Déjà Vu All Over Again

Walls of worry are for climbing

This is year 4 of publicly sharing how I’m thinking about markets heading into a new year — you can read last year’s post here.

If you don’t care enough to go back to that here are the quick highlights, though I think last year was especially nuanced and I admitted in there that I felt far less confident about my views as previous years1.

"The elephant in the room that makes this much less black and white is the new administration and its policies around immigration and tariffs."

"I think the fact that Trump views the stock market as a scoreboard means that if we do see violent sell-offs fueled in part by tariffs he will be quick to walk back the scale of this initiative"

"We’re operating at full employment today but unemployment typically trends so I expect to see this continue to tick higher over the next 12 months. I found it a bit odd that the Fed revised their expectations for unemployment lower, and in fact this makes me more inclined to believe we’ll see at least 2 cuts (and probably 3) in 2025"

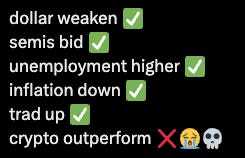

If you made me choose today, I’d say I expect to see the dollar weaken, the bid for semis to return, unemployment to trend higher with inflation coming down, traditional equities end the year higher17 and crypto will outperform once again.

It’s not necessary, but if you want some added context on how I’ve been thinking about these things on longer timeframes, feel free to rip through these too.

May 2024 (more crypto-focused)

2026

I feel a bit like a broken record because at least anecdotally it seems people have been asking me for a while if the bull market is over. My crude, high-level view on this is that unless we are heading into a recession or a rate-hiking cycle the answer is probably no.

People have been calling for a recession for a while but frankly, I still do not see that. But it’s worth considering the strongest arguments for why risk assets might underperform this year and perhaps some catalysts that could trigger this.

When I was jotting down notes for this piece I started listing out all the best observable reasons 2026 could be a bad year.

the labor market is weakening

AI capex can’t continue at this rate and is propping up the market

stocks are expensive and multiples will contract

private credit boogeyman

inflation returns

I am open to hear others, and there are geopolitical risks and tail risks but those always exist. If you want to mentally ascribe a higher probability to those downside risks because of the administration in place, I think that’s fair but there’s nothing worth writing about here imo.

So let’s spend some time on each of these…

The labor market is weakening

Objectively true. Unemployment is going up. Historically it trends, meaning it is likely to continue going up. Incidentally this is one of the main drivers of inflation (labor market) but the quits-rate is quite low meaning people aren’t leaving their jobs. This suggests employers have the leverage between these two groups. If that’s true then it’s probably also true that we won’t see wage growth accelerating. All this is to say that, unemployment will probably continue trending higher which suggests a bias toward more accommodative policy. I still think the Fed is too restrictive which is most visible in the housing sector. But consumer health remains in good shape and the dirty secret is that because of the much-maligned K-shaped economy, this is unlikely to deteriorate in the short-term2. This is a bit of a tangent but I actually think one of the under-priced risks is some version of an inverse wealth spiral. Some shock that gaps equities lower and where there is genuine uncertainty not easily solved in the short-term. If that actually prolongs then it’s at least feasible it could lead to the highest spenders feeling less wealthy and thus spending less which leads to weaker earnings and lower multiples as a result. I don’t know what the catalyst for that would be to be fair. Ok, tangent over.

