SOL Survivor

A unique perspective on what makes Solana a compelling asset & network to build on + why low fees can be actually good for value accrual

There’s been exhausting debate over whether modular or monolithic integrated blockchain architecture is superior. We’ve seen relentless finger-pointing about how decentralized a network is, what constitutes true decentralization and how feasible (or relevant) it is to run your own node. These discussions aren’t meaningless, but they usually end up dragging both sides into the mud and somewhere along the way intellectual honesty goes missing. Tribalism is human nature and we see it everywhere now – religion, sports, music, politics. But a lot of the reason people are so disenchanted with the US political landscape is because we root for the jersey: red or blue. Candidates within these parties can’t give an inch to the other side or they’re ostracized by their own team. This is increasingly visible within crypto as we argue about smart contract platforms. There was A LOT of dunking and grave-dancing on Solana just 12 months ago when FTX went down. Critics called for its death claiming it was an FTX/Alameda-sponsored ponzi chain all along. Lots of not nice things were said, mostly by people who were just happy to see a credible competitor to Ethereum disappear (or so they thought). We know that period wasn’t the ultimate death of Solana, and in fact has served as a catalyst for the dedicated “glass-chewing” teams who continue to build on the network.

We have long held the belief Solana is interesting because of its differentiated approach to building blockchains compared to the rest of the landscape. Ethereum remains the dominant layer 1 smart contract platform, and there are valid reasons to expect that will persist. But technology markets – and in many cases most markets regardless of industry – trend toward duopolies, or oligopolies. Our view is that there’s a great chance Solana is one of these ultimate winners.

While we still expect Ethereum to be incredibly valuable and a bedrock smart contract platform, it is not without its own problems. It’s undeniably clunky and very fragmented – both from a liquidity perspective, but also from a social consensus perspective. Sure there’s a roadmap, but I think the hand-wavey perspective that “everything is moving to L2s it’s fine” oversimplifies things. Each of these providers is making their own niche architecture decisions and design choices, all while competing amongst each other to be the dominant L2 on Ethereum. Crypto is inherently a social technology as much as it is a financial one, and when you introduce more and more layers of social complexity it makes things move slower, fractures momentum and opens the window of opportunity for competitors.

An internal thesis we hold is that the sooner adoption comes to crypto, the more likely it is Solana outperforms and gains a greater share of the smart contract market. If mainstream adoption takes 10 years then it’s likely Ethereum will have enough time to smooth a lot of its existing friction. But if millions of users are pulled into the space over the next 3-5 years, we expect Solana to benefit disproportionately.

The most digestible way to walk through how we at Compound have been thinking about Solana is to address the main criticisms we often hear from others. Again, we think it’s important to be intellectually honest when talking about tradeoffs and design choices so while we believe both Ethereum and Solana are assets worth holding long-term, both have a lot of execution risk to reach the heights we think they can.

The fundamental thesis of Solana – lowest fees possible – is at odds with the underlying SOL token accruing and capturing value for tokenholders.

This is an interesting philosophical question, because it implicitly suggests the only valuable tokens will be those which can extract large fees from users. The irony of this being a narrative violation is not lost on us. “Strip away the intermediaries who charge high fees! Come join us on the chain where we…charge high fees!”1. I understand L2 fees are lower but lower is not good enough when we’re talking about the transaction loads we expect to see.

If you believe this is the only path towards valuable network tokens then that’s fine, and if you squint there is evidence to suggest you are right. That world though, is one in which crypto remains incredibly niche and is mostly used by the small group of nerds, degens, hobbyists, etc who are here today.

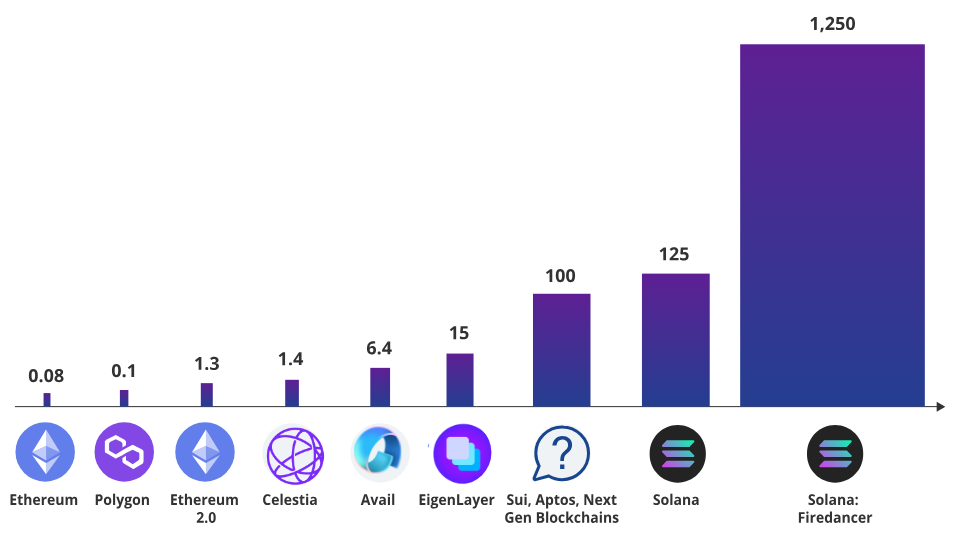

But if you do not believe crypto will remain a niche, fringe thing, then it behooves you to examine the existing landscape to see if there are truly differentiated networks that make other tradeoff decisions. Since Toly’s original pitch – blockchain at the speed of Nasdaq – the vision for Solana has always been incredibly high performance and throughput. One of the benefits to this approach is that Solana TODAY is orders of magnitude more performant than any of the existing blockchains out there.

