Volatility Is Back On The Menu

When the Fed flaps its wings...

We are back with another year-end macro larping piece and it’s once again a bit rough-around-the-edges, so bear with me. This is year 3 of publicly sharing how I’m thinking about markets heading into a new year — you can read last year’s post here. If you don’t care enough to go back to that here are the quick highlights:

“No reason to believe this bull market is ending anytime soon. Will there be drawdowns? Yes, of course. But in my mind, this market [SPY] will be much higher Dec 31, 2024 than it is today (15%+)”

“I didn’t talk a ton about crypto here but suffice it to say, if I expect traditional markets to have another good year, crypto can expect to outperform once again.”

“If you made me guess I’d say we get a meaningful pullback into the high $30k’s for BTC that people will be afraid to buy because the narrative will have shifted. But not bidding there would be a mistake in my opinion.”

It’s not necessary, but if you want some added context on how I’ve been thinking about these things on longer timeframes, feel free to rip through these first…

May 2024 (more crypto-focused)

2025

As we roll into 2025 it feels silly to start anywhere other than with the Fed. Heading into 2024 the market was expecting 6(!) rate cuts which always seemed ridiculous to me. The Fed ended up cutting 100bps total with the most recent cut leading to some internal dissent and a massive volatility spike for markets. In my opinion, this is the first time in a while that the Fed has some uncertainty on its hands, which I think you could feel in Jay Powell’s presser. He’s usually quite composed but it felt to me like he was annoyed that he had to explain a summary of economic projections that didn’t add up. The Fed was telling us they are expecting better growth, lower unemployment and higher inflation…but they’re still cutting rates. This is a bit nonsensical1.

I think too often though, market participants get distracted by asset prices when talking about the Fed.

“How can they cut rates with markets at all-time highs??”

“Fartcoin is at $1B and the Fed is cutting??”

Obviously the Fed pays attention to asset prices. But their role isn’t to be an arbiter for what every other market in the world should be doing. The Fed has a dual mandate: stable prices and maximum employment. For the better part of 2 years, the Fed has almost exclusively been fighting the inflation side of this mandate. But when they began cutting in September this year, it was primarily driven by concern about the other side of the equation. The labor market has clearly been slowing, albeit from incredibly tight conditions.

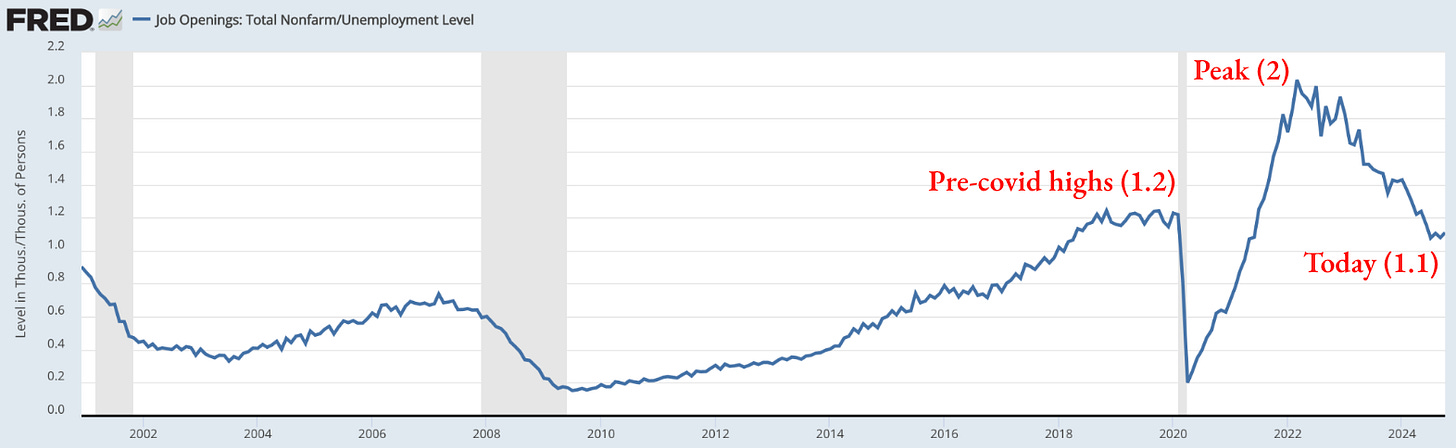

Below is a measure of nonfarm jobs / unemployment level, effectively showing how tight the labor market is.

We now sit below pre-covid highs, and the labor market is considerably cooler and looser than it was 18-24 months ago. Continuing jobless claims are the highest they’ve reached since November 2021.