AI capex can’t continue at this rate and is propping up the market

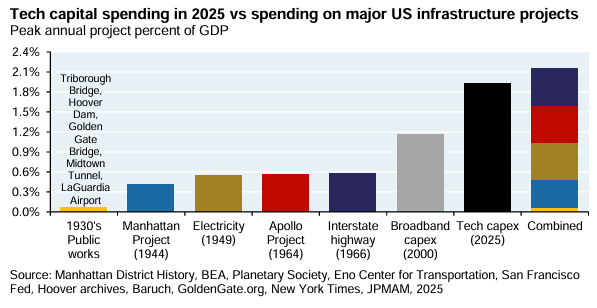

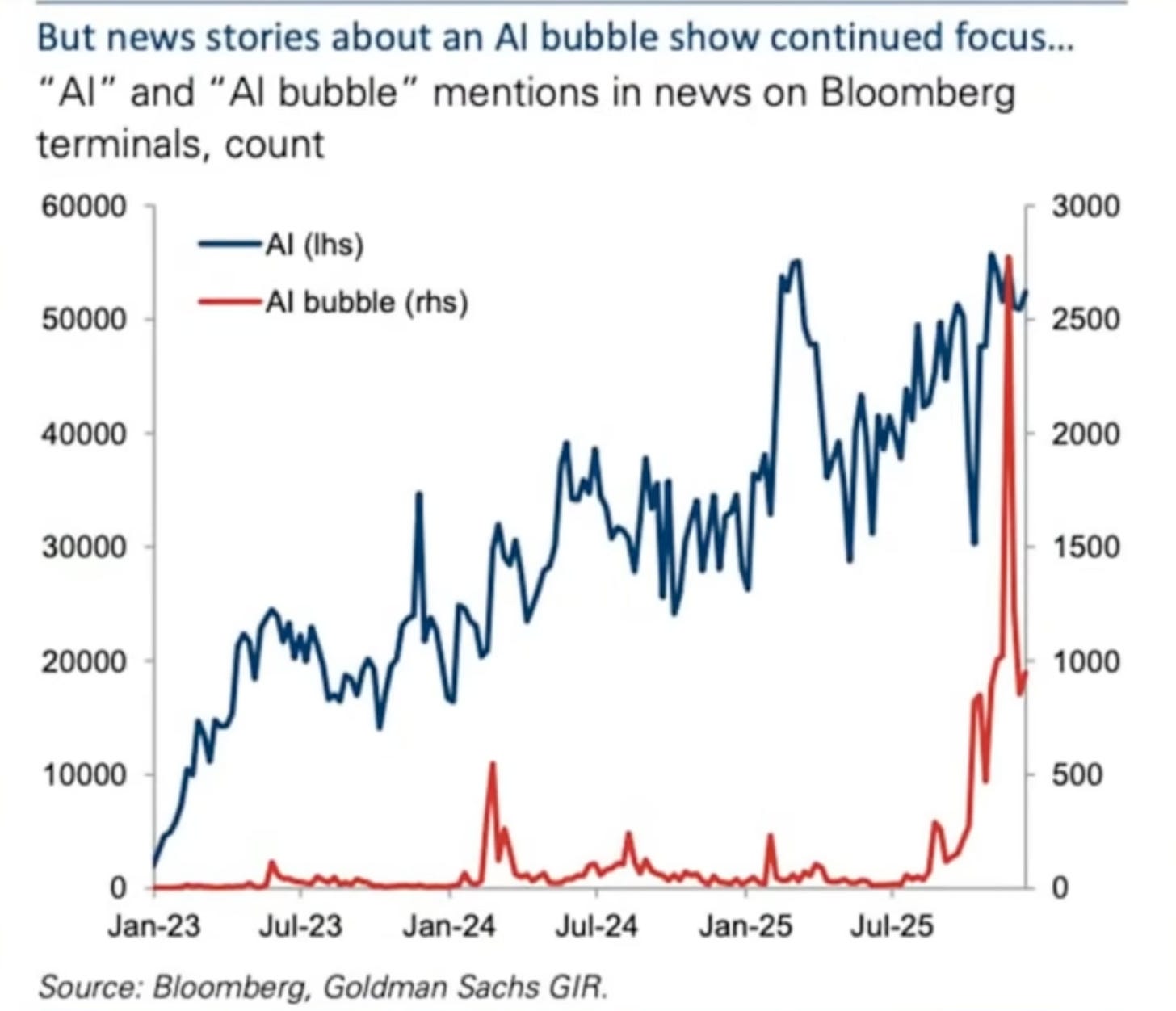

This is one we’ve begun to hear more of over the last year as technology companies have spent eye-watering capital on the AI buildout.

In the past, many of these technology companies were criticized for aggressively buying back stock, with an insinuation that the stock performance was buoyed by shrinking outstanding float. Obviously this has an impact on stock prices. But back then the complaint was that they should be reinvesting into the business and “aReN’t tHeRe bEtTeR uSeS oF cApItAl??”

Except now that they are (presumably) finding better uses of capital, the critics say “look how aggressive the spending is, this is unsustainable!! what will be the ROI??” To be fair, I think it’s fine to question how profitable this buildout will be, but I also don’t think we’re going to get an answer to that question in 2026. I will say this though: the capex boom has mostly been financed by internally generated cash flows (with the exception of Oracle and Meta’s Hyperion data center). If these companies begin to aggressively ramp financing via debt then I think there’s reason for concern3.

