Ahh to be young, dumb and eager. Many moons ago — during the heart of DeFi Summer — we lived in far simpler times. Projects launched, tokens were farmed to dust and within hours/days/weeks everyone moved on to the next project. It was a truly wild time with many a sleep-deprived night.

Fast-forward a few months and there were reasons to believe new DeFi primitives were gaining meaningful adoption, users were transacting on-chain and dApps had arrived. The truth we know now is there was also an incredible amount of recursive, unsustainable, poorly managed debt fueling a lot of what was going on. 0% interest rates will do that. I’m not going to belabor that point though because a) it’s been covered extensively the last few months, b) it’s not super productive for imagining the future and c) despite being cynical at times, I’m an optimist who prefers focusing on how things will improve rather than joining the “everything sucks” crowd.

If you’re a glutton for rehashing this recursive lending cycle, the first 15 minutes of this episode give a nice framing of just how much credit was extended and “what happened to all that capital”.

But if 2022 taught us anything it should be that trusting centralized parties, especially when it comes to financial security, is not without risk. As I’ll cover later, crypto still struggles fundamentally with pricing risk1. A lot of trust in the industry was damaged, but it’s not irreparable & is largely confined to centralized parties.

So have no fear, this won’t be a summation of all the embarrassment our industry has suffered. But it would be hard to pen a comprehensive DeFi exploration without referencing how the build-up of these risks (and their subsequent fallout) could be avoided with further development of the DeFi ecosystem. I’m also happy to say there are new primitives being built and teams are starting to experiment again, an encouraging sign and something we missed over the last 12-18 months. In speaking with other DeFi users and investors, many lamented the lack of novel experiments over this period and complained about endless “copycat” projects launching.

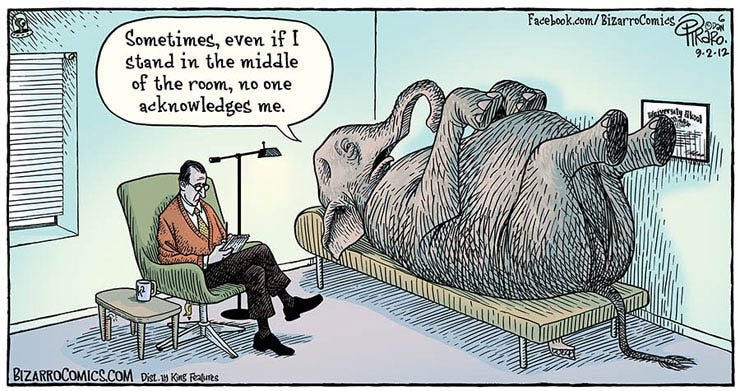

The elephant in the room is obviously the regulatory cloud hanging over us.2 Most participants seem to fall into 1 of 2 buckets when it comes to this regulatory fog:

either you’re operating in good faith within a frustrating and unclear reg environment, realizing that even in a best-case scenario you will be dealing with regulators and educating them…OR

you’re avoiding touching anything in DeFi until there’s a more transparent picture of what the dominant regulators will “allow”

l have personal opinions here. The TLDR of those is essentially: being an entrepreneur in crypto entails a bunch of different risks, one of which happens to be regulatory. I think it’s wise for all founders to be thinking about regulation and how it will impact them when it inevitably comes, but that doesn’t mean you should be frozen by the lack of clarity right now. My earlier thoughts remain mostly unchanged…

It’s inevitable the regulatory arbitrage that exists today will dissipate, so flexibility and a faster cadence for shipping new value-add services will be table-stakes. Some of these may include more white-glove professional investment services, consumer lending products, mortgages or estate-planning for digital assets. Slower teams or those unwilling to operate within an unclear regulatory environment will ultimately fall behind. “The institutions are coming” was a popular meme during the last bull run, and some indeed did show up. But they remain largely held back by uncertainty over how the regulatory landscape will shake out.

This won’t last forever. Entrepreneurs have an opportunity now to seize a foothold in the reimagined financial services world we hope to build. Regulatory uncertainty can be seen as a gating non-starter for some, but the teams that embrace it as an opportunity will be the ones who realize special outcomes.