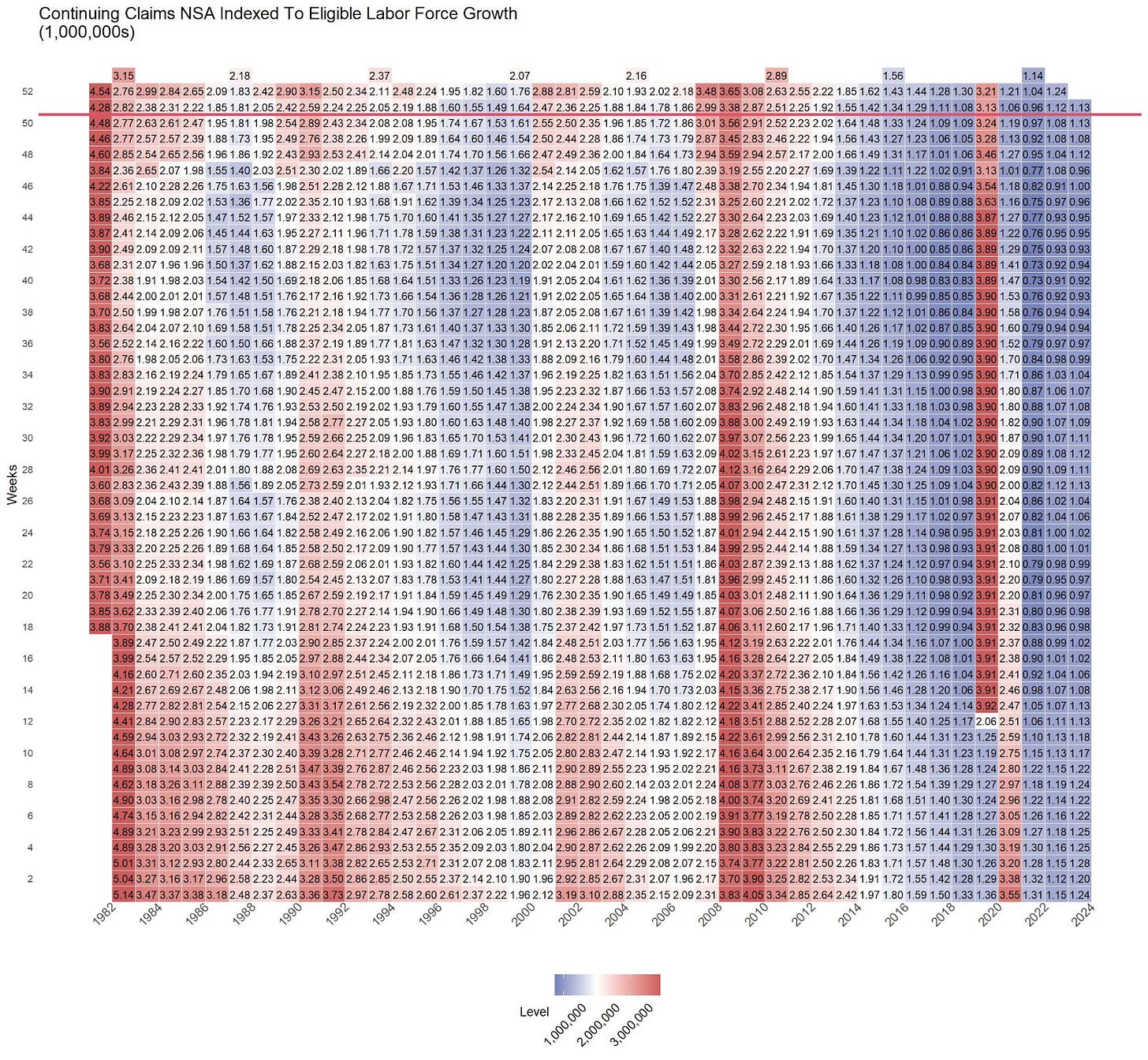

This may look scary but if we take a step back, these levels remain historically low.

This is all without even adjusting for labor force growth. If we adjust for that it paints an even more benign picture.

The obvious complication here is that this labor force growth has been buoyed by an influx of workers. Some of those workers will be in the crosshairs of the incoming President who has talked openly about tighter borders and mass deportation plans. Fewer workers generally means weaker demand, higher wages and less production, but I’ll come back to this in a minute.

The other side of the Fed mandate is stable prices, i.e. inflation. Core PCE was relatively mild in November and if we look at annualized-run rates across a few different time horizons, we can see that while inflation has been stickier, it’s not necessarily concerning at this moment2.