Data Throughput Comparisons MB/S

This is important for a number of reasons, but specifically as it relates to value capture, the obvious alternate path to fewer high-fee transactions is a huge number of low-fee ones. As it stands today this is only feasible on Solana, where developers are largely interested in building for massive distribution – they want tens of millions of consumers to use the apps they build. The trouble with this future for Ethereum is that it’s a global fee market. What this means in practice is what we’ve all experienced first hand: a popular NFT mint affects the gas prices for everyone using the network, even if they’re just executing stablecoin swaps somewhere in DeFi land.

Solana on the other hand has local fee markets. It’s less important to understand how fees previously worked and more critical to appreciate this: block producers can now specify their own fee rate for their leader slot on top of the global rate. In effect this enables the bifurcation of fees such that specific activity on one application (i.e. a popular NFT mint for example) doesn’t cause fee spikes across the rest of the network (i.e. within Solana DeFi for example).

The clear benefits of local fee markets include:

More granular fee markets allow validators to better price their work based on demand

Lower fees for users where validators set lower local rates

More optimal usage of resources as validators can dynamically adjust local rates based on actual workloads

A cluster fee rate that still acts as a baseline to avoid spam tx’s

On top of this you have downstream economic benefits as well:

More fee revenue flowing to validators who provide actual capacity

Better transparency & ability to manage operational costs for validators who can better align fees to actual workload

More predictable fee rates broadly

Lower fees for users when the network is underutilized

These are massively important distinctions for Solana when it comes to architecture and design. But almost by definition, a protocol designed for low fees will have a direct impact on network profitability. So from an economic perspective a core question becomes, how does SOL the token, appreciate in value as user demand for the network grows? It’s easy to assume on a high-level there will be more users 5-10 years from now and thus:

Intuitively this is a valid thesis but it doesn’t give any semblance of scale. It doesn’t tell you how many users you actually need given some set of assumptions. Maybe 1-2 MB/S of data throughput is fine after all? The *best* credible argument for how SOL sustainably accrues value is through the long-tail of applications. If you design for low fees you have to have a lot of users executing a lot of transactions. But how many exactly? And is there supporting evidence to suggest the SOL token actually appreciates in value as user demand & activity grows? If so, how strong is that relationship and do we have anything we can compare the current state of Solana to?

To some extent we do.

Below is a very high-level comparison of two separate blockchains. Keep in mind these are imperfect measures of actual usage/adoption given how easy it is to manipulate addresses and user activity data. But that’s not necessarily important for this exercise.

Blockchain 1 Metrics

Blockchain 2 Metrics

In each case we have relatively similar levels of absolute DAUs. We also see those DAU levels correspond to similar absolute levels of FDV for the network. There are some things that notably standout here:

The sheer size of the fees captured by Blockchain 2 relative to Blockchain 1; nearly 15x more given a similar level of DAU

The strength of correlation between fees and market cap of the network; it’s especially high for Blockchain 1 at 96%

Given the nature of this piece I don’t think it’s a big secret to reveal that Blockchain 1 is Solana, specifically the period from December 2020 to today.

It’s also probably obvious Blockchain 2 is Ethereum. But specifically it’s Ethereum from the period of January 2017 through March 2019. A much less mature network than Ethereum is today, but around the same age at that time as Solana is today.

If you are an ETH maxi you might point to how much value ETH is able to capture from users – nearly $5M in daily fees at its peak and ~$10 per DAU. Meanwhile SOL was only able to capture ~$0.70 per DAU and only ~6-7% of the total fees as ETH.

The counterargument is that back from early 2017 to mid 2019, the universe of available blockchains out there was nonexistent, so Ethereum was truly the only game in town. There’s also something to be said for a user base that’s far less sensitive to higher transaction costs, especially given the wealth creation event from owning ETH up to this period. As more and more regular people begin interacting with blockchains – either consciously or through account abstraction – is it wise to assume these people will onboard to chains where fees are high and UX is clunky2?

What struck me from parsing a bunch of on-chain data was how tight the correlation between fees and FDV were, especially for Solana. As much as the space likes to joke about shitcoins, magic internet money and memes – there is undeniably a strong positive relationship between fees generated and overall network market cap. That suggests forecasting network activity, growth and fee generation will actually tell us something about potential longer-term outcomes for these networks. Especially as the space matures and more sophisticated actors attempt to build frameworks for valuation. It’s not perfect and these are still small sample sizes but that doesn’t make the exercise any less useful in my opinion.

If we look at Ethereum during the period noted above we see it traded as high as ~10,000x on a market cap-to-annualized fee basis. Obviously this is an extremely volatile metric, especially in the earliest stages of a network’s life. Today, a much more mature Ethereum trades somewhere around 200x annualized fees.

Looking at Solana for comparison, at its peak it traded ~4,000x annualized fees and today trades somewhere between 600-900x.

It’s natural to assume this ratio compresses over time as the network matures. And while it’s still unclear just how these things will be valued on longer time-frames, we can look to ETH for some guidance. If we assume SOL compresses to a similar level (~200x annualized fees) over some shorter time period (4-5 years) then what type of fee generation do we need to see materialize3?

Solana today is a ~$12bn FDV4 network. For further context its peak annualized fees were just north of $113M at the height of the last bull market.

This at least gives us some idea of what type of scale we are talking about when it comes to daily fees and total users. Again, it’s still relatively inexpensive to game some of these numbers (especially on a low-fee network like Solana) but we are talking ballpark figures here.

