What is a Compound Crypto Company?

Vision without action is a daydream while action without vision is a nightmare

In an increasingly crowded crypto venture market, we believe it’s important to define the characteristics and principles of what we do and don’t invest in. Part of that includes contextualizing the types of founders we gravitate towards. It also means more explicitly defining why we feel our approach is best for the founders we partner with and by extension for us as a firm. There’s at best some fuzzy lines when it comes to crypto investing: sure there are some firms who focus more heavily on ecosystems or verticals (Ethereum-only or consumer-specific as examples). There’s also a more unspoken awareness of who is looking for quick liquidity or to hedge their exposure, versus those who view this space as a much longer-term technology wave. We've been investing in crypto protocols and dApps since 2016, and while the areas we spend time in continue to evolve, the core principles guiding us remain the same. Specifically as it relates to crypto, that means a few things:

N-of-1 or step-function improvement (not incremental)

Tackling a real problem better solved through crypto

Category-creating or category-defining

Utilizing a token model to incentivize or hyper-scale

Building on a multi-year (5+) time horizon

Obsessed founder(s)

If you’re not interested in more context you can probably stop reading here :)

But while some of the characteristics above may seem obvious, anyone paying attention will know this is not actually what most investors are interested in.

It’s generally not worthwhile to engage in whatever the narrative du jour is in crypto circles. There’s been a lot of discourse on infrastructure vs applications, the limited success (thus far) of consumer crypto products, and whether the only path through this is to launch more chains until it’s -EV for investors to fund them. There’s even been some suggestion that we’ve already found all the things people will do with crypto, and therefore we don’t need new apps. It seems odd to think that just a few years into having performant smart contract platforms, we somehow already know the entirety of the design space. It’s also a bit naive to expect larger funds won’t continue to fund new L1s and L2s – when the theoretical upside is $80+ billion1, they simply cannot afford to miss again.

Oftentimes we at Compound are criticized for having very prescriptive views of how we think the world will look in the future, or what types of companies we think should be built. When I observe the crypto landscape I see an outsized share of ~vibes~ investing. It feels less grounded in core beliefs and more geared toward a supply & demand imbalance2. The justification for this approach is usually some form of:

“Crypto moves so fast you need to be nimble”

“The space is too novel, you should have a basket of exposure because you can’t know what will work”

“Let founders show you what should be built”

“Liquidity happens quicker so shorter time frames are more important”

There are varying degrees of legitimacy to these arguments, but in the aggregate this is a very passive approach to what should be (imo) a much more active role. Especially as pre-seed & seed stage investors, it’s hard to support portfolio founders who are making critical, path-dependent decisions without having prescriptive views (loosely held). We don’t pretend to be more informed than the people actually building these companies, but it’s far more constructive for founders to work through decisions when the people they’re speaking with deeply understand the nuances of the orbit their company exists in (including the world outside of crypto). And we don’t think you get to that level of understanding by being reactive to markets on short-term time frames and blowing wherever the proverbially narrative winds take you.

So what does a Compound Crypto company actually look like? Let’s rip through the list from earlier one by one with a bit more context added.

“N-of-1” or step-function improvement (not incremental)

Category-creating or category-defining

I’m pairing these two together because they’re closely tied. In almost all cases, we’re not particularly interested in incremental improvements. For one, by definition if you’re incrementally improving something that already exists, then a lot of people deeply understand the specific area you’re building in. The degree of difficulty for incrementalism is also meaningfully lower when building with open-source technology. How that manifests in practice is many more decent or good ideas, which combined with an oversupply of capital leads to an easier path to funding. But that type of progress rarely leads to category-defining innovation. To us, venture capital is funding the exploration of unknowns, and so we intentionally spend time in areas not widely understood by many others. There’s plenty of capital that will fund the incremental improvements that remain important for moving crypto forward, but our focus lies on “n-of-1” type companies.

Some examples of what those look like:

Uniswap introducing the AMM

The Graph creating a decentralized network of indexers for querying blockchain data

Compound introducing algorithmic interest rates and a fully decentralized borrow/lend platform

FriendTech launching a bonding curve & PWA modality for social

Eclipse bringing the SVM to Ethereum

StepN removing the friction of earning tokens for average retail

HairDAO becoming one of the leading funders of non-alopecia hair-loss research

The degree and durability of success for these differ, but each of them has in some way either created or shaped the category they compete in. These are just a handful of examples, though I suspect the list of true n-of-1 companies is not as long as you’d expect. We’re looking for companies which make some assumptions that – if true – gives them a path to becoming unassailably valuable. Introducing truly novel concepts that can become the bedrock of new ecosystems or upend existing ones is the highest signal way of doing this and historically an immense amount of value in crypto has accrued to the first and early-movers to primitives.