As an aside – something I find a bit odd on a fundamental level is the idea that those investing at the earliest stage need regulatory clarity first. Please consult my giga-brain chart for more clarity on this.

So let’s quickly level-set the DeFi landscape and what the potential size of this space looks like. If we take a peak at the existing financial services market, we see it’s roughly $23 trillion3 and growing nearly 10% YoY4. Global GDP is ~$100 trillion so financial services comprise nearly 1/4 of the entire world economy.

Couple this with the realization crypto rails remain in relative infancy, and it’s easy to see that today’s technology is as janky as it’ll ever be. It will only improve from here. The creation, custody, velocity and innovation of money will only move more on-chain as we progress. All that being said, my hope for this piece is to think through some of the questions plaguing different corners of the DeFi world and share my perspective on what some of the answers may be.

What better place to start than the DEX world.

The obvious winners from the FTX fallout (beyond Coinbase & Binance) are the DEXes. There was a clear uptick in activity on these platforms following FTX’s collapse. On the one hand, it’s encouraging to see more crypto participants self-custody5 and my hunch is 2022’s events will lead to a marginal permanent increase in self-custody. But I'm not naïve enough to think users won't creep back to centralized exchanges over time. Incidentally it's also what's so frustrating about the SEC's continued communication-through-enforcement strategy. The Kraken settlement is just the latest example of the SEC shutting down products that serve US consumers well and pushing them toward unregulated, offshore alternatives. It's bad for innovation in the US — the most talented builders will go elsewhere if you force them — and equally bad for consumers who will continue moving to offshore platforms.

DEXes though have a window of opportunity to take advantage before the largest liquidity providers (i.e. non-retail) cultivate new, more efficient centralized relationships. A common narrative I hear today is as follows6:

“Take, for example, the plight of professional market makers right now. An exchange they (and everyone else) believed to be healthy and solvent ended up collapsing while many of these entities still had funds in their accounts. If FTX was doing shady things behind the scenes, the next natural question is which other exchanges are doing something similar? Perhaps market makers will now see how DEXs are the path forward for price discovery and trading in crypto”

This is unrealistic and not practical in my opinion. At least given the current options. It’s something I hear a lot but I know professional market makers aren’t interested in the existing DEX product suite. I’d love to be wrong about this but even the data suggests the immediate spike post-FTX was short-lived.

Any conversation about DEX volume needs to begin with the question of how to attract market-makers. Liquidity begets liquidity. So what future pulls these critical participants in?

I have a difficult time believing the oracle-based DEX model has a sustainable long-term future7. Why? The fee structure is so punitive and it's such a poor execution environment for users that I don't see enough sticky liquidity ever parking there. Everyone's favorite "real-yield" token has been GMX, but from my perspective this isn't a true exchange. I posed this question a few weeks back...

Interesting that 30% said it wasn’t. Presumably for similar reasons that I believe it isn’t — namely that no price discovery happens there8. If you pull on this thread more, you understand the reason for this poor execution environment is because you're trading against the protocol9 (as opposed to another user). The only way for the protocol to hedge its risk of blowing up is to build an edge for itself. Spoiler alert: this isn't the future of DEXes, especially for institutional capital. We're all aware how important liquidity is, and the largest pools of liquidity have no interest in poor execution. A couple bps may not mean much to your average degen punting some longs, but professional market-makers care about every single basis point. As more capital enters, volatility will compress and execution will matter even more. Sure, there will still be users on these types of platforms. Ones who optimize for the familiar UI and don't mind paying a vig. But that's a different business model targeting a different customer than what I imagine when I think about the future of DeFi.

Ok, so this must mean I lie in the orderbook-DEXes-are-the-future camp?

dydx seems like the obvious leader here but there are plenty of teams10 competing and by no means is this space decided.

Quick aside: I think too often in crypto a prevailing sentiment develops that suggests entire categories have already been spoken for. In my opinion, the pace of innovation is so rapid and it’s far too nascent of an industry to think *most* verticals are already decided (to say nothing of how regulation can quickly alter the landscape). Brand definitely matters, but I’m not sure there’s as many protocols with brand moats as people think.

