(any views expressed in the below are the personal views of me, 0xsmac, and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment tx’s.)

Time why you punish me

Like a wave bashing into the shore

You wash away my dreams

- Hootie & the Blowfish

Gather round children, it is truly the most wonderful time of the year. But if 2022 is any indication, it won’t be sugarplums dancing in our heads today. And no that’s not St. Nicholas bounding down the chimney with a bundle of toys…it’s 0xsmac with a sack full of macro larping takes. As we head into year-end, this is a time of decompression for some. But what awaits us on the other side is a 2023 fostering some of the widest dispersion of opinions I’ve probably(?) ever seen.

You will see tradfi opinions ranging from “it’s so over, recession incoming, just you wait” all the way to “rates peaked, time to run it back turbo to ATH’s”.

Just look at the initial 2023 S&P targets from our very “sophisticated” investoooor friends.

For those unfamiliar, toward the end of each year the largest investment banks publish their market forecast for the following year. I think it’s a really dumb tradition, but I play with internet coins for a living soooo glass house-throw stones and all that. To give some context for why I think it’s dumb, let’s take a look at last year’s forecasts…

This is much more typical of how these forecasts shake out. Each desk anchors to a 7-8% gain and then adjusts marginally higher or lower depending on how bullish/bearish they are. These are safe forecasts that won’t get anyone fired, which is why they’re mostly useless. But you’ll notice the first batch of 2023 forecasts show a much wider dispersion of opinion.

As I type this the SPY is around 393 so cowards using the 7-8% rule are RBC, JPM, Jeffries and BMO. But it’s quite rare to see so many shops take such a relatively bearish position, especially as we’re already ~20% lower than the start of this year1. I guess this is to be expected though – people are peak bearish at the bottom2 because the cracks in the economy/labor market/corporate earnings are clearly visible at that point. The time to be bearish is always before these cracks become visible to the wider crowd. In the same vein, it pays to be bullish when the data looks most grim. Deep down we all know this, but we’re rigid humans. Very few can set aside the emotion they feel in those extreme moments3.

From the large institutional side, there’s also a need to express views that align with the feelings of your biggest clients. Thankfully I’m not a large institution and the only feelings I need to consider are my own. So I will do my best to read the high-level tea leaves and offer my smooth-brained opinion on where we’re likely headed.

Of course, I will include some musings on how crypto fits into the wider macro narrative. You can think of this as a follow-up entry to my original piece.

As we sit here today the Fed Funds rate resides at 375-400bps. The next FOMC meeting is December 14th at which point the market expects rates will be hiked another 50bps to 425-450bps4.

Don’t forget, as of just 9 months ago that rate was 0-25bps.

Comical? Most definitely.

Informative? Perhaps.

Over this period the market’s seen *roughly* 20% of its value wiped away5 as the Big Bad for the Fed these days is inflation. So it’s been clear to people paying attention6 the Fed was/is focused solely on bringing inflation down to a more digestible level.

I largely think this is still the case and that one soft reading doesn’t mean we’re out of the woods.

However…

With the ISM Manufacturing report we saw last week7, every relevant piece of inflation data you could imagine has now rolled over.

(With one exception, which I’ll revisit shortly.)

Inflation data rolling isn’t necessarily a sign we should teleport to new ATHs in risk-assets, but it’s meaningful in the context of the current Big Bad for the Fed. It would appear the Fed has successfully navigated 2022 without “breaking anything” which was one of the most common permabear anthems since rate hikes began.

Look, I was certainly concerned during this period and saw very little upside to holding risk-assets. In the moment things felt quite fragile and many funds (and individuals) likely torched a lot of capital trying to catch falling knives8. I’m aware I probably sound exactly like said money-torchers as I start to get constructive9 on the market but I find comfort in two things:

Relevant data that tells us inflation has begun to roll

The risk of not being in the market now outweighs the risk of further downside10

You may disagree and that’s fine. This is what makes markets. But the two questions I would pose to permabears are these:

Can you point me to something that fundamentally “broke” during the rate hiking cycle this year?11

What do you need to see before you would be convinced the worst is behind us?

[An aside: I actually would really appreciate people flooding my DM’s with answers to these two questions. I won’t be offended if you tell me why you think I’m wrong.]

To me, it appears the drawdown in tradfi markets was actually quite orderly.

Sure, it may have felt different in the heat of those sell-offs. But taking a step back and looking at the bigger picture on the eve of 2023, it seems controlled. The crypto markets are a different story to some extent, but have patience I will get to them.