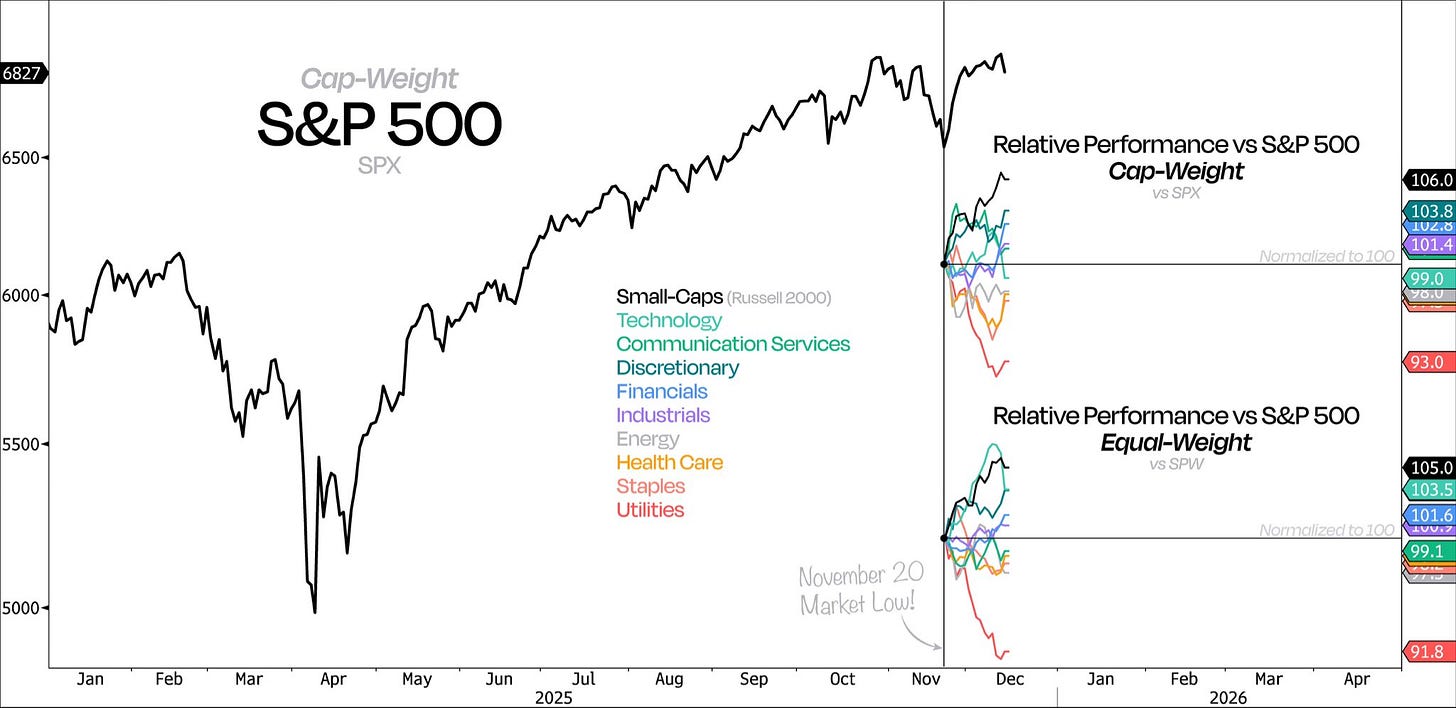

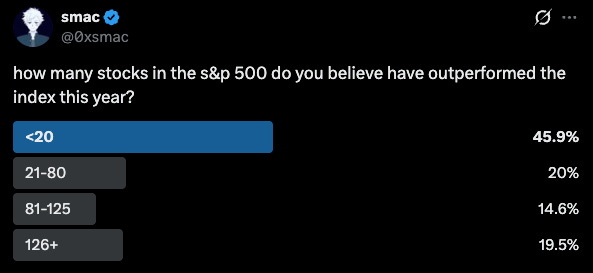

Another related fact: only 2 of the mag 7 names outperformed the underlying index in 2025. So the narrative that only 7 names are propping up returns and the market as a whole continues to be debunked (more on this later).