I said dydx seems like the obvious leader here, and that’s because we need to mention Uniswap. Uniswap dominates the spot DEX volume game, but it’s pretty clear even the pioneers of x*y=k realize orderbooks are the future. The Uni v3 value prop was more flexibility for LPs but if you just think about the high-level mechanics for market-making, v3 looks much more like an orderbook DEX. My sense is that Uniswap is looking to fill the FTX-void as it becomes more retail-friendly (offering NFT trading and a mobile wallet) and pushes the execution environment away from CFMM and toward orderbooks.

The other top-of-mind vertical in DeFi that’s been thrust into the spotlight earlier than expected (and frankly wanted) is undercollateralized lending.

Blockchain technology can solve a lot of complex problems and is orders of magnitude better than existing solutions for many use-cases. Underwriting credit risk has not been one of them (not yet at least). All the major11 uncollateralized DeFi lenders were exposed to defaults over the last few months. Some degree of defaults is expected for these businesses, but investors want to be compensated for that risk. The adage that crypto is speed-running the mistakes of traditional finance is a fair critique. Plenty of lending 101 rules were ignored or flat-out broken during this washout: sound underwriting principles, concentration risk and related party relationships. Just a few notes from the last few months here:

at the time of the Wintermute hack earlier this year, TrueFi had $92mn in loans outstanding to them. Wintermute obviously didn’t default but it leads to further questions around individual counterparty exposure. If we look a bit deeper we can see the following12:

TrueFi lifetime originations: $1.65bn

2/3 of that volume has been to just 4 borrowers

Alameda (15 loans for an aggregate $471mn)

Wintermute (9 loans for aggregate $350mn)

Amber Group (6 loans for aggregate $221mn)

Celsius (2 loans for aggregate $61mn)

Maple meanwhile got caught in the Babel Finance insolvency back in June and then more recently severed ties with Orthogonal after it suffered a similar fate

the inexplicable piece of this Orthogonal Trading blow-up was how Maple allowed it to have entities that both borrowed (in the M11 Credit pool) and separately acted as a Pool Delegate (Orthogonal Credit pool). Obviously this is a bad look regardless of how “independent” these entities were.13

Clearpool’s current design choice makes it a very different model but clearly lenders are taking concentration risk.

It may sound like I’m dumping on these protocols but I’m unequivocally rooting for them to succeed. I especially think Maple 2.0 has some interesting new features rolling out (specifically adoption of ERC-4626 standards which should lead to more experimentation across DeFi). But unsecured lending isn’t easy and the existing yields make little sense when treasuries are yielding 4-5%14. It’s proving harder to reach PMF here than I anticipated but the inevitability remains clear.

The future is path dependent and this vertical in particular could go a number of different directions. My view continues to be we’ll see platforms provide split-offerings over the short-mid term: a permissionless version and a white-gloved, KYC version, the latter of which will see more robust liquidity. Focusing first on the permissionless side, the unlock here likely revolves around identity and data-sharing from the end-user. This could be on-chain credit scoring15 but I think it's more difficult than that. For one, until we see more standards accepted and implemented, the core customer here (market-makers) has little incentive to provide the level of access on-chain credit scoring platforms want. It's honestly not dissimilar to what we saw with rating agencies before the financial crisis:

>“please rate my entity”

>“ok here’s your rating”

>“i don’t like that rating, nevermind”

>“if you gave us access to more financial information this might improve”

>“i don’t want to do that”

I know what you’re thinking…

“ACTUALLY, most on-chain undercollateralized loans are originated using on-chain balance sheets”