Before we get to the million dollar question of how we actually reach 10 million users, I think it’s important to slightly digress here…

Oftentimes people in crypto either neglect or refuse to attempt to think deeper about valuation. Some of that is people willfully sticking their heads in the sand. But part of it is also because smart contract platforms are still nascent. Extrapolating at these stages means somewhere along the way you must make some faith-based assumptions. For Ethereum those include things like scaling solutions developing, account abstraction reducing friction, bridges maturing, user behavior shifting toward the L2s, security hardening, ETH becoming “internet money”. For Solana it’s believing the next wave of consumers will gravitate toward an integrated blockchain, optimizing performance to handle orders of magnitude more activity, figuring out the mobile stack, diversifying clients and expanding diet clients over time. But these are just one part of an admittedly ambiguous model for valuing ETH and SOL tokens. The types of considerations I just mentioned are the fundamental leg. The bulk of this piece will focus on those. But there are two other components to valuing these assets worth mentioning.

The second is flows. This is most obvious during periods like the one we just saw with Solana over the past few weeks. You can attribute the price action to other things (i.e. information asymmetry compressing for example) but in reality, there are simply more buyers than sellers. Participants feel underexposed and chase. Plenty of investors wanted to own SOL, didn’t have conviction and assumed they would get some type of pullback to enter lower. It simply never came, and eventually they capitulate and buy higher. And while the capital pools are still small today, it’s clear that’s changing.

The largest asset manager in the world is pushing full steam ahead into crypto – flows will play a major role in how these assets are valued over the coming years. Shrugging off ETF announcements or claiming “everyone who wants to own crypto has a way to own it today” is S tier midwitting it. It’s lazy and not true.

Jurrien is describing just the tip of the iceberg. The mind virus is spreading as traditional finance slowly accepts the idea that crypto should be a staple in all of our asset portfolios. Slowly at first, then all at once. The majority of people in crypto now think of Bitcoin as a “boomer coin” which I find amusing. I will always have a soft spot for Bitcoin, but anyone who's been around long enough knows most of traditional finance laughed at the idea of Bitcoin as anything other than a ponzi or niche nerd experiment. It’s inevitable the institutional capital allocators we need – and we do need them, they have ALL the money – will continue expanding their breadth and depth of exposure to crypto. They may call it something else (“digital assets”) but we won’t care so long as they’re bidding. This is the flows element and it will be a one way river for the foreseeable future.

The final component for valuing these networks is thinking through the speculation premium. This is especially difficult as it’s the least rooted in reality, and markets have shown time and again they can stay irrational longer than participants can stay solvent. Especially with new technology it’s common to see the boom & bust cycle pattern we’ve experienced over the past decade. Each time the drawdown is less severe as the space matures and the floor is found at some higher level than the previous crash. It’s human nature. This is even more pronounced in crypto as the technology is so closely tied to a deeper ideological and social coordination dynamic that makes these assets incredibly reflexive.

There’s no perfect comparison to make here but throwing your hands up because of that seems less productive than looking at actual valuation changes for adjacent assets.

Let’s take Microstrategy for example…

Our good friend Michael Saylor first announced he was pivoting his business intelligence and mobile software company in July of 2020. If you dig through MSTR’s financial statements it’s pretty obvious there’s a fairly dramatic change beginning in Q3 2020. So what can we glean from this?

Here’s what the 10 prior quarters of performance looked like for Microstrategy BEFORE pivoting to Bitcoin accumulation:

And in the 13 quarters since transitioning >70% of his company’s assets to Bitcoin, here’s how Microstrategy has performed:

Admittedly the 78x Price/Book in 2Q ‘21 is an outlier but even if we exclude that, the average P/B is still >9x post-BTC buys.

The point of this is to demonstrate what kind of speculation premium the traditional markets are placing on these types of assets. All else being equal MSTR’s financial performance metrics haven’t really changed much; in fact, revenue growth has been pretty anemic for a software company. Yet the company trades at multiples far in excess of where it did previously (~3.3x higher on P/S & between 3-6x higher on P/B). This suggests a floor for the speculative premium when we consider the following:

Microstrategy is a publicly-traded company

The crypto asset it owns is the most dominant, most liquid, most lindy and most institutionally-accepted one

My suspicion is these multiples would be even higher had Saylor been an ETH maxi.

None of this is a one-to-one comparison but if we do some quick back of the envelope math it looks like this:

The QQQ’s trade at ~35x P/E5

An asset trading 3-6x these multiples is somewhere in the 105-200x range

That’s probably on the low-end given Ethereum (and especially Solana) are further out the risk curve than Bitcoin

My sense is something closer to 10x where high-growth tech stock multiples trade is a reasonable expectation for where Solana trades as it matures over the near-term (3-5 years). There will be violent fluctuations around this estimate as flows and speculation ramp but that’s to be expected.

With that framing in mind, in order to get back to new all-time highs from an FDV perspective the network is looking for something in the range of $420-$450M of annualized fees. Depending on your perspective, that may or may not sound steep but it’s ~3.5-4x the level Solana reached back in 20216. Given the FTX/Alameda stink is gone, the network has made incredible technical growth, and the cockroach developer community continues to build, it’s hard to imagine Solana doesn’t reach these levels sooner than people think7.

Ok, digression over…

This ultimately takes us to the million dollar question, not just for Solana but crypto broadly.

How do we reach 10 million DAU?