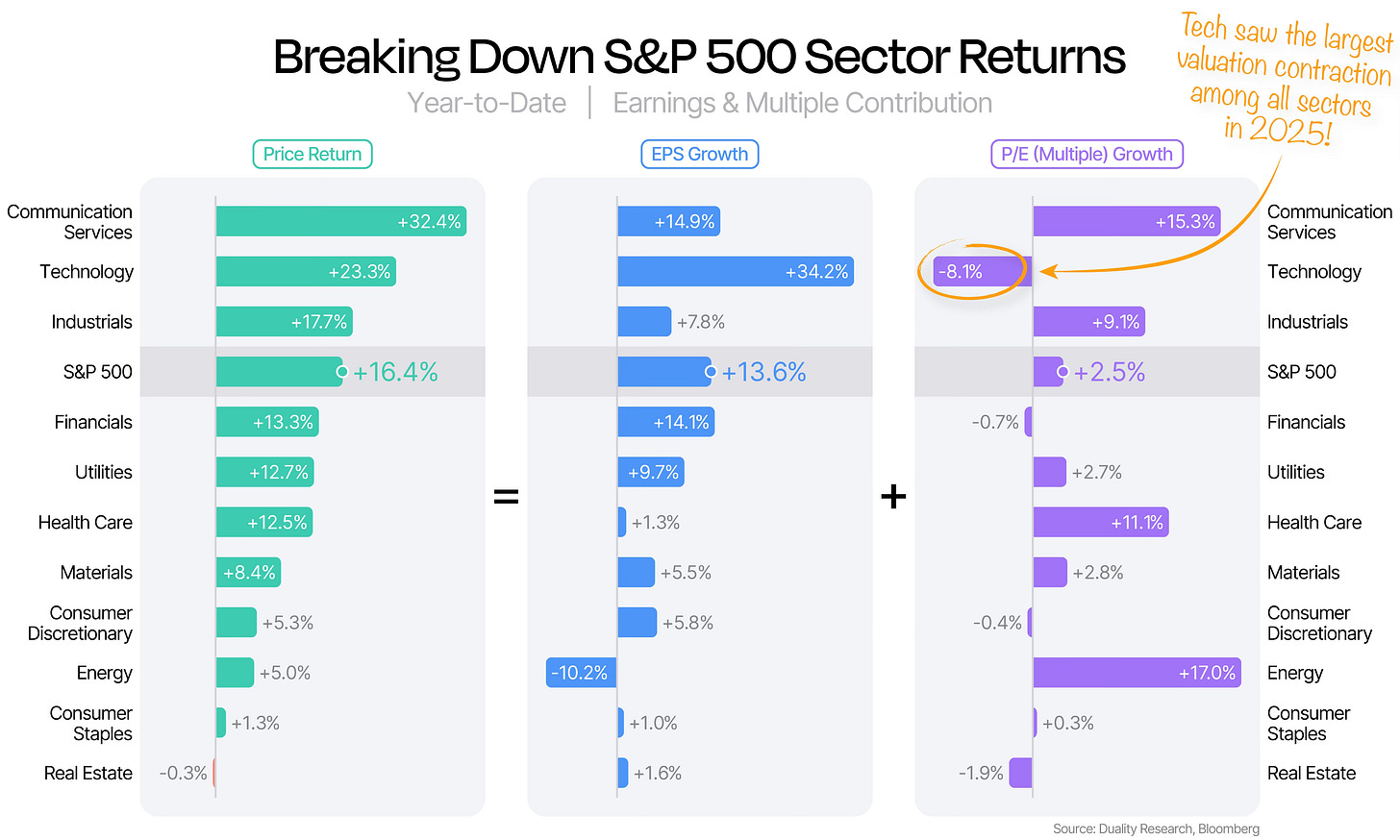

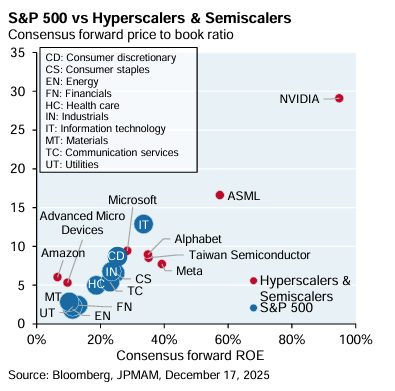

It’s also worth noting that with the exception of Oracle (who doesn’t have the cards), the companies fueling this are the greatest companies that have ever existed. I think something most investors are probably unaware of, is that the technology sector actually had the largest P/E multiple contraction of any sector in 2025.

This dovetails nicely into the next risk around valuations but before we get there, let me just reiterate what’s going on here. The Technology sector was the 2nd best performing sector in 2025, fueled by huge earnings growth while the multiple ascribed to the sector contracted. The performance wasn’t a function of investors becoming euphoric and slapping deranged valuations on the sector but rather actual earnings growth (the best long-term indicator of fundamental value/health).