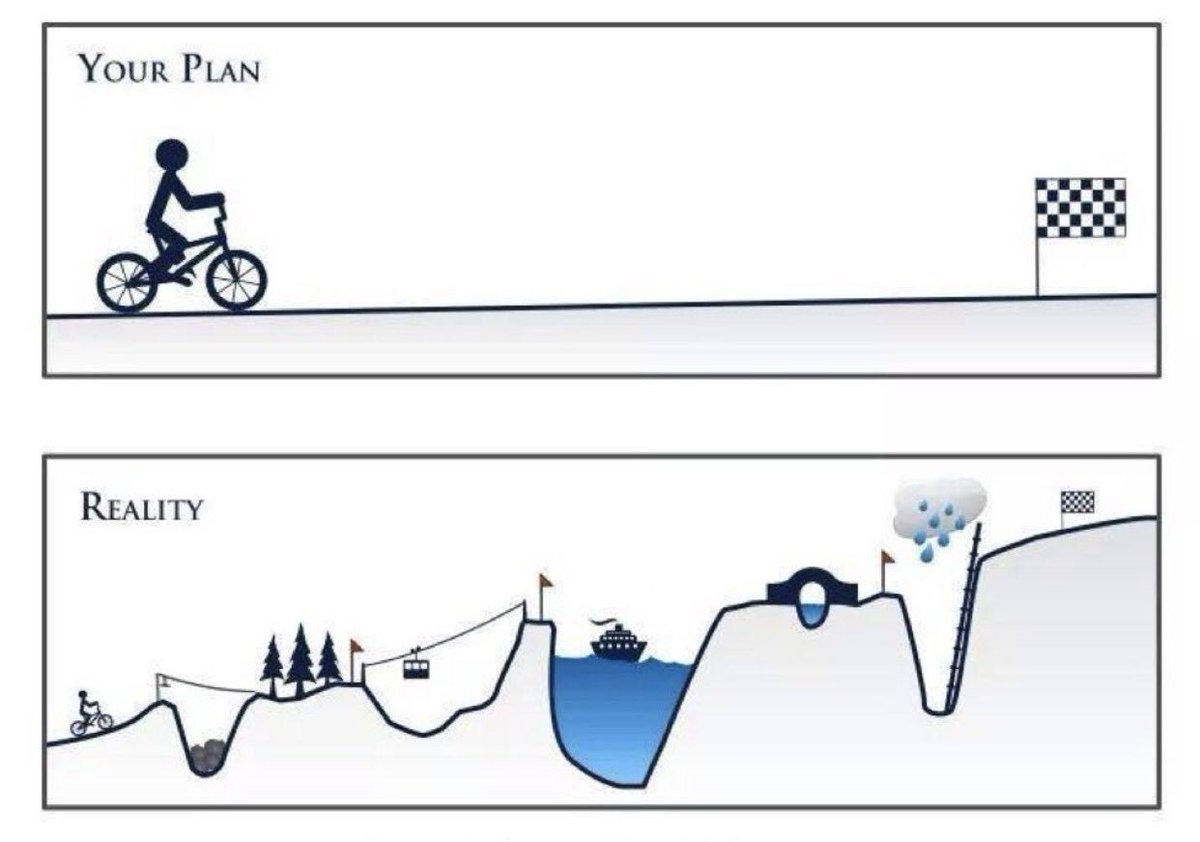

Obviously not everything can be a 0-to-1 primitive or protocol, and so in cases where the competitive space is more established, we tend to focus on what specific tradeoffs you’re making and why those are the right ones to accrue most of the long-term value. I’m always skeptical when I hear pitches that fail to acknowledge the actual tradeoffs being made. Everything in traditional technology startups and early stage protocol building features tradeoffs – those tradeoffs you make speak partially to your design choice but also to how you think about sequencing to a larger vision. Part of why we’re always interested in hearing about (i) the very near term focus of founders and (ii) the grand vision, is because everything in between is less relevant. There’s a reason this meme resonates with founders.