Reaching 10 million users is often talked about as an inevitability. “How do we onboard the next [redacted] million users” is catnip for crypto media. But this is much easier said than done8. My personal view is that part of the problem here is that often gaming is the default answer because everyone knows there are 3 billion plus gamers in the world today. Surely we can capture just a small fraction of them?! I will refrain from dunking on your favorite CT personality but suffice it to say, some delusional tweets about gaming adoption were sent over the past few years. Incidentally I’m not as bearish crypto games as I sound but I think assuming the gamers will save us is neither prudent nor realistic. Especially if constrained to desktop. We need more.

The Solana Mobile Stack (SMS) is unique when we think about regular consumer use. It already includes a secure custody protocol for mobile, facilitates instant signing of transactions while keeping private keys away from wallets, apps & the Android OS. The native integration of software and hardware is appealing and both Apple & Google haven’t been interested in pushing mobile self-custody forward, yet.

The other intriguing thing about mobile is that it’s been extremely powerful for sparking unexpected and unanticipated use cases. It wasn’t obvious that GPS within smartphones would lead to Uber, or that everyone suddenly having access to a camera at all times would lead to Instagram or Snap. One thing was true, which was that hardware providers made conscious decisions about what should be included in the device, with the idea that the wider developer community would use its creativity to build cool stuff. While it’s true plenty of apps and companies die along the way, the ones who succeed create orders of magnitude more value than all of the fallen companies combined. Uber is a $100 billion market cap company today. At its peak Snap was a $130 billion company. Instagram is a >$100 billion platform today. These outcomes dwarf the litany of failed companies that never reach the type of PMF, scale and distribution these winners did. The same is likely to be true in crypto.

So when we look at Solana today, it’s not obvious what future applications will take off or pull users in – we can hypothesize what those might be – but it’s also more likely a single developer or small team builds something that in retrospect seems obvious. A driving force of our thesis is the assumption that Solana continues to enable an order of magnitude more scale than Ethereum (and its L2s). Otherwise it’s possible this thesis breaks down. But there’s good reason to expect this will continue to be the case, namely thanks to the parallelized VM9.

So what verticals within the Solana ecosystem are intriguing today and are there unique advantages the network has relative to its peers.

Payments

Despite what crypto twitter might have you think, it’s not just the glass-chewers who think what’s going on here is cool either. Visa’s decision to expand stablecoin settlement capabilities to Solana is notable, not simply just because they’re doing it but because of the motivation behind it. Visa has the capacity to execute ~65,000 TPS10 and noted specifically that Solana has shown a “significant level of demonstrated throughput, making it viable to test and pilot payments use cases. In comparison, Ethereum handles an average of 12 TPS”.

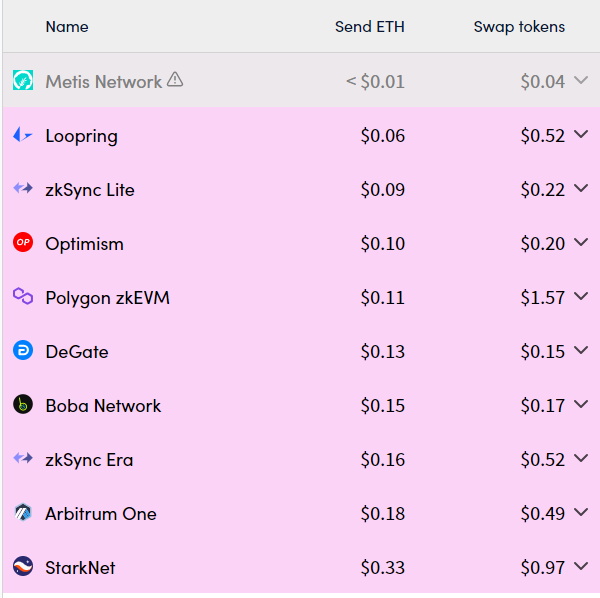

Low cost is of course important for payments, but just as critical is high predictability – this is what makes Solana so attractive to explore for payment operations. You can’t have global payments distribution built on a network that experiences the type of fee spikes Ethereum still faces today (see below). Modern corporate treasury operations are an extremely boring, yet massive potential use-case for activity on the network. It’s unrealistic to expect this type of use-case is feasible on Ethereum and there’s nothing on the roadmap that suggests this feature will be solved soon.

When we think about mobile payments for actual real consumers, time to transaction confirmation is just as important as network throughput. Solana is ~500 milliseconds compared to minutes in some cases for Ethereum11. You can argue about the reasons Solana is faster and whether or not optimistic confirmation is the right mechanism, but the fact is these are important determinants for mass adoption. This is one of the cultural differences I sense most when comparing the median Solana builder to the median Ethereum one. Solana developers seem more practical when it comes to thinking through baseline expectations of non-native users. This mindset is massively undervalued within crypto in my opinion.

The last point I’ll make on the payments side is the retail perspective; Solana Pay integrating with Shopify allows direct access to ~10% of all US e-commerce. US e-commerce today is closing in on $1 trillion in annual revenue. With a T. Merchants now have a nearly fee-less alternative to the standard credit card processing rake (~2% on average) – this is the type of distribution and broad adoption you need to reach tens of millions of users.

DeFi 2.0

It would be an understatement to say Solana’s DeFi ecosystem was completely rekt during the FTX fallout. It’s a testament to the builders who doubled down despite plenty of reasons (and incentives from other chains) to pack it up and move elsewhere. We’re now a year removed from that wreckage and the green shoots of a new generation of DeFi have been sprouting for months.