Stocks are expensive and multiples will contract

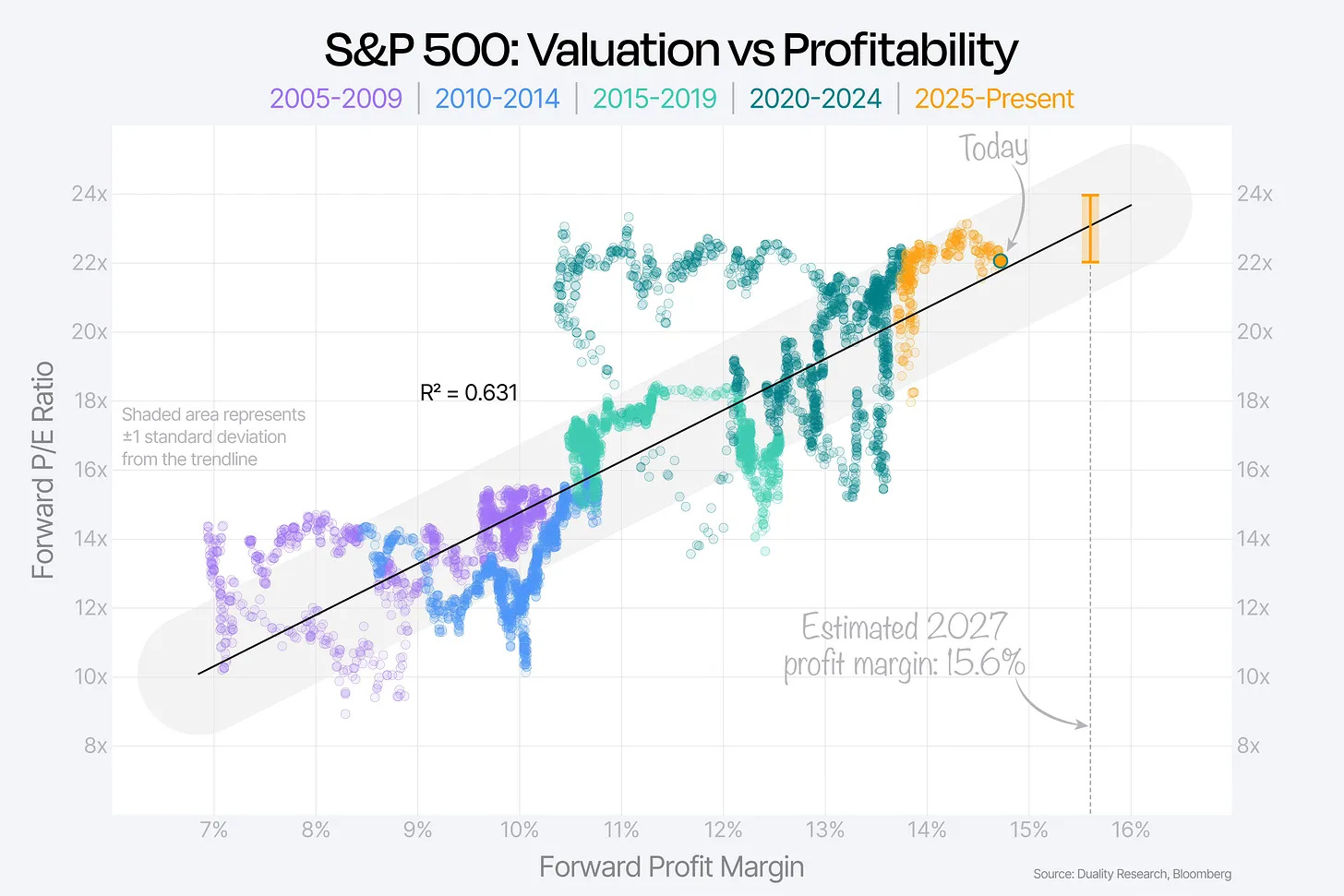

This feels like one of those things that is just taking people a long time to internalize. Today’s multiple (~22x forward earnings) is meaningfully higher than the trailing 10-year multiple (~18.7x). You could look at this and say one of two things4…

“wow, expensive, overpriced, we must revert”

“companies today are better at generating returns so they should have higher multiples”