This is fair pushback. But it’s also just another example of the myth of on-chain transparency. In theory, yes it’s great that the delegates16 for these undercollateralized lenders can look at real-time balances and the positions of their borrowers. But this model has limitations. It relies heavily on adequate underwriting by the delegates, which we've seen is a shaky assumption. It also rarely paints a full picture of what the composition of the borrowing entity looks like. In its current form this model feels painful for both sides: borrowers are hesitant to provide substantial financial information and lenders are not properly compensated for the risk they're taking, a lot of which is understated under the veil of "on-chain transparency". This is a focus where zk technology could drastically bridge the gap and unlock big efficiency gains. Everyone has zk technology on their "What To Look For In 2023" list but I've seen very few coherent thoughts on how specifically it will improve products or the developer and user experience17. Unsecured lending seems ripe for this to 10x the experience. Indulge me for a second here. What if we had comprehensive real-time identity access proving I am a good actor without revealing my actual identity. Borrower repayment history including repayment %, avg loan-to-portfolio value, debt roll frequency, historical loan-to-maturity yield, prepayment behavior, etc. These are the types of data outputs that could remain anonymized, but cryptographically proven to be true — this is how you unlock programmatic credit scoring without needing to trust centralized entities with your financial data. This is also what real on-chain transparency could look like.

Implementing zkp’s allows larger institutional borrowers the ability to retain varying levels of privacy which is hugely important. Nobody in their right mind wants the rest of the market to know their entire inventory of assets and cost basis. Enhanced privacy that allows underwriters (on-chain or off) to verify relevant data while protecting market-makers from revealing their book bridges a lot of the non-technical gap.

This is at least one path forward for permissionless pools to run more efficiently for all participants.

I know the hardcore cryptonatives won’t want to hear this, but the likeliest path forward is a split between permissionless & permissioned pools. Without a leap in the actual performance of blockchains, it’s difficult for me to imagine a world in which permissioned volume isn’t orders of magnitude larger in the short to medium term. Some type of KYC/AML NFT or ID which permits access for institutionalized players to access DeFi seems inevitable. Will these permissioned versions be watered-down to a certain extent? Ya sure, but we shouldn’t be disheartened by this because it’s positive momentum, adds meaningful liquidity and lends incremental legitimacy that we’ll need as the regulatory battleground evolves.

As institutional acceptance continues, the options landscape in DeFi will be extremely competitive.

One narrative we continue to see goes as follows:

“Just wait until the crypto options market emerges. The TAM is massive. Today crypto options volume as a % of spot is only around 2%. By comparison, in US equity markets, this number is 30-40x.”

It’s true of course the option markets in traditional finance are orders of magnitude larger than spot. But before we lazily ascribe the idea that “because it is the case in TradFi, so it will be in DeFi” we should examine why it isn’t the case already.

What are the existing limitations today that make it so options aren’t a primary instrument for users to express their view?

What might change that dynamic in the future?

Are there any DeFi products that already serve the purpose we expect options to?

The prevalence of derivatives broadly in traditional markets comes down to capital & tax efficiency, positioning and of course liquidity. To date, perps have been the dominant derivative form which I’d theorize is a function of historical volatility in crypto markets — perps were “good enough” but as adoption grows, volatility compresses and more institutions enter the arena, the demand for more precise instruments will grow.

Something that’s non-controversial is that institutions are really important at being the underlying liquidity for derivative products. Retail and degen DeFi users are not who on-chain options should be optimized for. Viewing the crypto options landscape through this lens will make things much clearer. Today, options volume is dominated by Deribit, a centralized exchange. Why that is is as much about Deribit’s breadth of product features as it is about the existing limitations of blockchain’s, which prevent the formation of a liquidity flywheel. It’s also worth noting this isn’t a new “problem” per se — there’s been innovation but finding PMF with fragmented liquidity continues to prove elusive. What do I mean by this specifically? DOV’s saw early traction because they packaged volatility selling into a slick UI/UX; projects like Ribbon or Friktion allow anyone to deposit collateral into vaults that generate yield (in theory) by selling options against that collateral.

It’s actually a relative straightforward and intuitive concept, but as with many first-mover attempts at complicated products, the incentive alignment is off. I won’t go into too much detail about the exact nature of this misalignment18 but suffice it to say that users wisen up quickly when they see consistently poor returns. TVL and user adoption quickly evaporated as a result.

If DOV’s aren’t the primitive that unlocks on-chain options, is the answer AMMs…

The concept of option AMM’s starts and ends with toxic flows. Liquidity providers (LPs) by definition provide liquidity. That makes them “price-makers”. You may think “whoa whoa hold on, LPs don’t make the price that’s automated by the x*y=k model”. Sure, but the model and smart contracts depend on liquidity existing to rebalance.