There’s a lot of expectation for the reinvention of DeFi applications to lead to a similar adoption explosion as what we saw during DeFi Summer. WE expect these teams have learned from Ethereum token launches and from the errors of Solana DeFi 1.0 (“Sam Coins”). This expectation applies to both distribution as well as more sophisticated tokenomics. The stakes are certainly higher now which comes with the increased attention the ecosystem will see. Jupiter announced their airdrop recently and immediately there were comps to a potential recreation of the UNI moment. I think this is maybe getting ahead of ourselves but it is clear Solana DeFi is meaningfully back – activity is picking up across the board and those who have never used Solana are asking what applications to try. Beyond the full suite of DeFi apps users are accustomed to, Solana’s CLOB-centric focus opens the design space for more sophisticated financial instruments that are simply not practical on any other network.

The obvious evolution of Solana DeFi will be further developing the LST and MEV markets. MEV hasn’t really been there but Jito is building a setup for this to be routed back to SOL holders through LST yields. For all of the decentralization-shaming Ethereum people like to do, LSTs there have largely devolved into political theatre and a centralizing force. Solana has the opportunity to learn from this and push the LST innovation space forward.

Today, >45% of staked ETH is currently sitting in liquid staking protocols, compared to just single-digit % of staked SOL. We know liquid staking is one of the largest economic activities in DeFi today (and growing) with some $25 billion worth of ETH staked in LSTs. It’s a great way to increase capital efficiency and it’s encouraging to see SOL staking has already returned to pre-FTX collapse levels. We’re also beginning to see more composability happening here as well with DeFi protocols allowing SOL LST tokens as collateral and Jito offering the first staking product that includes MEV rewards.

There’s a lot to cover on Solana DeFi but for those less familiar I’d suggest starting with Mert’s recent list. What seems overlooked from the past 12 months is that while the FTX/Alameda engine had a lot to do with Solana’s early DeFi success, plenty of sharp people were reluctant to spend time here because of this overhang. That stench is now long gone and the network is primed to enable unique applications not possible elsewhere. This will be critical to building out a sustainable, large and growing DeFi ecosystem – and it’s likely that DePIN will be a large part of that.

DePIN

Much of the reason DePIN is so heavily skewed toward Solana is because in many respects it’s the only network that can credibly scale these teams’ ambitions. When we think about creating actual applications and services that people in the real world use, a more distributed build-out of infrastructure offers advantages beyond decentralization. This is what’s compelling to us. While we’re aligned with the ideology of building trustless systems, something we see far too often in crypto is decentralization for the sake of decentralization. That’s not the path to widespread adoption or increased interest in what we’re building here.

DePIN networks however offer real advantages in some cases relative to their centralized counterparts. Rolling out 5G requires more frequent tower construction which can be far slower and more expensive than using tokens to incentivize this at the individual level. We’ve heard ad nauseum about the supply shortage of GPUs, a problem likely to get worse and one which distributed networks can help solve. There are plenty of other unique examples of teams attempting to use distributed models plus proper incentive mechanisms to rapidly scale: from Spexigon to Onocoy to Wynd to GenesysGo. Many of these ideas will ultimately fail, predominantly because the demand side never materializes. But as we mentioned earlier, that’s to be expected – the success stories from this vertical will far outweigh all those who never quite find PMF.

The other critical and slightly overlooked aspect of DePIN is its potential to introduce more tokens into the Solana DeFi ecosystem. Like it or not, part of Solana’s slow DeFi rebuild is because there simply aren’t that many tokens to do stuff with on the network. This is a reality of crypto today: users want tokens. Anyone who’s spoken to me knows I lament the fact that most founders think their protocol or application needs a token, when in reality, few do. The nuance here is that DePIN networks actually have a reason for tokens to exist – incentivizing user behavior to help scale a network is a perfect fit for the token model. It’s also a perfect fit to leverage the uniquely global nature of crypto. But figuring out the demand side of these networks is not easy, and there will be teams who chant “once the infra is built the demand side will show up”, when in reality no users actually want the thing they are building.

The SVM is now on Ethereum – anyone who wants to can now use Ethereum as the settlement layer. This is net negative for Solana mainnet and SOL.

This is another example of differing philosophical views on what the SVM on Ethereum means long-term. The argument many Ethereans (read: ETH bag holders) make is that sure it’s a win for Solana if the leading Ethereum L2s are SVM based…but if the majority of value executed by SVMs is settled on Ethereum, then the value accrues to ETH not SOL. I think this is true in a vacuum. But the counterpoint to this is: we already know Ethereum L2s will exist. Nobody debates this is true and in fact the entire Ethereum roadmap is centered around this architecture.

The fundamental underlying belief here is that the best SVM is on Solana mainnet so if L2s are going to launch (we know they will), it’s better for the Solana mainnet ecosystem if these L2s launch using the SVM vs some other competing VM.

Humor me for a moment here as we imagine 2 divergent future paths:

Future 1 – SVM adoption never really takes off at all within the Ethereum ecosystem. The EVM remains dominant (>90% share) and all L2s on Ethereum are EVM-based.

Future 2 – the SVM dominates. Turns out the SVM is a better alternative and it completely flips the EVM. All L2s on Ethereum are now SVM-based and the EVM shrinks to <5% market share.

If we think of these two extremes, do you believe the Solana ecosystem, Solana mainnet and specifically the SOL token would have divergent outcomes if Future 1 is realized vs Future 2? If the answer is no and that both of these futures result in the same outcome, then fine. I would strongly disagree with this assertion though. It’s difficult to imagine Solana mainnet struggling for adoption if the most widely-used Ethereum L2s become SVM-based. The reality is likely to fall somewhere in between these of course, but I find it a bit odd that SVM adoption on Ethereum is viewed as some boon for ETH. The closest parallel in my opinion is if we look at Binance Smart Chain, an EVM-fork that has no value directly flowing back to Ethereum. Some might say this development was good for the EVM and EVM-adoption but bad for ETH…to me this is a bit intellectually dishonest. More attention, more interest, more adoption of the SVM leads to more value creation and accrual to Solana mainnet; this is what I believe but there are others who think that’s not obvious or remains unclear. These disagreements are what make markets but it takes far fewer mental gymnastics to believe expanding the size of the SVM market is a great way to generate value for SOL12.