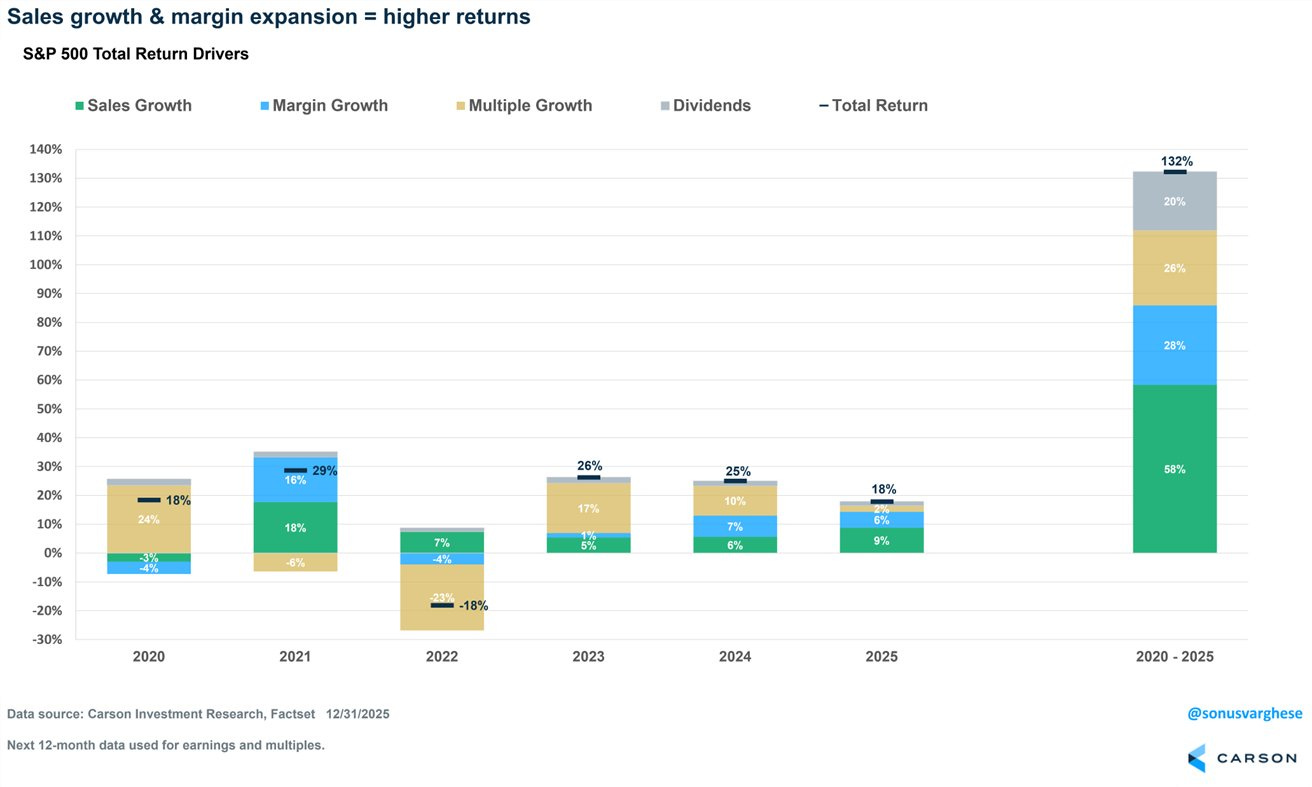

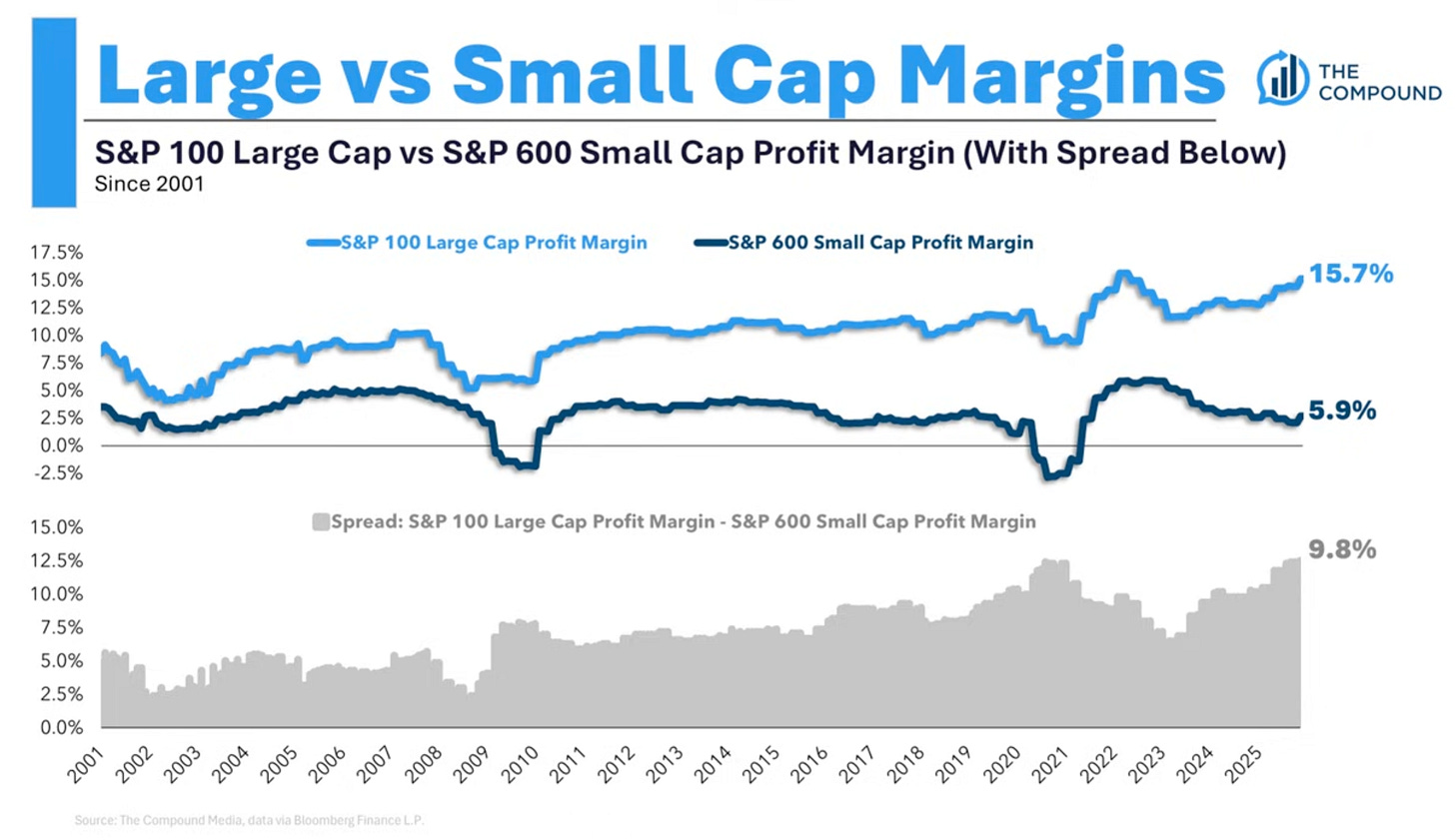

The hard reality is that companies are better at generating returns. Margins today are ~14.7% compared to ~12.5% over the previous 10 years. That may seem trivial but it does reflect a ~15-20% increase, in-line with the forward multiple increase. So in my opinion it’s not obviously true that stocks are overpriced (in the aggregate), especially when you consider that earnings are reported in nominal terms. So depending on your inflation conspiracy theory leaning, there’s a lot of wiggle room around these points. It’s not unreasonable to argue either side in my view. I personally lean toward the latter camp.

Private credit boogeyman

My days of reading monthly servicer reports and monitoring subprime delinquencies are long-gone. I’m not a big fan of trying to jam private credit down retail’s throat and stuffing it into retirement funds. But I am not spending much time looking at what these underlying loans look like either. So while my suspicion is that things are moving more cov-lite, underwriting standards are looser and go-forward returns on this stuff will be lower, I will likely let the bank stocks and bond market inform me on this5. There is only so much time in a day.

Inflation returns

This is probably the thing I worry most about. Not because it is the most likely but more-so that I think it’s the most under-priced risk. In part, this is because if I don’t believe we are heading into a recession, then the other big risk is the Fed moving toward a new rate-hiking cycle. This is admittedly maybe confusing because we’ve all been hearing about how once Jay Powell is gone, Trump is going to drop one of his homies into the Fed Chair seat and it’s off to the rate-cutting races6. But the market is smarter than it gets credit sometimes, and it will be looking through to the end of the cutting cycle. And not just the cut-and-we’ll-pause-and-cut-again-later end. I mean the end, end. And once the rate-cutting cycle ends, the next direction is hiking.

I suspect we will see a couple cuts in 2026, but everyone already knows this. The market will be on the lookout for what will tell the Fed to end the cutting cycle. And since the main inflation drivers are wages, housing and energy, those are the areas that I think are worth paying attention to. If these surprise to the upside or inflect higher for some reason7, that would be worrying.

Lot’s of Risks, What Mean?

Ok cool, there are a bunch of risks out there (probably some others as well that I didn’t highlight) but what’s going on otherwise.

