I’ve been teasing some version of a macro larp blog for a few weeks now and figured rather than make it super clean and neat, better to just word vomit what I’m thinking about. That way I can claim I was right no matter what happens :)

Look, I am a humble anon. I know I won’t always be right. Timing the market is extremely difficult and doing so consistently is damn near impossible. But boy was 2023 LIGHT WORK. Everyone was bearish heading in, but to me it seemed clear the next move was higher. I wrote about why I thought that was the case.

Heading into 2024 I have more mixed feelings.

On the one hand, the market’s expectation for rate cuts seems overblown to me. There’s an implied 80% chance of a cut in March and a 98.8% chance of at least one cut by the May meeting. In total the market is pricing in 6 cuts (assuming 25bps each) this year.

Now while I *think* it’s likelier than not we see a rate cut by May, it seems preposterous that the market is pricing this as a certainty. It also seems quite unreasonable to think we’ll see 6(!) rate cuts this year. To me, a slower than expected pace and/or more hawkish fed commentary1 is underpriced at the moment — at least in the very near term (Q1).

What would a surprise inflation print mean for example? Or hotter than expected consumer spending?

It just feels to me that the market is pricing things with too little margin for error and the immediate-term risk is to the downside (10-15%). Doesn’t mean it will happen, but that feels more likely than just sending everything up again in Q1.

The other notable metric that has me a bit more suspicious than I otherwise would be is the VIX. It spiked today but we’ve been in a low-vol environment for a while now, and volatility tends to mean-revert2. There are other metrics worth watching that I think will help sniff out any mild correction — QQQ’s losing 400, the spreads on BBB’s above treasuries starting to blow out, or the DXY strengthening.

The dollar breaking down in late 2022 was an obvious signal to me that risk-assets were going to run (crypto running fastest per usual).

But as it stands today, it seems more likely the DXY will be rangebound and chop around (btw 100-106) for a few weeks/months. I think this ends up putting a bit more pressure on risk-assets so it’s just another element that makes me less convinced we simply turbo pump.

And yet, the economy is still ripping, consumers are still spending3 and most importantly, my favorite people (sell-side analysts) are still not bullish enough.

I wrote about these forecasters last year:

“Each desk anchors to a 7-8% gain and then adjusts marginally higher or lower depending on how bullish/bearish they are. These are safe forecasts that won’t get anyone fired, which is why they’re mostly useless.”

Yet here we are today — 4750 heading into the year — and most of the Street refuses to believe we can continue going up. To be fair, some of these analysts have already revised their assumptions higher, but the coup de grâce of charts last year was this beauty…

These people literally have no idea what’s going on.

My admittedly wishy-washy bearishness over the last 2-3 weeks was really a result of my spidey senses tingling when I saw what I thought was everyone flipping bullish at the same time…

But it seems like this isn’t exactly the dominant sentiment and I may have just been caught in a hyper-optimistic, post-Christmas, crypto echo bubble?

I have no idea what crypto prices will do around the BTC ETF. My suspicion is we’ll see a lot of volatility in the weeks around it and twitter will be a cesspool of either “omg how could you fade Blackrock this was so obvious!” or “lol it was obviously all priced in, you sold didn’t you anon?!” Tweets will no doubt be misclicked.

But this is largely unimportant in the grand scheme of things. Crypto is criminally under-owned by everyone not on CT. Bitcoin is about to get the final blessing of the suits which means all the boomer money can now ~feel safe~ owning our digital assets. The short-term flows are unimportant in the grand scheme of things as we finally begin to see a structural shift toward the infinite bid.

Getting back to the short term (i.e. 2024), I mentioned this a few days ago on twitter but the sheer size of capital in money market funds is hilarious.

$5.9 trillion.

Last week alone there were $16 billion of new inflows.

That is an insane amount of underallocated and offsides positioning still left to bid risk assets. Especially at the institutional level.

Don’t forget, this time last year all the brilliant minds of high finance thought they found a layup trade buying 4-5% treasuries. These people got absolutely rekt in 2023. Imagine how fun those client conversations were at the end of the year…

“I know the Nasdaq ripped 50% this year, but we had you in some nice, risk-free 4% T-bills. Sure it’ll take a decade for you to make that up but look at it on a risk-adjusted basis.”

Specifically at the institutional level, there is $3.6 trillion of capital in money market funds — this money is meant to earn a yield and should act as a tailwind as it slowly flows into higher-risk assets. These allocators cannot afford to miss another double-digit move in equities. The one caveat here being — continuous flows would be much healthier than large, violent moves, which suggest chasing & fomo’ing in.

Asset prices trend, volatility mean reverts.