Something also slightly misunderstood is that Ethereum state is bridging into SVM forks (like Eclipse or Maker) not Solana state; so if these find real PMF all of those users can now easily connect & bridge into Solana mainnet – contracts, bridges, wallets, tooling, etc. These SVM forks aren’t competing with Solana mainnet, they’re actually competing for a share of Ethereum’s L1 state. An anecdote Toly made a few months back was that if Eclipse had been out a few months earlier, maybe Coinbase would have launched an SVM-based ETH L2.

Circling back to the Binance example, if BSC launched today as a fork of Solana serving a huge number of Binance users, I struggle to imagine that wouldn’t benefit Solana mainnet immensely, even if indirectly.

Another way to think of this is that L2s are a “good business” right now. There’s a lot of capital flowing there and everyone is launching their own L2. If you believe the school of thought that we’ll see some L2 dominance on the EVM (i.e. oligopoly dynamics) then it begs the following question: where will these other zombie L2s go? They’ll inevitably use grants to build dApps but as the SVM gains adoption and a handful of L2s emerge as winners, we can expect some of these L2 teams will port over to Solana vs Arbitrum or Base.

It’s also worth adding here that Hyperledger Solang13 allows EVM-chain developers to deploy applications on Solana now without having to learn Rust (or another programming language). The motivating factor is that you can now build on Solana with Solidity – more programming languages available means a broader skill set of developers entering the ecosystem, reduced friction for existing developers and overall it makes the Solana ecosystem more accessible.

All of the liquidity is on Ethereum, why would that change? Look at TVL. Look at users on L2s compared to Solana. A roll-up centric future on Ethereum is the logical future state.

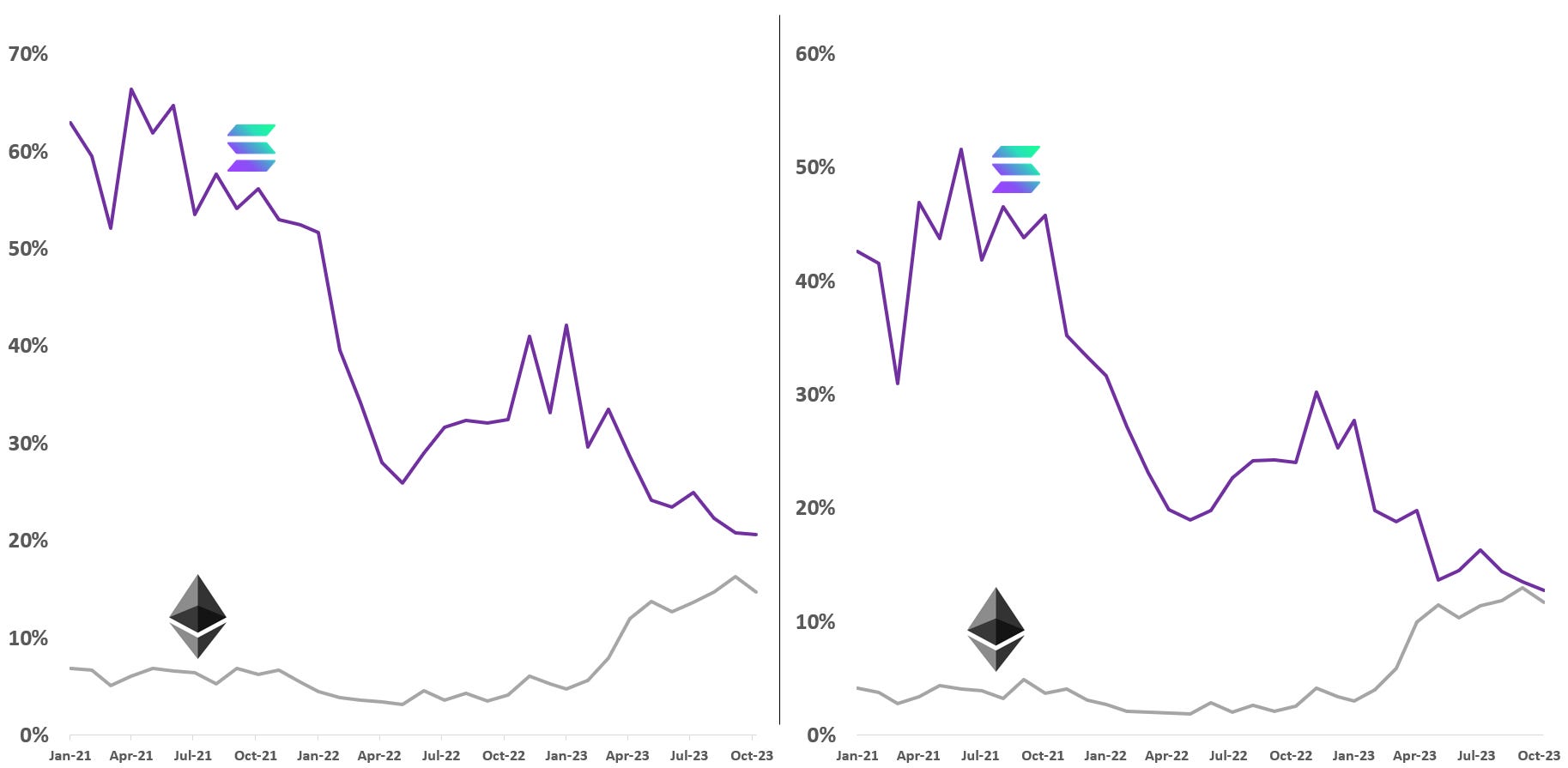

Leaving aside the historical precedence of how software technology develops, there’s danger in assuming that since Ethereum dominates the existing liquidity landscape today, it must be so in the future. Ethereum capturing a dominant share of liquidity right now is a function of a few things:

Lindyness – it was the first smart contract platform. There were really no other places to do anything on-chain before 2020 so the majority of crypto users’ first experiences were on Ethereum. Lindyness may not matter on longer time-frames as the development head start shrinks, but it undeniably led to Ethereum’s dominance up to this point.

The wealth creation event from owning ETH leading up to the last bull run14 means most users today are rich and don’t care that it’s unusable for the next wave of people. Some like to point to how the degen activity all happens on Ethereum because it’s where all the users & liquidity are. In reality this is an own goal of sorts as PvP’ing to level up your individual stack is not the future of france. Thinking the current state of activity on blockchains will persist ignores what activity is happening, why it’s happening where it is, and who is likely to be the next wave of new users.

The counterpoint to my above argument that I hear most often is – “Smac that’s why we have L2s. All normies will use those – it’s cheap to transact but they get Ethereum security too”. Ignoring that L2s are orders of magnitude more expensive than Solana – so much so that a lot of DePIN applications could not feasibly exist on any ETH L2 today – this is a very hand-wavey response. For one, the bridging experience is still terrible so a lot of the liquidity on Ethereum is “trapped” simply because moving it elsewhere is such a bad user experience. We can argue about the degree to which modular UX has improved but I think it’s often underappreciated how desensitized we’ve become. Normal people are accustomed to instant, clean, smooth mobile apps – it’s completely unrealistic to expect these people to use Ethereum & roll-ups the way they function today. I’d also add that often I’m told each of the major L2s have similar size user-bases on their own compared to Solana; does anyone believe these are unique users? How many people do you know in your life who have only ever been onboarded to Optimism for example, but never touch mainnet or Arbitrum or Base? Many of the people making this argument will also gleefully tweet about how “unique individual wallets have reached a new all-time high!”. Metrics theatre15.

The argument Ethereum heads like to make is that rollups are the answer, all the activity will happen there and settle back to mainnet. This is flawed thinking in my view but I will say there is a world in which I do believe this is *more* likely. If we don’t see meaningful adoption (tens of millions of users) within the next decade, then sure I will grant you that it’s more likely the Ethereum + rollups architecture becomes the de facto place where activity happens. Why? Because that gives the community a lot more time to smooth the existing friction today, figure out how to crack the bridging nut, improve UI/UX, optimize throughput and connect much of the currently fragmented state of the ecosystem. Part of the appeal for the Ethereum ecosystem is that it doesn’t change rapidly and so if the users don’t show up in the short term (<5 years) that’s probably sufficient time to build. But if I snap my fingers and 10 million new users show up tomorrow, I can promise you these people are not gravitating toward the Ethereum + rollup world. This isn’t a commentary on decentralization or permissionless systems or immutability – it’s a sobering fact of where the state of things are today…

Solana takes a more iterative approach focused on scaling today, with network upgrades like QUIC enabling lower latency and better control against spam. Integrating QUIC16 means Solana can leverage benefits like:

Significantly bringing down validation time which improves overall latency

Encryption to further protect against spam attacks and DDoS

More advanced congestion control which improves throughput stability

The TLDR is that it enables higher throughput and lower latency. In practice this means higher TPS capabilities and all of the associated benefits of this: improved usability for applications, DeFi, NFT minting and really any other on-chain user activity.

The elephant in the room that I haven’t brought up yet is the release of Firedancer, which just went live on testnet. For those who don’t know, Firedancer is a hyper-optimized validator client and provides huge benefits to the network and its participants. It can’t be overstated how important having a 2nd client is from a resiliency perspective, on top of the insane performance improvements early testing is showing17. There’s also growing optimism that Firedancer will further reduce hardware requirements for node operators. It’s a bit funny to see the narrative shift now to “well if the Firedancer client is so good everyone will run that and you have the same problem as before”. These people are unserious and will never be pleased.

The other notable upgrade is Quality of Service (QoS). This effectively allows validators to process transactions in a more optimized manner, specifically around transaction scheduling fairness and flexibility. How so?

By prioritizing:

Transactions from accounts with higher balances to mitigate low-balance network spamming and/or

Older pending transactions to prevent/mitigate starvation.

These are all important technical upgrades but as we’re thinking about value accrual and capture, the economic benefits are just as notable…

A fee market that’s more fully realized as users can now pay higher fees for prioritization (better incentive alignment)

Stronger transaction inclusion and finality guarantees (more predictability for developers)

Network resources are more efficiently utilized (spam is significantly deprioritized)

Improved application performance leads to a stickier user base (and easier growth)

The benefits of QoS are sequencing transactions in a more nuanced manner. It prevents spam from filling up blocks, reduces the orphan rate during congestion and ensures applications that rely on transaction ordering guarantees can function smoothly.

One of the final, but important nuances to mention when it comes to Solana is appreciating just how young this network is. It’s easy to punch down and compare the state of Ethereum today to the state of Solana today. But this is once again intellectually dishonest in my view. These systems decentralize over time as they mature, so it’s unfair to compare an 8 year old network to a 3 year old one.

