I’m just going to one-shot this and much of it may be irrelevant in a few weeks (and as early as a few hours after I publish it). But enough people have asked me for some thoughts so here’s where I stand on Saturday April 5th ~4pm EST.

I will assume you are aware of the administration’s proposed measures.

For context and so you can assess any bias you believe I may have, here is some of what I said on Jan 1.

Politics aside, immigration is a key driver of labor market dynamics – if Trump ends up moving forward with policies that reverse (or to a lesser extent slow) the labor supply increases we’ve seen, then we should see weaker demand and upward pressure on wages. At the same time, he’s consistently spoken about implementing tariffs, which raises a set of new questions:

How will these tariffs affect business sentiment & investment in today’s economy?

What share of the higher costs do corporations believe they can pass through to consumers?

Generally speaking, with tariffs we can expect the flow of goods globally to slow, which leads to weaker growth and the realized price of goods goes up.

It turns out these tariffs are affecting business sentiment & investment quite a bit.

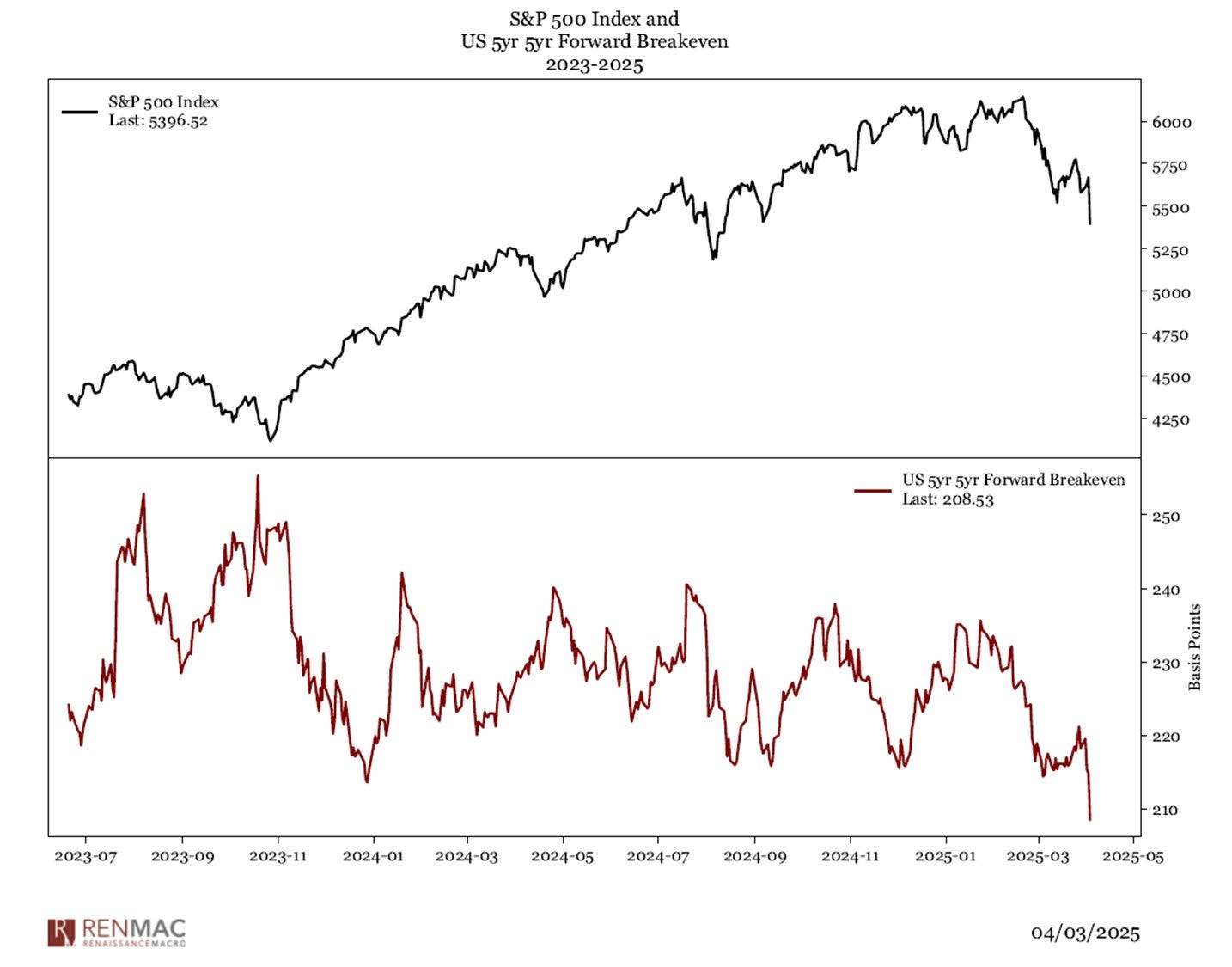

The administration has signaled for some time that they want to bring yields down. The 2Y’s down to ~3.66% and the 10Y caught a 3-handle for the first time since October. Congrats?