1mo annualized: 1.4%

3mo annualized: 2.5%

6mo annualized: 2.4%

12mo annualized: 2.8%

Headline PCE paints a similar picture…

1mo annualized: 1.5%

3mo annualized: 2.1%

6mo annualized: 1.9%

12mo annualized: 2.4%

Maybe the most glaring takeaway from the December Fed meeting was this:

In September, 3 out of 19 Fed officials thought the risks to their core PCE inflation forecast were weighted to the upside (i.e. if they were wrong, it was likely to be too low)

In December, 15 of 19 believed those forecasts (which were also revised higher) were weighted to the upside.

To be clear, this doesn’t necessarily mean it’s actually true that the risk is to the upside. The Fed has a long track record of being awful at projecting the future, but pivoting their collective belief so strongly is notable. As much as we like to talk about metas in crypto, the theatrics of the Fed and traditional markets is second to none. Ultimately the Fed shifting its expectations is important for policy decisions, but all of the posturing that happens between these decision meetings is the important stuff. If the Fed believes inflation will run hotter in 2025, then what does it mean for policy if it comes in cooler than they expect…?

I was clearly wrong a few weeks ago in thinking the market had fully priced in a more hawkish Fed stance heading into the December meeting. But expectations have been reset, and there’s a ton of data rolling in between now and when the Fed will make their next decision3. The elephant in the room that makes this much less black and white is the new administration and its policies around immigration and tariffs.

Politics aside, immigration is a key driver of labor market dynamics – if Trump ends up moving forward with policies that reverse (or to a lesser extent slow) the labor supply increases we’ve seen, then we should see weaker demand and upward pressure on wages. At the same time, he’s consistently spoken about implementing tariffs, which raises a set of new questions:

How will these tariffs affect business sentiment & investment in today’s economy?

What share of the higher costs do corporations believe they can pass through to consumers?

Generally speaking, with tariffs we can expect the flow of goods globally to slow, which leads to weaker growth and the realized price of goods goes up. This isn’t Trump’s first rodeo so there is some precedence here. But I think it would be naive to assume the Fed will react in the same way today as it did back in 2018-19; at that time Trump was waging a trade war and the Fed opted to cut rates in response. But those cuts were driven by concerns over growth and investment slowdown, which is wholly different from the economic environment we find ourselves in today. We had more than half a decade of below-target inflation back then – 2019 was pre-COVID when many believed we couldn’t create inflation for the life of us. Today’s environment is very different, and Powell hinted at just as much in his presser:

“What the committee’s doing now is discussing pathways and understanding again the ways in which tariffs can affect inflation and the economy. It puts us in position, when we finally do see what the actual policies are, to make a more careful, thoughtful assessment of what might be the appropriate policy response.”

The last bit of complexity also lies in how corporations interpret their ability to pass higher costs to consumers. I would posit that companies will feel much more willing to pass through higher costs to customers today than they were 6 years ago, which, if true, would add inflationary pressures that didn’t manifest from the previous Trump tariffs. If they believe they can do so fully and completely (a one-time cost shock) then it’s easier to imagine consumers swallow it and move on. But if corporations believe the underlying economy and consumer is weaker than it appears on the surface (and thus consumers aren't willing or able to accept a one-time cost shock) and they try to phase the cost increases in over time…well that could lead consumers to believe the inflation problem is worse than they imagined. I think the fact that Trump views the stock market as a scoreboard4 means that if we do see violent sell-offs fueled in part by tariffs5 he will be quick to walk back the scale of this initiative6.

My personal sense is that the economy remains in solid shape – growth is strong, the consumer is still well positioned, credit spreads are the tightest they’ve been since the late 90s. All of these things reflect a healthy underlying economy7.

A major cause of consternation this past year was the looming election. That is finally behind us and the general sentiment is that businesses have been rather cautious the last 2-3 years8. In theory this administration should be more pro-business but the flipside to this is that all this optimism and promise carries a lot of execution risk. If you’re concerned about valuations being stretched and growth slowing, then it’s not unreasonable to think markets might be more impatient.