We looked at just how concentrated the top fee-payers on each platform have been over time. It’s important for us to understand how lumpy the distribution is when it comes to these users18; if the top wallets continue to dominant activity on the network that would be worrisome. But as you may expect, we found that the share of fees the top wallets on each network accounted for declined over time19.

It’s not an apples to apples comparison as many of the top ETH fee-payers are aggregated wallets like zkSync Validator or Arbitrum’s Batch Submitter – so it’s fair to say the Ethereum values are actually smaller than displayed above. But as you can see quite clearly, the concentration of top fee-payers on Solana continues to trend lower as the network matures and grows. This is exactly what we’d like to see from an emerging smart contract platform. Broader distribution, a longer-tail of fee-payers and a decreased reliance on a small group of actors.

You may look at the above and think — “ok but Ethereum is so much more broadly distributed, how is this at all positive for Solana?”

Let’s frame this comparison a bit differently. We keep the Solana data the same and we adjust the Ethereum timescale to reflect what its concentration looked like in its earlier days, specifically from 2016 to 2019. This is at least a closer depiction of two networks at similar stages of maturity.

All of a sudden these trendlines look much more similar. You’ll notice Ethereum was ALSO far more reliant on a smaller set of fee-payers back in its earlier days, but grew out of this as the network matured. Solana now finds itself doing the same thing. Funny how that works innit?

While I’m sure some people were shouting at me through their screens while they read this, I can assure you that was not the intent of this piece. Crypto is as much a social technology as it is a financial one, so I don’t expect the combative discourse around ecosystems to completely subside, but it would be disappointing if it devolves further into blindly rooting for one team or the other. Ethereum has advantages over Solana today, no question. But in other respects, Solana has characteristics that make it an attractive asset to own and a compelling place to build.

It’s the only network that can realistically handle a new wave of adoption today

It internalizes a lot of complexity so that developers can focus exclusively on building applications, without devoting resources to non-core activities

It’s already the most performant blockchain with clear visibility into further improvement thanks to Firedancer

The asset itself is strongly correlated to network usage, which will scale far quicker than many realize thanks to a combination of new applications and broader traditional tech adoption

The previous point ties into valuation as Solana’s low-fee design does not preclude it from accruing massive value, especially if you believe crypto expands beyond its current status as a niche industry.

When you look across technology more broadly, it’s just very unlikely that the first smart contract platform will be the one optimally designed to capture ALL of the value. That doesn’t mean Ethereum isn’t great or that we don’t like ETH. It just means it would be shortsighted to not explore differentiated designs when they have clear advantages. A lot of people get overly attached to assets or narratives or ideologies and it can hamper our ability to explore new things. Competition is great for improving these systems so to the extent new architectures and designs emerge we will explore those as well.

It remains to be seen how these networks develop, but we think it’s very likely Solana emerges as one of the major winners — the community has now endured it’s own version of the DAO hack, and oftentimes these traumatic events are what bind people together. The foundation is built for what we expect will be a highly-performant, developer-friendly platform where the next wave of decentralized applications live. Execution risk remains high but as a firm, we’re in the business of asymmetric upside outcomes. Solana represents that.

History has shown that when disruptive technology shifts occur, a handful of winners emerge to realize outcomes that dwarf the sea of failed startups along the way. There are obvious first mover advantages that Ethereum benefits from today. But fast-followers can learn from the drawbacks & limitations of existing platforms. While path dependency is important, it would be naive to think the future of smart contract platforms has been decided in 2023. It’s still not clear what use-cases will dominate or how competitive dynamics play out, but the tradeoffs each of these platforms make will indeed matter in the end.

If you’re building or investing in and around the Solana ecosystem, I’d love to hear from you. My dm’s are always open @0xsmac on twitter.

You can also reach me at smac[at]compound[dot]vc

Thank you to Michael, Mert, Austin, Natalie, Jon, Zion, Andrew, Garrett and many others for their input, discussion, pushback and help as I developed my thinking around many of these things.

This content is for informational purposes only, and should not be relied upon as the basis for an investment decision — none of this is investment, legal, business, tax or any other kind of advice.

But our high fees are because blockspace is in high demand and their high fees have nothing to do with demand for their services. Got it.

“Clunky” is an understatement

We can quibble over assumptions – feel free to tell me I’m dumb on twitter so long as you tell me how you would change assumptions

RIP that I didn’t get this out when FDV was $12bn

ARKK traded >1000x at its peak & mostly btw 150-300x in 2021; currently trades ~50-60x

Peak annualized fees were $113M

NFA, DYOR, etc

Obviously I believe we will reach this type of scale otherwise I would not be here

This has been written about extensively – if you’d like my recs please dm me

Solana averages ~400 TPS, surging to ~2,000 TPS during peak periods

Albeit during times of congestion

With the assumption that Solana is likely to capture the bulk of value of SVM markets

A new compiler to bridge the gap between EVM developers and the Solana ecosystem

2015 through peak 2021

QUIC is an upgrade on Solana referring to a transport layer network protocol that provides benefits over TCP and UDP. You can learn more here

highly recommend looking up all of Kevin Bowers’ discussion on this — these are extremely talented people & it’s maybe less well-known that HFT firms are one of the places you need expertise at the lowest level of the stack + hardware level. you literally go out of business if you’re not excellent at this.

Again, I understand these are not ideal metrics that can be gamed but looking at relative distributions is useful imo

With the exception of some noisy recent months for Ethereum