So if the LPs are price-makers, who are the price-takers?

The short answer is everybody else. But importantly for this discussion, who’s included in that “everybody else” is very informed market participants. These takers exploit the x*y=k model to stuff stale price order-flow to the makers when it deviates from the “real” price of the asset19. This is rampant in spot markets, which are far less technically complex to price than options. Spot price is simply one of the underlying variables that needs high-frequency data updates to appropriately price the option. Volatility is the other most critical variable (and typically a quite proprietary input for each participant).

As if that’s not enough, options also have far different return profiles than spot. Quick example:

Let’s assume I’m not using leverage and am long spot BTC. If BTC goes down 25% in a day, my return is?

a) -25%

b) -25%

c) -25%

d) all of the above

Not too hard to model returns on spot, is it?

Now let’s assume I buy a call option on BTC. If BTC goes up 25% in a day, my return is?

Options have convex return functions, which just means they have higher returns at the extremes relative to spot/linear payoffs.

In the options example above, I was kind to myself and positioned on the winning end of that trade. But the flipside of this is that option-writers (sellers) would be in a world of hurt if the underlying moved this dramatically in such a short window20. This dynamic is why market-making in the options arena is very capital intensive.

Blockchains need to be much more performant in my opinion before we’ll see this market transition completely on-chain. The most important problems are latency, capital intensity and privacy. But there are tangible intermediate steps we should see pulling us toward that end-state. *cough* oracle innovation *cough*