Snark aside, part of my belief volatility would return in 1H this year was because I believed Trump (& Bessent) would look to front-load any pain in markets for two obvious reasons:

easier to blame it on previous administration (“we were dealt a garbage hand and must now fix it”)

more time between pain & midterms

At the start of the year I was in the camp that the administration would use more targeted tariffs & cause some disruption in markets that would ultimately lead to a game of “is the economy weakening vs is inflation re-accelerating”.

With what we’ve learned over the last 48-72 hours from the administration, the question now is…

Citrini does a great job laying out the specifics of what positioning for stagflation on the publics side might look like, but one important point is a recognition of the methodology for these “reciprocal” tariffs.

The methodology used to calculate reciprocal rates is simply driven by the relative trade imbalance of the counterparty (Trade Deficit ÷ Total Imports x 100)– not their actual tariffs imposed on US goods. This means these tariffs are not simply a bargaining chip to reduce trade restrictions on the US, but rather a more sticky policy meant to shrink the trade deficit. In other words, they may be much more prolonged than the market hopes.

I’ve had a bunch of people reach out and ask who in their right mind is asking for the proposed measures we saw this week. The short answer is, nobody who understands the cascading effects of these types of things. The more complicated answer is that Trump won all of the swing states and the popular vote — he feels emboldened to follow-through on what he believes he campaigned on. Now, is this what he actually campaigned on? No, in my opinion it’s obviously more consequential and far-reaching than “we’re going to be tough on China”. The other complicating factor that I’ve personally been thinking more about is that fateful day on July 13, 2024. The degree of proposed measures just seems so absurd to me, that the only two plausible explanations I can come up with are:

the administration is willing to play an insanely dangerous game of chicken with the economy & global markets

Trump believes an Act of God saved his life in order to do whatever it is he thinks he’s doing (bringing us back to the 1970s?)

Of course he may walk them back, and I suggested as much in January.

I think the fact that Trump views the stock market as a scoreboard means that if we do see violent sell-offs fueled in part by tariffs he will be quick to walk back the scale of this initiative.

One problem here is that it appears he doesn’t actually view the stock market as a scoreboard (yet) and is far more focused on bringing down rates. He’s actively pressuring Powell (lol) to do just that. An aside here — my guess is that Powell will continue to ignore Trump pressure such that eventually the administration will just flat-out announce who the next Fed chair will be1. This is probably their best shot at trying to discredit policy they don’t agree with it. It’s a bad look if it happens but I don’t see Powell bending the knee — he is solely interested in trying to set policy as best he can.

All the while, the economy is weaker today than it appeared on January 1st. No fancy charts or explanations since this is a one-shot but auto delinquencies are rising (a metric I like to pay particular attention to), consumer spending is softening and expectations for longer-term growth are pulling back.

One relative trade we called out earlier in the year that would be a sign to de-risk was the SMH/SPY

If SMH/SPY rolls over, I think it means trouble for risk-on assets. The TLDR here is that if this relative performance breaks down it’s an early sign of risk-off sentiment as investors move toward more defensive sectors (staples, utilities) either because of economic slowing concerns or higher volatility expectations.

Let’s take a look…

Then:

Now:

So what happens next, since that’s what matters. The only thing I feel relatively strong about is that we won’t be seeing a V-reversal to new ATH’s in the near-term. This may sound obvious now but I continue to see a line of thinking that suggests the Fed will have to cut earlier and more aggressively now which will lead to everything ripping higher. This misses the point in my view. A world in which the Fed is forced to act this way is not one we want — that means unemployment is spiking, the economy is rapidly deteriorating and things are far worse than we anticipated. Recessions are not linear events, once they get going they don’t simply stop & reverse. Especially if it’s induced by much more structural changes to how global trade is conducted.

I may be naive (or overly optimistic) but my base case remains that this is a (ill-advised) negotiating tactic and we’ll see a bunch of carve-outs, concessions, exemptions, etc over the coming weeks & months. Depending on how long this drags out though, the odds of a recession increase by the day. I worry about the administration being too cavalier about how long they really have to play these types of games. I expect the market to digest all of this over the coming months, and in my view patience will be tested. We often see some of the most violent rallies happen in bear markets and I suspect we will continue to see fits & starts as the market tries to figure out what is really going on.

Hopefully by the time you’re reading this Trump has already scaled back some of those Liberation Day numbers, or at least asked o1 to try again.

Powell’s term ends in 2026 — a more extreme version would be firing him and if that happens then we have way more interesting long-term structural dynamics to think about (will Powell be the last ever independent Fed chair and what does that mean for how markets function moving forward)

Thanks for writing this up!