring an initial product to market. It’s inevitable the regulatory arbitrage that exists today will dissipate, so flexibility and a faster cadence for shipping new value-add services will be table-stakes. Some of these may include more white-glove professional investment services, consumer lending products, mortgages or estate-planning for digital assets. Slower teams or those unwilling to operate within an unclear regulatory environment will ultimately fall behind. “The institutions are coming” was a popular meme during the last bull run, and some indeed did show up. But they remain largely held back by uncertainty over how the regulatory landscape will shake out10. This won’t last forever. Entrepreneurs have an opportunity now to seize a foothold in the reimagined financial services world we hope to build. Regulatory uncertainty can be seen as a gating non-starter for some, but the teams that embrace it as an opportunity will be the ones who realize special outcomes.

As an aside – something I find a bit odd on a fundamental level is the idea that those investing at the earliest stage need regulatory clarity first. Please consult my giga-brain chart for more clarity on this.

Capturing customers at this stage with simple products will lay the foundation for long-standing relationships. At the end of the day, these companies will need to grow alongside their customers – this is customer lifetime value. A great failure of the existing fintech space was a lack of innovation and product development.

This can be seen clearly if we look at the first paragraph of LendingClub’s “Risks To Operating Our Business” section from the most recent 10-K:

“The financial services and banking industry is evolving rapidly and changing with disruptive technologies and the introduction of new products and services. We derive a significant portion of our revenue from transaction-based fees we collect in connection with the origination of unsecured personal loans. To enhance customer engagement and diversify our revenue streams, we are undertaking a strategy to broaden the scope of our products and services we offer. Failure to broaden the scope of our products and services leaves us dependent on a single revenue stream and vulnerable to competitors offering a suite of products and services. Accordingly, a key part of our success depends on our ability to develop and commercialize new products and services and enhancements to existing products and services.”

If we observe the underserved SME market, crypto solutions are well-suited to solve the existing problems. The most glaring need for SMEs is working capital11. Crypto rails are an exponentially more efficient method for addressing this – they compress the 2-3 day settlement period into seconds and provide an instant audit trail. One of the loudest gripes from SMEs is how slow and frustrating the loan application process is. The difficulty of lending to small businesses will ease as reporting cycles compress and transaction speed increases (thanks to fast finality on-chain). Smart contracts can automate and abstract away many of the impediments that put a drag on application-to-funding timelines. Factoring, ARR financing, short-dated receivables should all be done more efficiently on-chain. ARR financing is especially interesting as DAOs begin accruing meaningful revenue; their treasury management groups will need to become more sophisticated and robust. P2P lending pools will also unlock new use cases for crypto more broadly. Bringing real-world small business activity on-chain can open the door for real-yield fixed income products12. This is the opportunity that brings widespread adoption (>30 million US small businesses today) and legitimate yield (not just inflation ponzis) to crypto. I encourage you to go through this primer on real world assets which includes a helpful visual:

There’s activity across these subgroups but it’s the barbell categories that are most intriguing and where I see the greatest opportunity for value capture. If crypto rails and DeFi are going to eat fintech and ultimately traditional finance – something I strongly believe – then the piping must be developed to support it. The muddled regulatory environment will persist in the short-term but I tweeted recently that crypto enjoys an obvious benefit it should lean into.

Providing significant value-add to small businesses is one of the few bipartisan political issues remaining. Neither side can afford to actively block crypto startups who are clearly meeting an unserved need for such an important and sizable chunk of the US economy.

Just this morning another survey revealed similar sentiment.

Now look, there’s a meaningful delta between the unbounded potential that exists and where we’re at today. This future doesn’t get built by people like me writing about it. It gets built by the entrepreneurs with unique visions on how to solve these problems. So for any founders or teams out there excited by any of this, please reach out. I’m more than happy to share my views on the space and be an early user / share feedback / do what I can to help builders who are mucking it up everyday.

My dm’s are always open @0xsmac on twitter.

this should be easy for most of you who do this regularly on twitter

I think this has been a net-positive on the whole but I am sympathetic to the arguments against this. There are obvious pitfalls to the gamification of investing (or gambling depending on your view) but I tend to think it’s a space you must learn by doing. Better to make mistakes when you’re younger and not when you’re in your 40s-50s with children, a mortgage and family to support. I asked a close friend who is in this target demo if he thought the experience he’s had the last 2-3 years is good or bad. His response was effectively: “i think it’s been a net positive for the long-term - it’s crippled me in the short term bc i’ve yolo’ed into different things but now realize the best thing is to just set it and forget it unless i want to lose everything. so now i know that i have real savings where 85% of my money goes, and then i set aside some money to ape stuff that’s more discretionary”

In fact, the implications of Robinhood driving trading fees to zero are now being reexamined given the payment-for-order-flow debate. But that’s a conversation for another time.

The richest source was gaining access to borrower real-time bank account feed, which although an opt-in feature, was one lenders increasingly incentivized through discounts/rebates/fee waivers

For example a one-time short-term bridge loan

Other tangential industries have seen similarly lackluster results (see: OpenDoor).

Just this week we saw heated debate around DCCPA from a lot of important characters

This remains the most cited use for loan applications

Centrifuge is currently pushing the space forward on the securitization side here but there are others as well