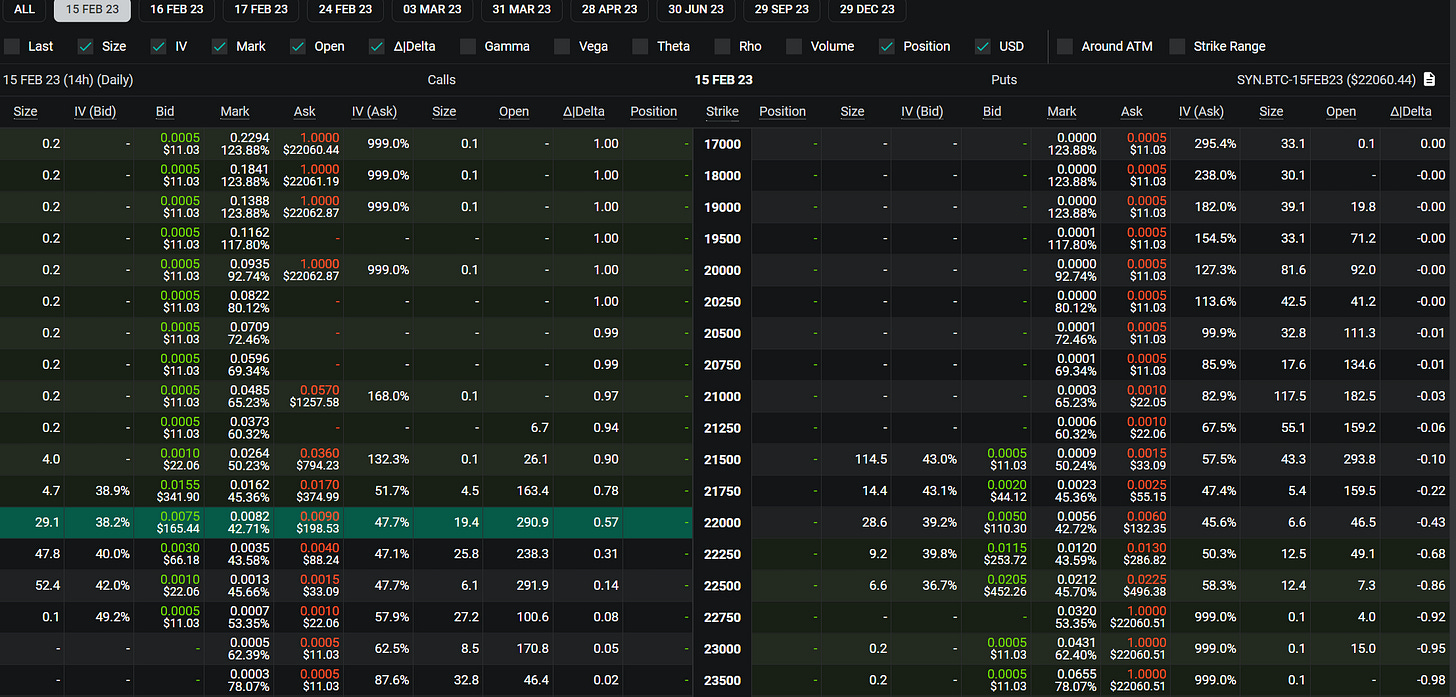

An added complexity is the option-chain, seen here:

Liquidity depth is already a difficult problem. With options, the tradeoff is breadth of product offering (i.e. length of the option-chain) vs concentration of liquidity. If you offer just one strike & expiry, obviously the liquidity you can provide for that is dramatically deeper than if that’s spread across 20 different strike & expiry combinations. One of the key success drivers of any successful options provider will be onboarding big market-makers. I’m not sure how mature this space gets otherwise. It’s very capital intensive to write options because of the convexity profile described earlier and if you’re on the losing end of an uncapped upside payoff you need a lot of collateral. This is what makes Deribit so successful today — it allows market-makers the ability to offset options & perp positions to bring down the capital intensity requirement. The catch is…you need a perp exchange to do this. To my mind, anyone building a true options market needs to be simultaneously building a perp exchange. The difficulty level here is obviously immense but the compound benefits are what make it worth pursuing.

I’m going to cut this off here as I’ve already crossed 3,500 words… There’s more to say about other areas of DeFi, especially around the security infrastructure that needs to be built to harden this system. If you’re building or investing in and around any of the areas covered here, I’d love to hear from you.

As always, my dm’s are open @0xsmac on twitter.

You can also now reach me at 0xsmac[at]compound[dot]vc

This is to be expected in a nascent industry and shouldn’t be viewed negatively per se. Inefficiencies will compress over time.

The Kraken and Paxos news over the last week are just the latest examples of a misguided regulatory stance the SEC continues to take. Hester Peirce’s dissent statement on the Kraken case is a breath of fresh air from an agency that continues to fail U.S. customers.

ok fine this is 2021 and so maybe double-digit growth is unrealistic to project forward especially given the law of large numbers but that’s quibbling

despite the impetus being disaster

at least beyond pure speculation

almost by definition this is what an exchange is — matching buyers & sellers organically

if my buddy and I think opposite teams will win a football game and want to wager on it, better for us to bet with each other rather than use a gambling app for example, since we’d be charged a vig there

drift, kujira, injective, sei, zeta are just a couple that come to mind

keep in mind this is still a mostly undeveloped space in DeFi today

data is now a couple weeks old

Orthogonal Credit deserves credit for shutting down its Alameda borrower pool back in Q2-2022 after citing “key weaknesses”

TrueFi has $40mn of interest lifetime on $1.65bn of volume; Maple has $44mn of interest earned on $1.8bn

a few of these protocols are already working with Credora, a project using zk technology to assess financial health

using the Maple terminology here just for example

I am being overly harsh here intentionally. Cunningham’s Law and all. Please roast me in the comments and send me angry DMs about what cool zk stuff is being built.

LPs are hoping the fees they collecting from providing liquidity offset the losses they incur from this flow. We know generally these fees don’t suffice.

Be sure to check out our latest upgrades at TrueFi, as well. In addition to being 4626 compatible, we also have some of the most robust tranching of any credit protocol today (also shoutout to credix + centrifuge for also handling tranching in a good fashion).

You can deploy your own tranched vault on testnet here if you're curious of the flow: https://docs.truefi.io/faq/getting-started/manage/creating-a-fund/how-to-deploy-a-vault-on-testnet

More on our roadmap and progress: https://forum.truefi.io/t/dao-contributors-q422-recap-and-q123-roadmap/1348#q1-2023-2

Awesome substack! Thanks.