If we go sector-by-sector it’s hard not to be bullish8.

These are just not things you see in bear markets. It is broad-based. Even materials (XLB) and energy (XLE) are getting ready to participate. You need wide participation to sustain bull markets, and we are seeing that today.

Obviously at some point things stop making new ATHs but I think a big part of developing conviction is recognizing what is actually going on.

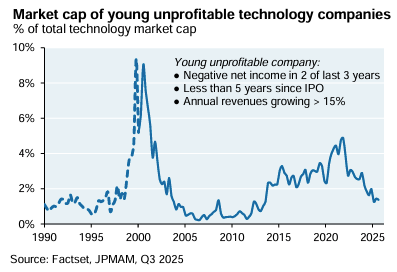

Today, the consensus on the Street is for ~14% EPS growth. Now for as much as you want to rip on these strategists (and I do this as well), they are quite good at forecasting aggregate earnings9. This is the fundamental part of the job. What’s also maybe illuminating is that despite what we hear about unprofitable tech companies, the equity market is less reliant on these types of companies than it was in previous eras. Look at how exorbitant these were during the dot-com bubble and even during the SPAC boom in 2021.

The bottom-line as I see it is that earnings are strong, margins are expanding, the economy continues to hum along (albeit with unemployment likely to continue trending higher), inflation is under control and there’s still fiscal and monetary impulse at our backs. There are clearly ways this can go wrong: there’s uncertainty around tariffs, geopolitical tensions (China/Taiwan I’m sure will be more center-stage this year), a new Fed Chair10, midterms11 and the looming fragility of everyone living & dying by tech earnings. Climbing walls of worry are necessary to extend bull markets. When investors suggest there is nothing to worry about is when things go really bad.

What about the coins?

You may recall this image from earlier…

I would give it all back to have seen the coins outperform.

Last year we saw the President launch a memecoin so it’s hard to imagine we’ll see something more outrageous in 2026. I think plur_daddy did a nice job laying out the retrospective for crypto underperformance in 2025 so I suggest you read his words on it. But also, in my opinion the majority of the negative sentiment around crypto can be attributed to this…

There have been louder and louder calls for the death of crypto. But this is evergreen. When you start to see “crypto is dead” content go viral and it becomes en vogue to shit on the space as an insider, then rest assured you’ve reached some sort of sentiment bottom. I continue to believe crypto return dispersion increases. Most alts deserve to go to zero. They will. There are some liquid assets that will outperform significantly over the coming 12-24 months12. Bitcoin is a real macro asset despite the quantum talk and despite the previously-crypto-trader-now-metals-trader telling you it failed. Just this morning Morgan Stanley filed for Bitcoin & Solana ETFs. The passive flows will continue into the asset class. The coins will be alright.

If you made me choose today, I’d say I expect to see unemployment continue to drift higher, inflation concerns dissipate, traditional equities end the year higher (>15%), small caps to outperform and BTC to outperform. I also think we probably see a similar period of “it’s over” with a 10-15%+ drawdown along the way.

But as always, do not listen to me I am literally just an anon on the internet.

More charts if you’re interested:

ty to jez & specifically @demk0814 for the manga cover image

Also doing these is more for fun because it’s pretty silly to tether your worldview to an arbitrary calendar date.

At least insofar as we care about its impact on markets.

Not because I think it threatens their standing or position, but I think it is the type of negative sentiment and uncertainty that could infect investor confidence and flows. Honestly, it’s worth reading page 4 of Michael Cembalest’s recent piece which gives a nice breakdown of exactly how the Meta/Blue Owl Hyperion complex financing was done.

the answer is ofc a secret third thing (some nuanced view that both can be true)

Blue Owl is the most obvious equity proxy

fwiw my preferred Fed Chair in order would probably be Waller, Hassett, Warsh

i am not smart enough to know why these might surprise or inflect higher. also, wages going up is generally a good thing so not everything is exactly black & white here

these are all monthly charts btw

there is a FactSet (i think?) report showing that exclusive of crisis years (a big caveat tbf, though i am accepting the assumption since i do not believe we are heading into a “crisis” year) the average margin of error between beginning of year forecast and realized earnings is <2%; i think last year the estimate was $274 and it came in at $271

i think we will quickly come to miss Powell as I suspect whoever fills the seat next will not be nearly as adept at Fedspeak which will probably make for some annoying volatility around these events (even more-so than usual)

year 2 of presidency generally not super accommodating

debating publishing public memo’s on some of these tbh

I learn a lot from your article. Thank you