2022 was the year to sell your risk assets, park yourself in filthy fiat (or better yet stables) and touch grass. If you did this, you missed nothing, and outperformed 90% of the market. gg. But it’s time to start paying closer attention because markets will be interesting once again, both in tradfi and with crypto assets. I’m not going to beat you over the head with lots of charts but here’s one courtesy of JC.

Tradfi Put/Call Ratio hasn’t been this imbalanced since pre-2004. For those unaware this is effectively a measure of insurance…when the ratio is high it suggests market participants are more interested in paying for downside protection. One truism across market cycles is people buy insurance right after they need it – it’s top of mind, they act emotionally and think “ouch that really hurt, let me buy some insurance so I don’t feel that pain again”. This is literally the worst time to buy insurance. Very rarely do people purchase insurance right before an event that rewards them for owning it.

Remember earlier when I said the dispersion of tradfi strategists was quite wide…

Well, isn’t it also interesting that this is the first time in over 2 decades that the Street is expecting a down year for stocks?

Here’s one more anecdotal, mini sample size, probably nothingburger poll

Ok we get it, sentiment is bearish.

But that doesn’t mean things can’t get worse.

Very true! Here’s where I’d direct you to something I wrote 6mo ago:

Policymakers can’t afford to see US stocks experience the types of drawdowns we go through in crypto. That would pose a societal stability problem. This is not a joke or hyperbole.

A useful & amusing analogy is to think of the tradfi markets as babies. They cry, scream, and throw temper tantrums when they don’t get exactly what they want. They want candy (i.e. loose monetary policy) all the time. Our policies should be designed like a good parent: cognizant of the baby’s needs and feelings. They want their baby to grow up healthy and happy in the long run. But if the baby is constantly screaming because they want candy, that doesn’t mean the parent gives in every time. Unfortunately, with enough screaming & crying, the baby does often get its way.

Thus far, Papa Jerome has found ways to distract the crying baby just enough to avoid disaster. The late summer relief rallies soothed the market to buy time for the Fed. Say what you will about Jerome, the man is god-tier at Fedspeak. This is arguably the most important aspect of the job too – he alone doesn’t dictate policy, but as those of us in the crypto world have come to detest realize, his every word has a profound impact on asset prices. Maybe you believe the Fed shepherding markets lower without too much pain can’t last. I won’t tell you this is an unreasonable opinion, but I will tell you the people I’ve heard this from generally don’t appreciate how market cycles evolve.

Jurrien Timmer tweeted a constructive look at how historical market cycles progress – specifically the relationship and timing of bond yields, inflation, fed policy rate, ISM, stocks, spreads and earnings. Obviously all market cycles are different but the adage that they rhyme is apt. The typical flow is something like this:

What does our current bingo card look like?

Yields bottom? ✔️

Fed begins hiking? ✔️

ISM peaks? ✔️

Stock market peaks? ✔️

Earnings peak…

🤔

I promised I would return to one inflation data point that hasn’t yet rolled over…

Employment.

Pretty big one to be fair.

