Smac's Mailbag #1

TBD on what this series will actually be named going forward - open to suggestions :)

As promised, I am starting a mini-mailbag series. Ideally I’d like this to be driven by people who read my stuff and/or follow me on twitter.

It’s meant to be a more casual, shorter-form and more frequent series of topical thoughts. If nobody sends me questions, I’ll just assume you’re not interested in hearing anymore from me…so let’s see how this goes.

Also, just fyi for now I will also be responding individually to every question I get via email. So if I didn’t include your question in this public piece, please check your spam because I definitely replied back privately.

Send any & all questions to smacsmailbag@gmail.com

Here’s how I decided which Q’s to include in this post…

> is it something I think more people would like to hear a different opinion on

> do i have anything worth saying

> do i think answering this could be helpful to other ppl who either might have the same question or could benefit from my response

> can i sneak some meme’s in

Ok without further ado, here’s Smac’s Mailbag #1 (for the love of God please help me rename this)

Q: How do you start your research process when you are trying to figure out where markets (regular ones or crypto) are going to go next?

A: Journal everyday. This is the number one piece of advice I would give to anyone who wants to develop better habits for staying on top of markets, be they crypto or traditional ones. I’ve said this before but writing things down forces you to express what your actual opinion is at all times. Some entries will be longer and more detailed than others, that’s fine. It also makes it so that you can go back to see what you were thinking in the moment after things unfold. Humans are so good at psyops’ing ourselves into thinking we believed something in the past even though we didn’t. In my opinion this is why most strategists and forecasters suck.

A perfect example is that all through December & January I saw conversations from these people (and economists & researchers) that was some version of…

Suit 1: “So as we go into 2024, how are you seeing the markets, especially with rate cuts looming?”

Suit 2: “Ya I mean if you remember last year at this time the consensus was just dead wrong, almost nobody could have seen the year playing it out the way it did. So as we come into 2024…”

This is just cope in my opinion. It’s a way for people who were wrong to feel better about being wrong. They can mentally cross last year’s mistakes off by preaching that “almost nobody was right” and so therefore it must have been impossible to come to the correct conclusion heading into last year.

This is a very roundabout way of answering the original question but it starts with journaling because you can then hold yourself accountable. What did I get wrong, what did I get right, was I right because of the reasons I thought or did I get bailed out by some event that made it seem like I was right, etc. There’s a million ways to self-evaluate but you can’t do that if you don’t write stuff down.

As far as actual research, here are some things I don’t do:

> I don’t read the WSJ or FT everyday

> I don’t watch CNBC/Bloomberg

> I don’t pay attention to individual stocks for the most part (mostly because I don’t have time)

I have a few weekly podcasts I try to listen to as a way to gauge sentiment & a handful of macro people I follow on twitter whose feed I will check regularly1 – it’s kind of a curation of curators. I think one of the important things here is that I definitely disagree with some of these people, but it’s still worth listening to their thought process. Insulating yourself with just bulls or just bears makes no sense.

This is just the starting point of accumulating information though. Over time you’ll begin to develop your own internal algos for deciding what new information you think is relevant/useful; some of this will validate your existing thinking, some of it will invalidate your theses. It’s much easier to be intellectually honest if you have notes to look back on.

For me personally I still think crypto markets are beholden to current broader economic conditions. So I always start there. Do I think things are getting better or worse, and what assumptions are being made around rates, dollar strength/weakness, traditional markets, liquidity and the Fed. This lens has made it easier for me to be bullish when people think everything has gone to shit.

As far as crypto-specific research goes, it’s much less orderly. I sometimes begin with markets outside of crypto and think through whether or not those pain points can be solved with smart contracts. Other times I think through how tradfi market structure exists today and think through which pieces are most relevant in a crypto-centric world. I’d say one highly valuable thing to do is examine why things haven’t worked before…lots of times the idea may have been right but the timing was wrong, or the crypto infra wasn’t there yet. I still think this is the case for some categories in crypto, but a lot of people tend to write-off things that didn’t work in the past — either because there’s some PTSD from losing money, or complacency around how a category has evolved.

Q: If someone were to say “we’ve lost the plot” in crypto, what would you say they’re referring to as ‘the plot’?”

A: Ok this is a heavy question lol. First I would push back on this assertion. I think we lost the plot in mid 2021 for sure, but I don’t think that’s what’s going on now. Part of why I say this is because the original “plot” of crypto is not one that will ever appeal to the majority of people — at least as the world exists today. I think in the earliest days, crypto did a fantastic job of finding people who cared deeply about decentralization, alternative financial systems, ownership, resiliency, protection from overly intrusive government, etc. But these are things most people who control a majority of wealth in the world (i.e. boomers) don’t care about – in fact, much of their wealth is a result the status quo.

If you forced me to say “we’ve lost the plot”, then in the current environment I would describe it like this:

There are a lot of builders who are trying to create things that make existing crypto systems more user-friendly, accessible to a broader audience, solve real problems and who generally view this space as positive-sum. These are the best kinds of people.