Things are not going to go according to plan, which is why the tradeoffs founders make in the short-term are so important. Ultimately those decisions are made in service of the longer term vision. Sure it may be great to be explicitly and immediately correct. But that’s largely unrealistic and in fact the likelier path is one where teams iterate around a core set of assumptions – either validating or invalidating them quickly and using that information to guide them forward. This comes back to our perspective on funding the exploration of unknowns – understanding what’s driving the decisions a team makes and what assumptions they hold is how we align with potential founders.

Tackling a real problem better solved through crypto

Candidly, the technology world doesn’t need another solution in search of a problem and crypto is no exception. The beauty of blockchains and smart contracts is that they are under-explored spaces in which you can look at problems through a news lens – specifically those related to capital formation, coordination and automation. When we think of networks attempting to solve real problems, DePIN is the most tangible vertical. Helium is the poster child for this and likely the only one which has found PMF so far, though there are obviously others building interesting infrastructure here. When Helium set out to build its network in 2013, it was specifically looking to solve the connectivity problem for IoT devices; these devices were growing massively but coverage was a problem. The focus at that time was incentivizing individuals to build out density for the Helium LoRaWan network. That singular focus naturally shifted over the years but the core mission they set out on was in service of a real problem. DePIN is a specific space we’d like to see more founders emerge from, and not necessarily just in the storage and compute areas. There’s a host of other less explored infrastructure verticals where scaling a distributed network can bring immense value. We’ll have a lot more to say on this in the next week or so.

While DePIN is the easiest to grok, it’s also possible the specific use-case is one focused on a subset of users that want (or need) decentralization as some form of self-sovereignty. Is there a compelling wedge to meet the needs of a specific underserved group with a credible path to expanding that service to a broader, much larger market? A thesis that follows the path of “we know there’s a subset of motivated individuals who care deeply about this today, and believe that subset will grow massively” is attractive.

DeSci in particular is an area we think is especially apt here. We’ve written specifically about healthcare data platforms, and believe the crossover space of DePIN x Bio/Healthcare is ripe for disruption. Two recent theses we’ve been thinking about here are focused on decentralized wearables and distributed peer review science. There are others, and we feel strongly this is an area that will see immense disruption over the next 5-10 years.

Utilizing a token model to incentivize or hyper-scale

If we’re talking about what a Compound Crypto investment looks like, it probably makes sense to address the elephant in the room.

We like tokens, we think they should exist, we think they’re a powerful mechanism for incentivizing behavior & coordinating action. We also think there are far too many today. Too many on an absolute basis3 but also too few that serve a purpose beyond exit liquidity. The token model is clearly a double-edged sword, but there are few stronger mechanisms for rapidly bootstrapping networks or programmatically moving value around. Blur is a canonical example of this: the pace at which users, activity and value shifted from OpenSea to Blur was staggering. Clearly Blur’s success extended well beyond the vampire attack but it’s a great example of how effective tokens can be for coordination and behavior alignment.

We typically expect our crypto investments to utilize a token, though this is a far more nuanced point than simply “wen token”. Because we’re investing at the earliest stage, it would be naive to expect founders to have all the plans for how a token would function, accrue value or otherwise supercharge what they are trying to build. But we do press on whether or not this needs a token in the first place and if so, how is the founder thinking about some or all of the possible manners it could be implemented. We’ve worked with a ton of very successful early stage crypto companies pre & post token, so we’re well-versed in the pitfalls, tradeoffs and successes of token design. Livepeer is one unique example of a team that’s iterated on token design and function since inception – today the protocol operates on a stake-for-access model. Anyone can join the network and run software that allows them to contribute resources (CPU, GPU, bandwidth) in service of transcoding and distributing video for paying broadcasters. Doing so allows these orchestrators to earn fees in ETH or stables. But before you have the right to run this software and contribute your resources to earn fees, you must own & stake the LPT token. LPT is required to perform the actual transcoding and distributing work – the more LPT you own, the more work you’re able to perform and thus the more fees you’re able to capture. The thesis then follows that as demand for this service grows, the demand to become an orchestrator and the demand to own & hold LPT also grows. This is a much different and more productive model than just a governance token.