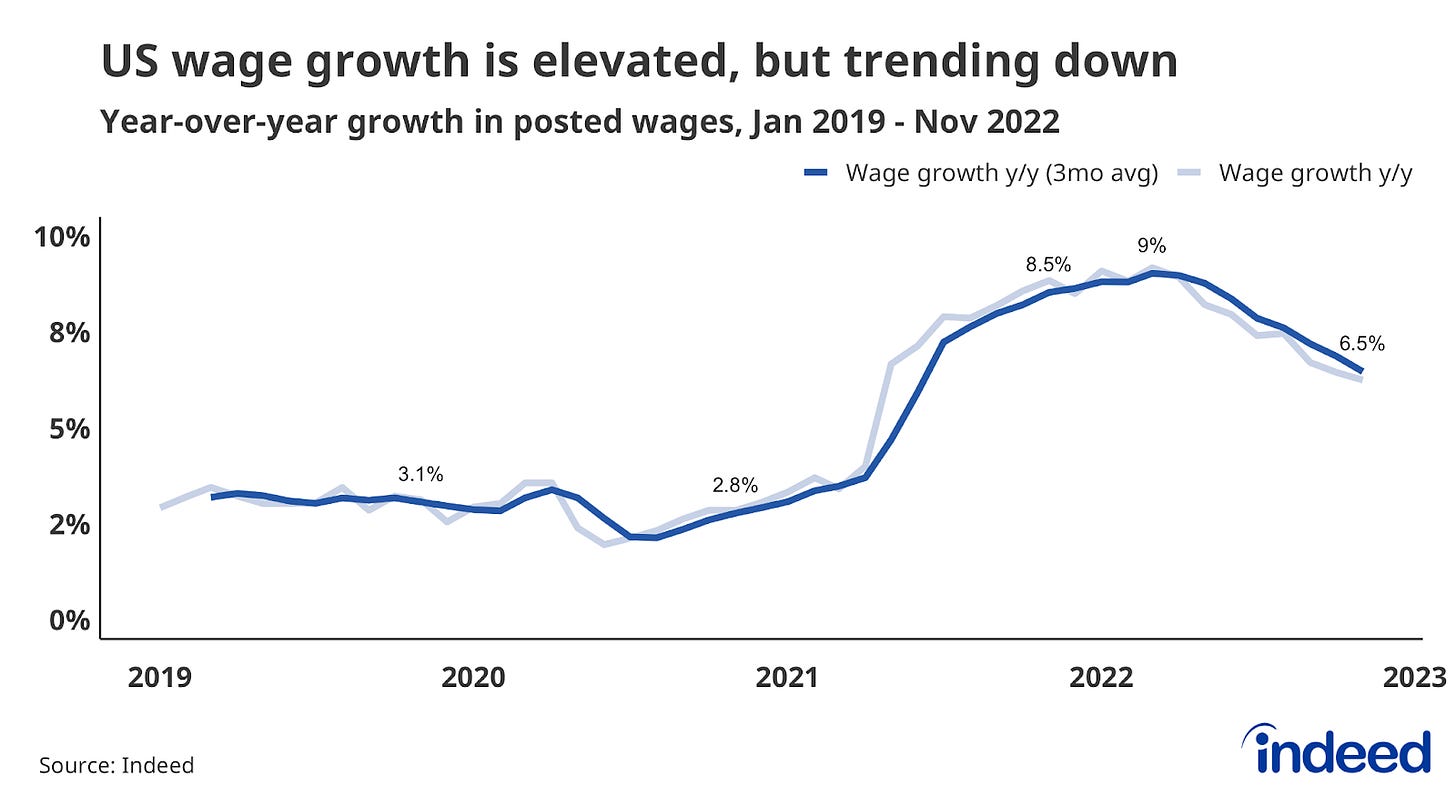

The most recent jobs report showed NFP up 263k (vs 200k expectation) and unemployment unch at 3.7%. Wage inflation was particularly strong12. If I were to play devil’s advocate against myself I’d say something like

“Unemployment is still at historically low levels, wage inflation has yet to subside. It will persist at higher levels just as price inflation did and fuel a wage-price spiral where higher prices fuel higher wages.”

This sounds reasonable but is difficult to imagine in practice. For one, it supposes that unemployment will increase and yet wage inflation will also persist. That’s a strange expectation though I guess it’s possible. Maybe the theory here is a further squeezing of the middle class? The more important knock against this argument though is that consumer expectations for inflation are already softening.

Why is this so important?

The scary situation policymakers want to avoid at all costs is entrenched high inflation.

The path to this looks something like: Households & businesses expect higher inflation in the future because of some inflationary shock13 which leads workers to demand more now to compensate for the perceived higher future inflation. This dynamic can lead to inflation rising and persisting higher than the Fed’s target for prolonged periods. Not good.

On the contrary, when people’s expectations are for inflation to come down post-inflationary shock, households and businesses see it as temporary and they revert back to target levels. This appears to be where we are. Households and businesses are already adjusting inflation expectations lower. Good.

What’s all this mean, tldr pls?

My read of the current macro environment is that we’re likely past the point at which “something will break” and I think the Fed successfully walked the 2022 tightrope. The difficulty level for policymakers is far lower now than it was 6 months ago. Like I said earlier, this doesn’t mean we go straight to new ATH’s and everything pumps again. In fact, as I’ve mentioned before inflation is so frustrating because it takes time to move through the system; it’s slow and often exhausting. But that also means many become complacent and parrot the easy narrative. The same people who were caught offsides & completely railroaded by the macro shift — those who thought it was impossible we'd ever see real, sustained inflation — are now universally calling for a painful recession with infinite tightening. Meanwhile, bonds have already caught a meaningful bid14 so I think sideways (months) is most likely, but directionally the next meaningful move is higher.

6 months ago I wrote:

I find it difficult to envision a scenario where crypto decouples to the upside (i.e. stonks down, crypto up) for any material period at this point in its lifecycle.

Bitcoin was at $30k when I published that. Heh :P

I also highlighted how important the stock market has become for policymakers since the US shifted to a defined contribution retirement regime. The structural appetite for stocks is always there. But I want to highlight a relevant piece of news that went underappreciated15 in my view.