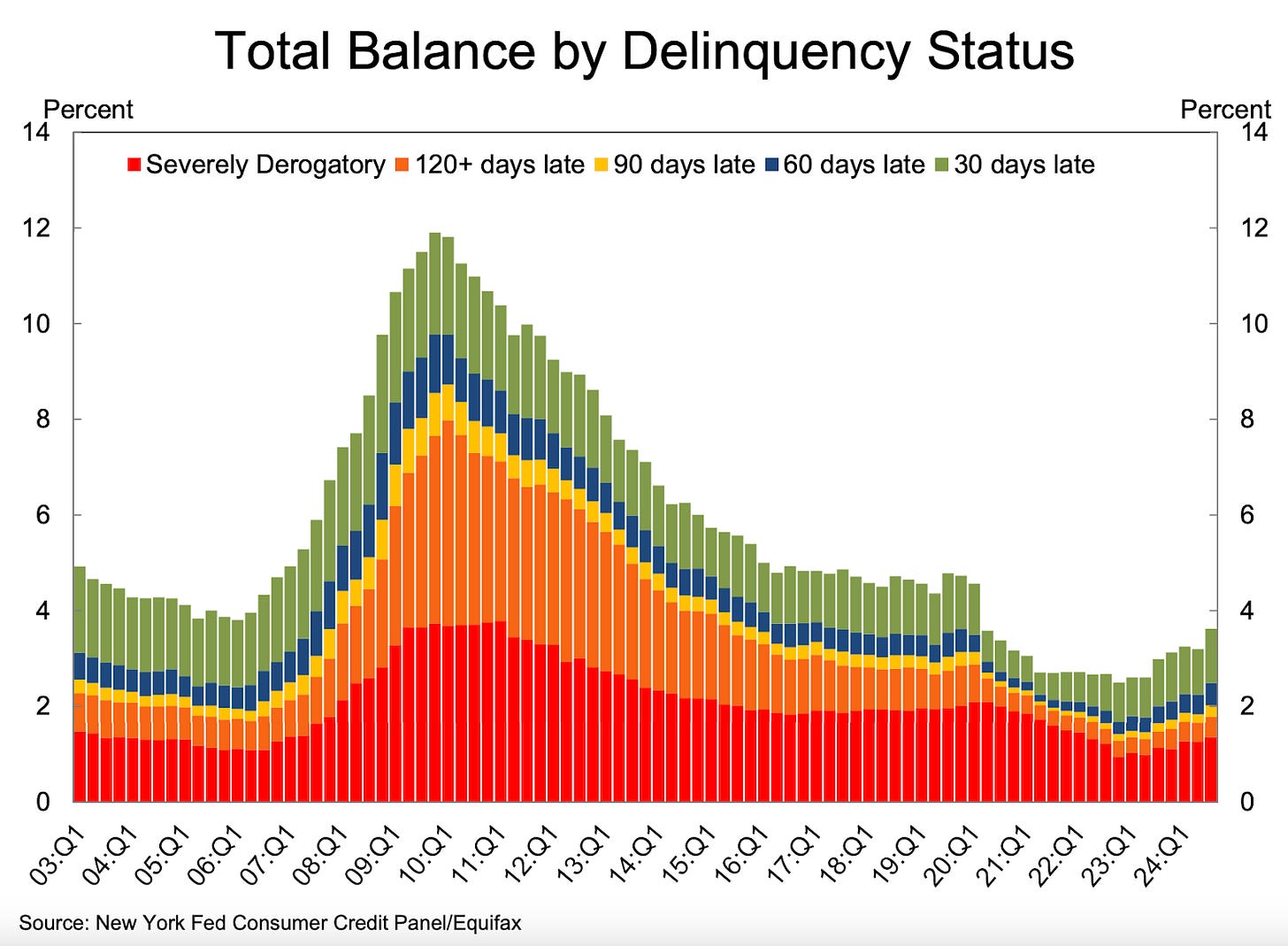

At the consumer level, broadly speaking things look healthy but there’s not a ton to say here in my opinion. Underlying delinquencies are trending higher in some cases9 but consumer spending remains strong.

I still find it difficult to imagine consumer spending deteriorates without more weakness in the labor market. We’re operating at full employment today but unemployment typically trends so I expect to see this continue to tick higher over the next 12 months. I found it a bit odd that the Fed revised their expectations for unemployment lower, and in fact this makes me more inclined to believe we’ll see at least 2 cuts (and probably 3) in 202510.

Ok so beyond slower developing data like unemployment surprises that lead to a deterioration at the consumer level, what are the things I’m looking at that which would tip me off that markets are rolling over? Right now the two biggest things I’m paying attention to are the dollar and the relative strength of the semiconductors.

If SMH/SPY rolls over, I think it means trouble for risk-on assets. The TLDR here is that if this relative performance breaks down it’s an early sign of risk-off sentiment as investors move toward more defensive sectors (staples, utilities) either because of economic slowing concerns or higher volatility expectations. It could also signal an early sniffing out of earnings weakness for chips; this is one of the legitimate “tail11” risks given all the attention AI has sucked up over the past 2 years. Tariffs and trade wars are the other obvious geopolitical risks that could weigh on this ratio and it’s worth noting that historically we’ve seen semis peak ahead of broader downturns.