We also think that more creativity, experimentation and public learning can help unlock more effective token designs. That being said, not all companies need a token. We aren’t going to push you to shoehorn a token in, launch one without putting real thought into it or pressure you for liquidity sake.

Building on a multi-year (5+) time horizon

Obsessed founder(s)

This leads us to another overarching theme of Compound Crypto investments: long-term building. Obviously this is a meme in some respects, but it’s also true. Everyone will tell you they are building or investing for the long-term, at least publicly. But we also know this isn’t the case, and there are signs that reveal true preference4.

I’ve paired these two principles together because to me you can’t really have one without the other. We are not especially interested in founding teams who prioritize 12-24 month, short-term liquidity for investors. I realize there’s a large share of investors who pressure teams for quick liquidity, and a function of that is we see pitches that highlight early liquidity as if it’s a positive characteristic. It isn’t. We want to back founding teams that are thinking on 5+ year time horizons. We’re not a hedge fund, we’re not an opportunistic fund, we’re not flipping SAFTs or hedging portfolio exposure on exchanges5. We want to work with founders who are obsessed with building durable, long-term dominant companies that will persist for years into the future. Part of this obsession reveals itself in how contextually aware teams are of everything going on around the space they are building. Recognizing competitors is table-stakes — the founders we gravitate towards deeply understand all of the players and adjacencies around their company. Vincent & Johannes at Prime Intellect are a perfect example of this — we were quite skeptical of the AI x Crypto crossover narrative given the unique complexities of these industries. Throughout our diligence process though, it became clear they had a strong grasp on both the technical feasibility of the company they were building and thoroughly understood the AI ecosystem away from crypto. We think this level of obsession both is obviously good because it enables founders to navigate the cyclicality and high noise to signal ratio in crypto, and perhaps less-obviously dominant because it enables them to navigate complex industries that are utilizing crypto as the industries themselves and underlying fundamentals of crypto company building continue to rapidly change.

Building durable companies is especially difficult in crypto, where narratives shift constantly and the ground is ever-evolving beneath our feet. But the best founders in our opinion have an eye towards the long-term and don’t get caught up in the noise of the current market. Admittedly this noise is extremely difficult to ignore.

The narrative winds shift constantly and so there will be times when crypto is the hot thing to be investing in, and there will be times when it’s left for dead. Within crypto especially, there will be times when the vertical you’re building has a lot of attention and times when it seems as if nobody cares. This is why obsession and conviction are so important – most of the time very few people will care. It’s hard enough to build a company, let alone one in an industry that’s historically prioritized rapid liquidity over finding product market fit. Add to that our shrinking attention spans and it’s easy to see how founders can be distracted or drift away from the core assumptions they set out to validate.

The added complication with crypto is decentralization. Twitter would suggest this is a binary, Holy War choice rather than the reality that it’s a spectrum. We don’t pretend to be decentralization maxi’s. We think it’s a fundamentally core principle but can also acknowledge it doesn’t happen overnight. We also recognize centralized decision-making has a ton of benefits, most notably the pace and quality of execution. In practice, one of the highest signals of exceptional founders is pace – companies that leverage centralization strategically, sacrificing immediate decentralization in exchange for long-term building is a tradeoff we think makes sense.

Venture investing in crypto has become increasingly crowded and we think a lot of it is undifferentiated or unopinionated. That doesn’t necessarily mean it’s wrong. Some of these investors will be very successful taking a different approach than we do. But as a firm that’s been investing in this space since 2016, we have a well-defined view on what principles we are uniquely suited to invest in and partner with founders on. Though we share a lot of public opinions on what we find most interesting in crypto, we are just as likely to partner with founders who shatter our existing views as those who align with them. Some of those current theses live on our frequently updated public database, but at least part of the motivation behind this piece is to encourage those building with similar principles to reach out. We continue to actively invest at the earliest stage, and I’m personally always down to talk through ideas, – the more under-explored or outrageous, the better.

My dm’s are always open whether you’re already building a company or just have an idea you’re kicking around and want feedback on.

Roughly Solana FDV today

When I say supply/demand imbalance here it’s a belief some hold that we are still so early that aping everything is +EV because so many more people will show up later

Though I don’t want to rehash the market structure argument here

We’ve been investing in this space since 2016, far longer than many self-dubbed “crypto-native” investors and long enough to see many others come & go

We are getting dumped on 👍