Fidelity is one of the world’s largest financial services providers with ~$4.5 trillion of AUM. That they’re opening retail trading for bitcoin and ethereum is no small deal and is especially noteworthy given where crypto markets are. It would have been so easy to delay this roll-out or quietly shut it down, but I give them – especially Abby Johnson – a ton of props for marching forward with this. It also provides further evidence for any of you questioning the sustainability of crypto’s future. The last few months have been especially dark in our crypto world16 to the point where I’ve even heard some OG’s express apathy. I get it. But there is plenty of reason to be optimistic, and while “builder szn” is a cringe trope there is obvious truth in it.

What are the knock-on effects of this Fidelity move? They’ve already signaled the allowance of up to 20% of 401(k) retirement savings to bitcoin. I will let you do the quick math on what this means for flows17 but the important point is this introduces a structural change to demand for crypto.

The infinite bid is coming to crypto.

And do you think this ends with Fidelity? If so, I have some wonderful utility altcoins to sell you. Surely Fidelity’s competitors — who include Vanguard ($7+ trillion AUM), Schwab ($7+ trillion) & Blackrock ($10+ trillion) — will introduce similar offerings. Especially as younger generations accumulate wealth and opt for a different composition of risk assets.

It doesn’t take a rocket scientist to see how this plays out. A structural change in demand means more capital flowing into bitcoin and ethereum, which in turn leads to more capital flowing downstream into defi, infrastructure, scaling solutions, security, gaming and teams building weird fringey crypto stuff. Money alone doesn’t solve crypto’s problems by any stretch of the imagination, but it does lead to greater surface area coverage to build the entire ecosystem out.

Allow me to now throw some cold water on this optimism: the flywheel described here doesn’t happen overnight. Many are anxious to get the next bull market started again but as with traditional markets, the x-axis on crypto charts is more important than the y-axis. Time matters.

While I subscribe to the theory market cycles are more compressed today than ever before, I still think we need some time before our coins begin moving materially higher. As with tradfi though, my belief is the worst is behind us18. Sure we may come to find out other smaller exchanges were misbehaving or entities were misrepresenting their exposure to FTX, but we’ve already seen the market easily digest smaller ripples19. I haven’t read Arthur’s latest blog but I saw the TLDR was effectively “the 3 main groups forced to sell their coins – centralized lending & trading firms, mining operators and speculators – have already done so”. I mostly agree with this. But exhausted selling doesn’t mean buyers show up right away lol.

Again I will reiterate this is a good thing for many of us. Very few tourists remain during these apathetic times so the people and teams you interact with now are far likelier to be committed for the long haul. That positive selection bias should encourage you to stay engaged, talk to people, go to developer meetups and project-hosted hangouts. There’s even time to read whitepapers again!

Jokes aside, the coin bid will return (bitty will lead again imo) but I suspect crypto is more susceptible to further drawdowns than tradfi at the moment20. I said last time I found it difficult to imagine crypto decoupling to the upside and I still believe that to be true. But oddly enough, I’m more confident now there's a path to this no longer being the case.

As always, dm’s are always open @0xsmac on twitter.

in fact later in this post i’ll show just how rare this bearish tilt is

to be clear I am not “calling a bottom”

as an aside, i’m a little uncomfortable with how this ability gets lionized by the financial community in general. i get that it’s an extremely rare and useful trait for people who participate in financial markets. but marveling at those with this ability fails to appreciate how it affects other aspects of life beyond capital markets. i dk, something to think about.

i’m referring to the S&P 500 here. obv the QQQ’s have performed worse but the only people referencing the nasdaq when they say “the market” are cringe tech bro’s

jeromey could not be more explicit. he literally stood there and said “we're never going to say that there are too many ppl working, but the real point is this: inflation...”

full disclosure: i did not participate at all during the 2-3 significant bear market rallies this year. you may laugh at this but i’m not a tradooor and to me it was always highly likely those were ephemeral relief rallies. time remains an overlooked component of bear markets and i viewed the probability of a V-shaped recovery as extremely low. this was not march 2020, inflation doesn’t disappear overnight

fancy speak for getting booolish

this is my personal probabilistic opinion and everyone’s risk tolerance is different. not financial advice, etc

housing probably the easiest argument but i think there are unique reasons this is not valid

the market sold off heavily on the announcement but recovered most of the losses by the close that day. curious.

in our case that shock was helicoptering in free money during the pandemic

look at the 10Y if you think otherwise

typical bear market complacency

as I write this I see that The Block’s CEO also had his hand in the SBF cookie-jar

assuming it gets maxed out is disingenuous so don’t go TOO crazy just yet

DCG unwinding the GBTC and ETHE products would make me reconsider this though I view this as unlikely. Genesis going under/away would not change my current view fwiw

orthogonal trading for example

still think you won’t regret prices for btc/eth at these levels on any extended timeframe. still nfa, etc.