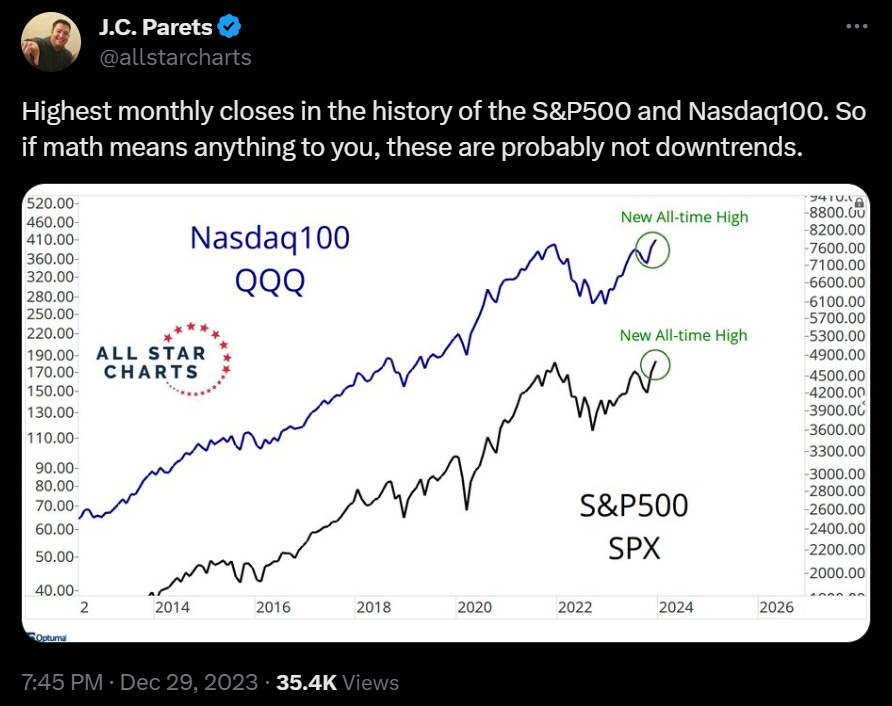

This is a great chart from JC that suggests no reason to believe this bull market is ending anytime soon.

Will there be drawdowns? Yes of course.

But in my mind, this market will be much higher Dec 31, 2024 than it is today Jan 24.

So what would need to happen for me to flip bearish?

I think there’s a few things but two of note would be:

consumer spending slowing materially

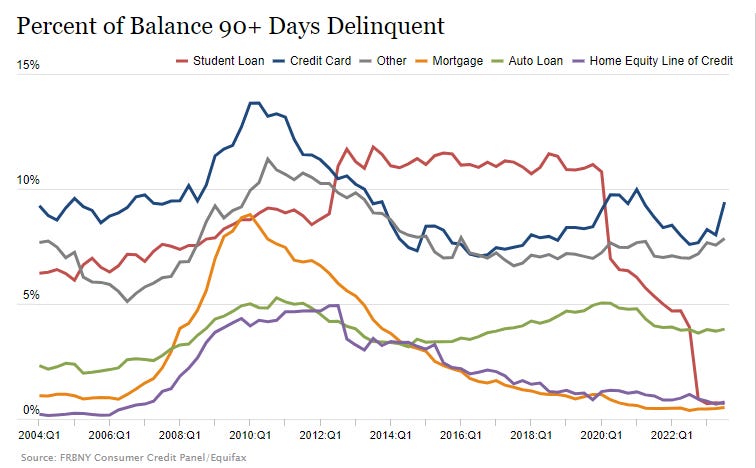

delinquencies spiking — especially on auto payments

We’ve seen some evidence of delinquencies starting to creep higher but these are coming off historic lows. I like to look at auto loans as a litmus test for consumer health because they’re one of the first payments people make (after the mortgage); this seems odd to people in NY/SF but most people in the US need a car to get to work. Losing the car has a domino effect on employment, consumption, etc.

It’s difficult to imagine consumer spending falling off a cliff, or delinquencies spiking without some deterioration in the labor market. So long as consumers are employed, they are going to spend money & pay their bills.

Below is a measure of nonfarm jobs / unemployment level, effectively showing how tight the labor market is.

A number >1 implies there are more jobs available than unemployed people. Less than 1 means the opposite.

While it’s obvious the labor market is not nearly as tight as it’s been the past 18-24 months, it’s actually still above pre-pandemic highs.

We can see this peaked ~2 in March of 2022 and has steadily declined ever since. So while the labor market isn’t quite as hot as it was before, it’s still pretty warm. Until this starts to look concerning — which to be fair it could with a few more months of this trend — it’s hard to imagine we see consumer weakness.

I didn’t talk a ton about crypto here but suffice it to say, if I expect traditional markets to have another good year, crypto can expect to outperform once again. There’s more idiosyncratic risk for the coins, and especially so around the ETF but we’ll find out soon how much of Q4’s run was more ETF front-running.

If you made me guess I’d say we get a meaningful pullback into the high $30k’s for BTC that people will be afraid to buy because the narrative will have shifted. But not bidding there would be a mistake in my opinion. But do not listen to me I am literally just an anon on the internet.

to argue against myself, asset price trends can continue even as volatility picks up.

15%+