They view the Bitcoin ETF as a milestone event. It’s further validation that the things they are working on will ultimately be used by millions of people as crypto becomes less stigmatized.

There is another subset of people who view the existing crypto landscape like an hourglass sand timer. They see the Bitcoin ETF and think – damn crypto is about to become much more efficient and sophisticated, I’m running out of time to “make it”. They shill garbage, dump on followers, think everything is zero-sum and are leeches who try to extract everything they can. These are the worst kinds of people.

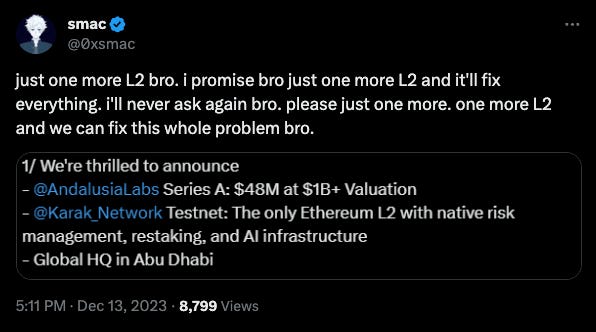

Somewhere in between is this nebulous crowd with mismatched incentive systems who are simply acting as rational humans do. Their thinking goes something like – If I am incentivized to fund more infrastructure that the market assigns a higher FDV to, then I will keep doing this, even if it means another piece of piping that nobody uses. I get why this happens. At some point the market has to decide to stop rewarding this behavior. The main problem I have with this group is when they try to pretend this isn’t the game they’re playing.

I think some of this also has to do with fear of failure, from both sides (founders and investors). From the investor side, if you invest in infrastructure you can credibly claim “well it’s not fully developed just yet…wait until the users show up…let’s raise an up round because the product/platform is much further developed”. This can drag on for years before you ever really know whether or not your piece of infra is critical, useful, able to capture value, etc.

Whereas if you’re investing in the application layer, the feedback loops are much tighter – “Are people using the app or not? What is retention? What is churn? Can they attract liquidity? Is there a path to value capture?” As an investor, if the answer to these is that nobody wants this app, then you have to deal with the realization of “failure”2 much sooner. This is uncomfortable for most people so it’s easier to avoid.

The same is true from the founder perspective – feedback loops are tighter and so you can tell much quicker whether or not the thing you’re building is something users want. It’s easier to kick the can when building at the infra layer. Of course that’s obviously not to say all infrastructure is bad or shouldn’t be funded – that should not be the takeaway. I’m over-generalizing but I do think this ethos is too common today. It’s just a slightly more serious commentary on the “one more L2 bro” meme.

Q: I wiped my following list clean to start fresh on crypto twitter. Can you give me a list of accounts I should be following?

A: Here’s a quick list off the top of my head that covers varying eco’s / topics…

@cburniske

@QwQiao

@buffalu__

@boldleonidas

@Data_Always

@0x_Osprey

@0xRainandCoffee

@andrewhong5297

@jon_charb

@EffortCapital

@MylesOneil

@sheila_warren

@rushimanche

@laurashin

Q: You complain most crypto VC’s aren’t very good so who is your favorite non-Compound investor?

A: [Redacted]

No free ads :)

Q: Up or down next?

A: I got a bunch of variations of this one. Some for specific tokens, others asking about tradfi more generally. I cannot see into the future people. My views are mostly unchanged from earlier this year. Hopefully you read that piece already and got some nice bitty entries (though I’m not so sure we don’t revisit those levels again at some point 1H)

Also, I still know nothing and am a cartoon on the internet.

Q: You’re wrong about crypto gaming.

Ok to be fair this one wasn’t a question. But it wouldn’t be the first time I’m wrong.

I’m rooting for crypto gaming to bring in 100 million DAU. That would be sick for crypto as a whole so I hope it happens. I just think the ideology and hype has so far outpaced reality (even for crypto). Part of the reason for this is that a bunch of people didn’t understand how long & expensive traditional game development takes and they hitched their wagon to the crypto-gaming narrative – rather than acknowledging this, all they can do is double and triple down (“soonTM”). Also, part of my “hate” (which is a bit tongue-in-cheek) is that at Compound we make very concentrated thesis-driven investments – we’re not going to yeet into 20 gaming companies and hope 1 of those is a megahit.

Incidentally, I HAVE been bullish a very specific type of crypto game…

Very fun to see everyone on CT having a blast playing “Crypto: The Game” this past week. Maybe 2024 really IS the year crypto gaming happens…

I’ll be doing these every other week but please keep sending questions to smacsmailbag@gmail.com

My dm’s are always open @0xsmac on twitter

If you’re building something cool or weird in crypto at the pre-seed or seed stage, definitely reach out to me there or at smac[at]compound[dot]vc

Feel free to DM me if you want the complete list - alfalfa requires an extra step

I put failure in quotes because it’s a topic that deserves it’s own discussion