The dollar breaking out is the other concerning development12 for risk-on assets in my opinion. It looks today as if it’s resolving to the upside which I think puts a lot of pressure on US equities and by extension crypto. You can see from some of my chart art that the DXY has already extended its rally past where I initially expected it to sputter out and chop around. This is another tricky one because oftentimes we think of dollar weakness as a tailwind for risk assets, but I think the strength of US markets relative to the rest of the world is probably what allowed these two to move up together13. Interestingly enough, back at this time in 2016 when Trump was first elected we saw a similar move from the DXY heading into 2017; at that time there were similar fears about dollar strength and trade wars but then the DXY spent the better part of 2017 breaking down. It’s an n of 1 though so I wouldn’t read too much into it. As it stands today, I think we see dollar weakness return in Q1 2025 rather than run to 113-114.

I don’t love comps to past periods but if I had to choose one, I’d probably say we’re closest to 1997. Things feel solid, we’ve been in a bull market14 and yet there’s still some fear from market participants. Back then the fear was driven by the currency crisis in Asia & Russia (1997) and the collapse of LTCM (1998). The Fed did an emergency cut and it was off to the races again. Today the fear is some cocktail of inflation, high valuations, weakness in labor markets and the sustainability of multiple expansion. These all just feel like regular business cycle concerns to me. It’s possible I’m being too complacent and the counter argument is that the market is much more fragile today because of these concerns — if we get a geopolitical event or some tail risk spark it’s feasible the kindling is there to drag markets lower. There’s also some more microstructure shenanigans going on with the ATI15 and the TGA16 that could make the early part of Q1 more liquidity constrained than people are hoping.

Once again, I didn’t speak much about crypto here but I still believe in general we are tethered to the macro environment. I said previously “the structural change to crypto markets cannot be overstated” and I still firmly believe this. Bitcoin is now being floated as a strategic reserve asset (though I think this is less likely in the near term) and the entire space is still just ~$3.4T today. I anticipate traditional markets will continue their trend higher in 2025, though I think we see a much less orderly march than we had this past year.

There’s going to be a lot more volatility as the path is more unclear, and the Fed has a far more difficult balancing act this year compared to 2024. This time last year I felt extremely confident in what the next 12 months would look like; today I feel less confident but more excited because I think the difficulty level to parse through what’s going on will be higher.

If you made me choose today, I’d say I expect to see the dollar weaken, the bid for semis to return, unemployment to trend higher with inflation coming down, traditional equities end the year higher17 and crypto will outperform once again.

But as always, do not listen to me I am literally just an anon on the internet.

More Charts If You’re Interested

I’ve included a handful of other charts I find interesting for one reason or another below. If you’re curious or confused about why any of them are included feel free to DM me.

I actually think this is a symptom of the Fed over-communicating. The Fed has reached a point where they are trying to suppress volatility and don’t ever want to surprise the market. In my view, they felt compelled to cut in December mostly because they didn’t want to spook markets by pausing when everyone (90+% heading in) anticipated a cut.

there is some irony here in that for a full decade prior we couldn’t create strong economic growth and thought we’d never see meaningful inflation again

the March meeting is really the next important one

and increasingly it seems like he views the Bitcoin price in a similar manner

or rhetoric around them

he may not say this publicly ofc

we did get a weak Chicago PMI reading this week so it’s not as if everything is perfect

this intuitively makes sense — businesses first dealt with COVID, then supply chain uncertainty, then massive inflation and worries about how far the Fed would have to go to stomp inflation out

most notably with autos and mortgages albeit moving into 30+ not more severe-stage 90+

if the Fed expect unemployment to be lower (they revised it down from 4.4% to 4.3%) then they’re opening the window to cut more than expected if unemployment comes in higher (i.e. if we see unemployment tick higher they will tell us “need to cut more to support weakening economy/labor market”)

i don’t think tail risk is the right characterization since i don’t think people can really predict those but you get the point

i would probably say it’s the most concerning development

realistically this is a bit outside my expertise and I mostly don’t like to explain past performance since it’s easy to fit a narrative when you already know the outcome

tbf that 90’s bull market was 6-7 years deep by 1997

Activist Treasury Issuance

Treasury General Account

another 12%+ year

I appreciate you taking the time to write this. Good read.

I ain't reading all that

i'm happy for you though

or sorry that happened